› Business Loans › Lender Reviews › Uplyft Capital Review

To learn more about Uplyft Capital and decide if it’s right for your needs, please continue reading:

Online business loans are increasing in popularity among small business owners, especially with bad credit borrowers or those needing fast funding. Uplyft Capital is an online lender that specializes in both.

You only need a minimum credit score of 450 to qualify, and business owners can receive same-day approval with funding in 1-2 business days. However, the convenience and brevity of approval and funding carry higher costs than some competitors.

If you’re considering applying for Uplyft Capital, we can help guide you. This review covers the available business loans, costs, pros and cons, and how to apply.

Specifically, we’ll answer these questions and more:

Uplyft Capital is an online lender specializing in merchant cash advances to serve the small business community. The company can also help connect customers to other small business loans through its third-party lenders. Uplyft Capital’s services provide comprehensive business funding solutions, making it an essential financing partner for small businesses. Invoice financing allows obtaining capital based on customer invoice payments.

Uplyft offers same-day approvals with funding available in 1-2 business days. The company’s merchant cash advance product is a viable option for small businesses with less than stellar credit that need fast funding.

Founded in 2012, Uplyft has provided over $300 million in funding to more than 4,500 small- and mid-sized businesses (SMBs). Uplyft is available in all 50 states.

The company also does business under its alternate names:

Merchant Cash Cloud EaglePhillips, LLC.

Uplyft Capital is a business funding platform dedicated to providing fast and flexible funding solutions to small businesses. Founded on the principle of supporting small businesses with the help of other people’s money, Uplyft Capital’s mission is to empower business owners by offering quick access to working capital.

Unlike traditional lenders, Uplyft Capital’s technology platform evaluates a business’s cash flow, growth potential, and character rather than relying heavily on personal credit scores. This innovative approach allows Uplyft Capital to offer funding to a broader range of businesses, ensuring that even those with less-than-perfect credit can access the financial support they need to thrive.

Uplyft Capital only directly funds merchant cash advances (MCAs). With an MCA, you receive a large sum of money upfront deposited directly into your business account. You then repay that amount, plus interest, in daily or weekly payments from your credit card sales or ACH transfers from your debit card sales.

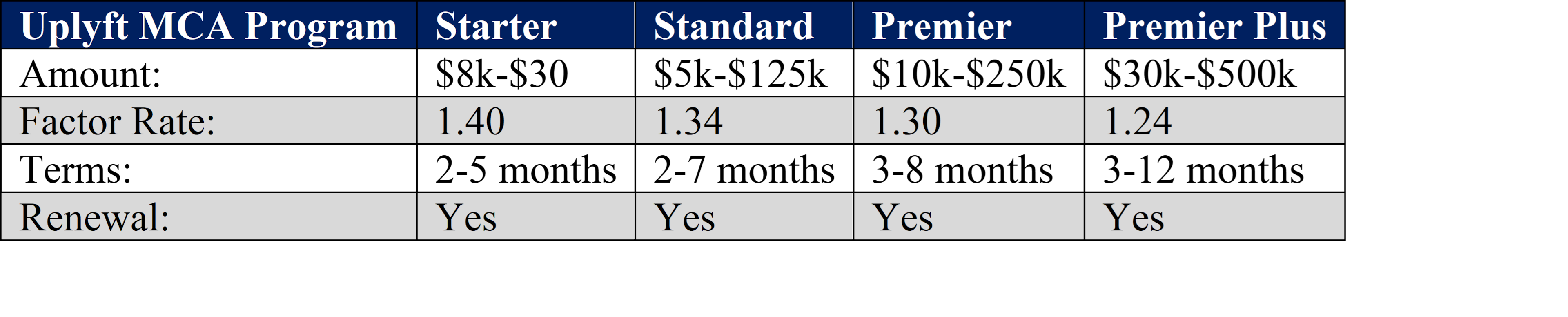

The Uplyft merchant cash advance programs offer:

Uplyft Capital’s business cash advance amount ranges from $8,000 to $500,000 based on eligibility.

Uplyft Capital offers a tiered MCA program. Providing this information upfront allows you to estimate your costs and available borrowing amounts.

Uplyft only directly funds the MCA programs but works with third-party lenders. It might be possible to get one of the following funding solutions from an Uplyft lending partner: Uplyft Capital does not require collateral for its business lines of credit, but borrowers need to show at least $8,000 in monthly revenue and 12 months in business.

Uplyft Capital offers hard money business loans as part of its comprehensive funding solutions. These loans are designed to provide businesses with quick access to capital, often with more flexible terms than traditional bank loans.

