What is the Units of Production Method?

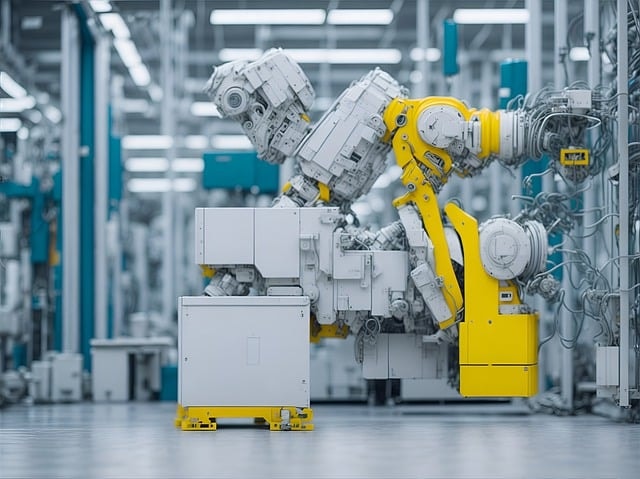

The units of production method calculates depreciation based on actual usage. This method is ideal for assets like machines and equipment that wear out differently depending on how much they are used. For example, a machine may have a longer life if used less frequently.

This approach measures depreciation relative to production output instead of time. It provides a clearer picture of an asset’s value. Companies can assess how much value the equipment loses as it produces goods. This method helps businesses make better financial decisions. Calculating depreciation is essential for bookkeeping and tax reporting.

Industries that rely heavily on machinery benefit significantly from this method. In manufacturing, for instance, knowing how much a machine depreciates based on its output helps managers plan for replacements or repairs. They can track the total number of units produced and calculate depreciation accordingly.

What is the Units of Production Depreciation Method Formula?

The units of production depreciation method helps businesses calculate how much an asset loses value over time based on its usage. The formula has two essential steps for the production depreciation calculation: calculate the unit production rate and multiply it by the actual units produced.

Start by determining the units of production rate:

Unit Production Rate = (Cost of Asset – Salvage Value)/Estimated Units Produced During Useful Life

Depreciation Expense = Unit Production Rate x Actual Units Produced

Each part of this formula has a specific role.

- Cost refers to the initial purchase price of the asset.

- Salvage Value is what the asset will be worth at the end of its useful life.

- Total Units Produced is the estimated total output for the asset during its lifetime.

- Units Produced is how many units were actually produced in a given period.

This formula calculates the production depreciation expense based on actual use rather than time. It reflects how much value the asset has lost due to production. This formula allows businesses to manage their assets effectively and report accurate financial statements.

How do I calculate the Units of Production Depreciation?

Here is a step-by-step guide on how to calculate units of production depreciation:

Step 1 – Calculate the Unit Production Rate

You’ll need the following information:

Cost of the Asset: This is the initial equipment cost, including the purchase price, sales tax, delivery and installation costs, and other relevant expenses.

Salvage Value: This is the estimated value of the equipment when it is no longer useful. This amount is typically little more than its value in scrap metal. The salvage value is also called the residual value, scrap value, or break-up value.

Estimated Units: This refers to the estimated production capacity of the number of units the equipment will produce during its useful life.

Once you have these values, plug them into the formula mentioned above:

Unit Production Rate = (Cost of Asset – Salvage Value)/Estimated Units Produced During Useful Life

Step 2 – Determine the Depreciation Expense

Calculating the depreciation expense involves multiplying the unit production rate by the actual number of units produced within the year. This gives you the annual deprecation value.

Depreciation Expense = Rate of Units Produced x Actual Units Produced.

You can then use this formula to calculate the depreciation expense for each year:

Year 1 depreciation = actual Units x unit production rate

Year 2 depreciation = actual Units x unit production rate

Year 3 depreciation = actual Units x unit production rate

And so on.

Step 3 – Track the Year-Over-Year Depreciation

You’ll want to track the depreciation for each year the equipment is in use. This is also called the accumulated depreciation.

Accumulated Depreciation = Year 1 depreciation + Year 2 depreciation + Year 3 depreciation…etc.