Hard money business loans utilize property as collateral and do not require a credit check. Whether you need funds for business expansion, equipment purchases, or working capital, Uplyft Capital’s hard money business loans can be a viable option.

The approval process is fast and efficient, with decisions often made within hours and funds delivered as quickly as the next business day. This speed and flexibility make hard money business loans an attractive option for businesses needing immediate financial support. Uplyft Capital offers multiple funding programs, including Starter, Standard, Premier, and Premier Plus, with varying amounts and terms.

One of Uplyft Capital’s main advantages is that you can qualify even if you have bad credit and have only been in business for six months. However, you will need a minimum monthly revenue of $12k.

Here are the minimum qualifications for Uplyft Capital:

It can be an expensive way to borrow money. Merchant cash advances are generally considered one of the costliest small business lending options.

Uplyft’s factor rates are also slightly higher than those of similar MCA providers. However, the company doesn’t charge the fees most of its competitors do, so it’s a bit of a tradeoff.

With a factor rate, you multiply the principal by the rate to determine how much interest you will pay. Let’s say you borrowed $100,000 at a factor rate of 1.34:

($100,000 X 1.34 = $134,000).

In this case, you’d pay $34,000 in interest to borrow $100,000. You can use the funds for a wide range of business purposes, including:

Understanding the loan terms is crucial as they can significantly affect a business’s cash flow during the repayment period.

Uplyft Capital doesn’t restrict any industries except nonprofits. It is a good option if you’re in a riskier industry with difficulty qualifying for business financing.

Uplyft Capital’s fees and interest rates vary depending on the specific funding solution chosen. For instance, the company’s merchant cash advances come with a factor rate that determines the cost of funding. Many business funding options require fees or interest rates that impact accessibility. One of the standout features of Uplyft Capital is its transparency in costs—there are no origination or monthly fees, which can be a significant advantage for businesses looking for clear and predictable financial commitments. However, it’s crucial to review the terms and conditions of each funding solution to fully understand the associated fees and interest rates, ensuring that you are making an informed decision.

Uplyft Capital’s loan terms are designed to be flexible and accommodate the unique needs of businesses. For example, the company’s merchant cash advances have repayment terms based on a percentage of future credit or debit card sales.

Business cash advances do not require standard monthly payments with interest. This structure ensures that repayments are manageable and aligned with the business’s cash flow. Uplyft Capital’s loan terms aim to provide businesses with the capital they need to grow and succeed while ensuring that the repayment terms are both manageable and flexible.

This approach helps businesses maintain their financial health while leveraging the funds necessary for growth and operational needs. Merchant cash advances provide immediate working capital in exchange for future sales.

Applying for funding with Uplyft Capital involves a streamlined online process designed for efficiency. Below is a step-by-step guide to assist you:

Before initiating the application, gather the necessary documents to ensure a smooth process:

Having these documents ready will facilitate a quicker application experience.

In addition to documentation, you will need to provide key details about your business. This includes your business name, contact information, and any “Doing Business As” (DBA) names. You must specify the loan amount you are requesting and identify the industry in which your business operates. Your credit score will also be required, as well as a list of any existing business debts. .

Uplyft Capital may also ask for details regarding your banking relationship, such as the type of business bank account you use. Finally, you must indicate the date your business was established. Accurately providing this information is crucial for the assessment process.

Once you have gathered all the necessary documentation and business details, you can proceed with the online application. The application is hosted on Uplyft Capital’s official website and is designed to be completed within minutes.

The platform integrates artificial intelligence to help streamline the process, making it faster and more efficient. You will need to input all required information carefully, ensuring there are no errors or omissions that could delay your application.

Before submitting your application, take a moment to review all the provided information. Accuracy is essential, as any discrepancies may slow down the approval process. Once you have verified that everything is correct, submit your application through the online portal. This final step moves your request into the review phase, where Uplyft Capital assesses your qualifications and funding eligibility.

After submission, Uplyft Capital will review your application and determine whether you qualify for funding. Approval decisions are typically made on the same day, allowing for a quick turnaround. If your application is approved, the funds will be deposited directly into your business bank account. In many cases, businesses receive their funding within 24 hours, ensuring minimal disruption to operations.

By following these steps, businesses can efficiently navigate Uplyft Capital’s application process and access the financing they need to support their growth.

Repayment begins after you receive your cash advance. Depending on the program, you’ll make daily or weekly repayments via ACH transfers.

The loan is short-term, meaning you must repay it within a few months. Ensure your cash flow can handle the frequent repayments.

Once you’ve made consistent, on-time payments, you could become eligible for renewal. It might be possible to renew it at a lower rate.

One of Uplyft’s primary benefits is its fast and efficient service, ensuring a quick funding time. The company offers a quick and easy application, and you can get a same-day approval decision. Funds are transferred within 1-2 business days after approval.

With a minimum credit score of 450, Uplyft is among the best options for bad credit borrowers. You also only need six months in business to qualify, as long as you have proven revenue in that time. The company has a 90% approval rate.

Uplyft is transparent about its costs. The company does not charge origination or monthly fees, which are standard fees that other MCA lenders will charge. The company also has a reputation for exceptional customer service.

The most significant drawback of Uplyft Capital is the cost. Merchant cash advances are already an expensive way to borrow money, and Uplyft has higher factor rates than the competition. Traditional bank loans can offer lower interest rates between 2% and 13%.

The company only lends MCAs, at least as a direct lender. It lists other small business loan options as part of its business funding marketplace, but you must apply to those lenders, each with its own underwriting requirements. This can make the information on Uplyft Capital’s platform confusing compared to other small business funding options that offer streamlined processes, quick loan applications, and same-day decisions.

While the company accepts low credit scores and a shorter time in business, you do need high revenue to qualify. The requirement of $144k in minimum annual revenue will preclude many small businesses.

Borrowers must repay the advance with a daily or weekly percentage of credit and debit card transactions. The frequent repayments, short terms, and high factor rates can strain your cash flow.

Here is a quick summary of the benefits and drawbacks of Uplyft Capital.

Pros:

Cons:

Yes, Uplyft Capital is a legitimate online lender. The company has a 4.7 out of 5 rating on Trustpilot with over 150 reviews.

The Better Business Bureau (BBB) has accredited Uplyft since 2022, where it has an A+ rating. Uplyft has a 4.43 out of 5 customer rating on the watchdog site, which is outstanding for BBB.

The company’s merchant cash advance isn’t necessarily right for every small business. Uplyft might be the right fit for your business if:

Most reviews of Uplyft are very positive, but there are some negative ones you should know about. Positive reviews praise the speed of funding. Uplyft Capital has 92% of its reviews rated five stars.

Other positive reviews discussed the ease of the application and fast approvals for merchant cash advances. Many reviews praise the company’s great customer service, with several business owners mentioning their service rep by name. Customers often highlight the personalized support they received from Uplyft Capital.

The most common complaint in negatives by far is the cost. Multiple commenters mentioned not accepting the merchant cash advance offer because of the cost. Others stated they accepted the offer, but repayments strained their cash flow to the point of risking the business.

Uplyft Capital has a 90% approval rate, but there are still some reasons an application might be denied. The biggest reason for denials is the revenue cutoff, but other factors like your industry or credit history could be an issue.

The denial letter should explain why the company didn’t approve the request. If not, you can contact them for more information.

Thankfully, there are plenty of online lenders if you were denied (or were approved but felt the costs were too high). There are many options for merchant cash advances or other small business loans that might not be as expensive as MCAs.

Uplyft Capital’s merchant cash advance programs are a solid option for bad credit borrowers who need fast funding. The factor rates might be higher than some, but the lack of fees almost makes that increased cost a wash. SBA loans are government-backed loans with low interest rates and flat monthly payments.

You’ll also have the benefit of upfront, transparent pricing from Uplyft. You won’t have to worry about hidden fees or unexpected charges.

The easy application process, minimal documentation, and high approval rate also make Uplyft an attractive option. However, more established businesses with good to excellent credit can likely find less costly small business loans.

Based on Uplyft Capital’s range of business financing solutions and customer reviews, we rate Uplyft Capital as a 4 out of 5. The company only loses points for its limited product offerings and high factor rates.

Disclaimer: The Uplyft Capital trademark is owned by Uplyft Capital and its use herein is for reference purposes only and it does not indicate sponsorship or endorsement from Uplyft Capital.

Fraud Disclosure:

Please be aware that individuals have been fraudulently misrepresenting to business owners (and others) that United Capital Source, Inc. (“UCS”) can assist small businesses in receiving government grants and other forgivable business loans, when in fact those grants or loans do not exist or are not available. These individuals have ulterior motives and are engaging in the unauthorized use of the names, trademarks, domain names, and logos of UCS in an attempt to commit fraud upon unsuspecting small business owners.

UCS will never communicate with a prospective client on Facebook, Facebook Messenger, or any other type of social media. Further, any email communications will always come from an official UCS email address and not a Gmail, Yahoo, or other email domain. If you believe you have been contacted by someone posing as an employee of UCS, please email [email protected].