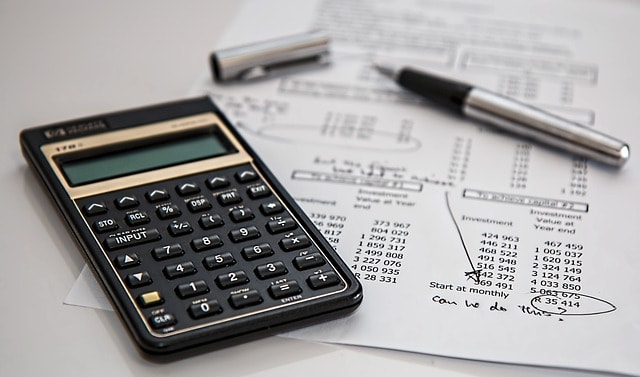

Step 4 – Record the Depreciation Expense as a Journal Entry.

To record depreciation expense as a journal entry for bookkeeping purposes, you would debit the depreciation expense account and credit the accumulated depreciation account. This helps to allocate the cost of an asset over its useful life, reflecting its decrease in value over time. Consider consulting with an accountant or financial professional for guidance on properly recording and reporting depreciation expenses in your financial statements.

Example Calculation

Let’s say you buy a machine for $10,000. You estimate it will have a salvage value of $1,000 after producing 100,000 units. If you produce 20,000 units in one year, here’s how it works:

- Total Cost: $10,000

- Salvage Value: $1,000

- Estimated Total Unit Production: 100,000 units

- Actual Units Produced in Year 1: 20,000

First, let’s find the unit production rate:

($10,000 – $1,000)/100,000 = $0.09

Now that we know the unit production rate is nine cents, let’s multiply it by the actual units produced in year one:

$0.09 x 20,000 = $1,800

The first-year depreciation for the equipment is $1,800.

Now, let’s say there were variations in the actual units produced each year. We can keep the unit production rate of $0.09 and multiply by the actual units produced:

Year 2 Depreciation: 18,000 units produced x $0.09 = $1,620

Year 3 Depreciation: 16,000 units produced x $0.09 = $1,440

Year 4 Depreciation: 19,000 units produced x $0.09 = $1,710

Year 5 Depreciation: 15,000 units produced x $0.09 = $1,350

After five years, the accumulated depreciation would be:

$1,800 (Year 1) + $1,620 (Year 2) + $1,440 (Year 3) + $1,710 (Year 4) + $1,350 (Year 5) =

$7,920 in accumulated depreciation over 5 years.

What are the benefits of the Units of Production Method?

The units of production method offers several advantages for businesses. This method aligns depreciation with actual usage. It is beneficial for companies that experience fluctuating production levels.

For example, a factory may produce more goods in one year than the next. This method allows for more significant deductions during high-production years, which can significantly reduce taxable income.

This method also benefits financial planning. Businesses can better predict their expenses based on production levels. If a company knows it will produce more units, it can plan for higher depreciation costs. This helps in budgeting and cash flow management.

This approach also improves asset management strategies. Companies can track how much each asset contributes to production over time. This insight aids in deciding when to replace or upgrade equipment. Firms can optimize their investments by understanding the wear and tear on machinery.

What are the drawbacks of the Units of Production Method?

The units of production method has disadvantages and limitations to consider. One major drawback is that it can be complex to calculate. Businesses must track the actual usage of an asset closely. This requires detailed records and constant monitoring. If a company fails to maintain accurate data, it may lead to incorrect depreciation expenses.

Another issue is the potential for fluctuating costs. The method ties depreciation directly to production levels. If production drops, depreciation expenses also decrease. This can create challenges in financial planning and budgeting, and companies may struggle to predict future costs accurately.

The method also assumes a direct relationship between usage and wear. This assumption might not hold true for all assets. Some assets may experience wear and tear even if not used heavily. This can lead to underestimating costs in some cases.

The method may not align with financial reporting standards. Many businesses prefer more straightforward methods, like straight-line depreciation. These methods provide consistency and ease of understanding for stakeholders.

Finally, this method can be less effective for assets with long useful lives. As production levels change over time, businesses may find it hard to measure actual wear accurately.

Units of Production Depreciation Method Pros & Cons

Pros:

- The depreciation rate reflects the actual usage of an asset.

- Useful for assets that are not used evenly over time.

- Can result in tax savings if production levels fluctuate.

Cons:

- Requires accurate tracking of production levels.

- Can be complex to calculate for assets with varying production levels.

- Does not account for asset obsolescence or wear and tear over time.

Why do businesses use the Units of Production Method?

Small businesses may opt to use this method for several reasons.

Accurate Depreciation: Businesses use this method to calculate depreciation accurately. This method bases depreciation on actual usage. It reflects how much an asset is used rather than just time. For example, a machine operating for more than one year will show higher depreciation.

Cost Management: This method helps with cost management. Companies can match expenses with revenue. If a product sells well, the related equipment costs increase as well. This balance allows for better financial planning and forecasting.

Asset Lifespan: The units of production method considers an asset’s lifespan. Companies can estimate an asset’s length based on its production capacity. This helps them make informed decisions about repairs or replacements.

Financial Reporting: Accurate reporting is vital for businesses. This method provides clearer financial statements. Investors and stakeholders prefer this clarity. They want to see how effectively a company uses its assets.

Tax Implications: Tax benefits also play a role. Businesses can deduct depreciation from their taxable income, leading to tax savings if the asset is heavily utilized.

Frequently Asked Questions

Here are the most common questions about the units of production depreciation formula and method.

Is the Units of Production Method a fixed or variable cost?

The units of production method helps businesses calculate depreciation based on usage. This method is often considered a variable cost. As production increases, the depreciation expense also rises. If production decreases, the expense lowers.

This approach aligns costs with actual use, better reflecting an asset’s true value than fixed methods. Fixed costs remain constant regardless of usage, while variable costs change depending on activity level.

What types of assets benefit from this method?

This method benefits assets that vary in usage. It aligns depreciation with actual wear and tear, providing a more accurate financial picture.

Examples include:

- Manufacturing equipment.

- Construction machinery.

- Vehicles.

- Agricultural machinery.

- Industrial machinery.

Can the Units of Production Method be used for all assets?

No, it’s not suitable for all assets. It’s best for those whose value declines with use, like manufacturing equipment. Fixed assets with consistent usage may require different methods.

How often should I calculate depreciation using this method?

Small business owners should calculate depreciation at regular intervals, typically annually or quarterly. This ensures that financial statements accurately reflect current asset values.

What are the other Methods of Depreciation used in accounting?

Here are some of the other most common depreciation methods.

Straight-Line Depreciation Method

The straight-line method is one of the main depreciation methods. It evenly spreads the cost of an asset over its useful life. For example, if a machine costs $10,000 and lasts ten years, the annual depreciation expense would be $1,000.

Double Declining Balance

This method is an accelerated depreciation method. It charges more depreciation in the early years. The formula involves multiplying the book value by double the straight-line rate, resulting in higher depreciation deductions at first.

Sum of the Years’ Digits

This is another popular depreciation method. It calculates depreciation based on an asset’s remaining life. The formula uses a fraction, where the numerator is the number of years left, and the denominator is the sum of all years. This leads to more significant depreciation expenses early on.

MACRS

The Modified Accelerated Cost Recovery System (MACRS) is widely used for tax purposes. It allows businesses to recover costs faster than traditional methods. MACRS divides assets into classes with specific recovery periods. This results in significant depreciation charges in the initial years.

Accelerated depreciation methods help businesses manage their depreciation expenses effectively. They provide different ways to record depreciation in financial statements, and each method can impact net income and tax liabilities differently.

Units of Production Depreciation Formula & Method – Final Thoughts

Understanding the units of production method can significantly enhance your approach to asset management. This method ties depreciation directly to usage, ensuring that your financial statements reflect real value.

Ensure you evaluate other depreciation methods and use the appropriate one for particular business assets. Consider working with an accountant or financial advisor to track depreciation accurately, keeping your balance sheet current, and leveraging the most beneficial tax deduction available.

Contact us if you have more questions on equipment depreciation to apply for a small business loan. Our alternative financing experts can help you find the best funding program for equipment purchases or other business needs.