What is the federal tax rate for small businesses?

The IRS does not have a tax category for “small business.” Instead, the taxes your business owes depend on how your company is structured.

Corporation Income Tax

Entities listed as C Corporations (the default corporation status) are only required to pay the corporate tax rate. It’s actually simpler for C corporations (C-Corp) since the corporate income tax is a flat rate of 21%. However, C-Corps are subject to the dreaded double taxation.

The corporation pays 21% of business income off the top of gross receipts. Shareholders are then taxed for any dividends they receive from the business. C Corporations only comprise 7.9% of US businesses but contribute 58.9% of business receipts.

Pass-Through Entities

Most small businesses are structured as some form of pass-through entity. These include sole proprietorships, partnerships, some limited liability companies (LLCs), and S corporations (S-Corps).

Pass-through entities usually don’t pay any tax at the entity level. Instead, the tax burden “passes through” the business to shareholders, partners, and business owners.

Any income received from the business is included with their personal income taxes. This is where things get complicated.

Personal income operates on a progressive tax structure. The more you make, the higher percentage you must pay in taxes. Income from the business gets added to any other income from wages, other businesses, etc.

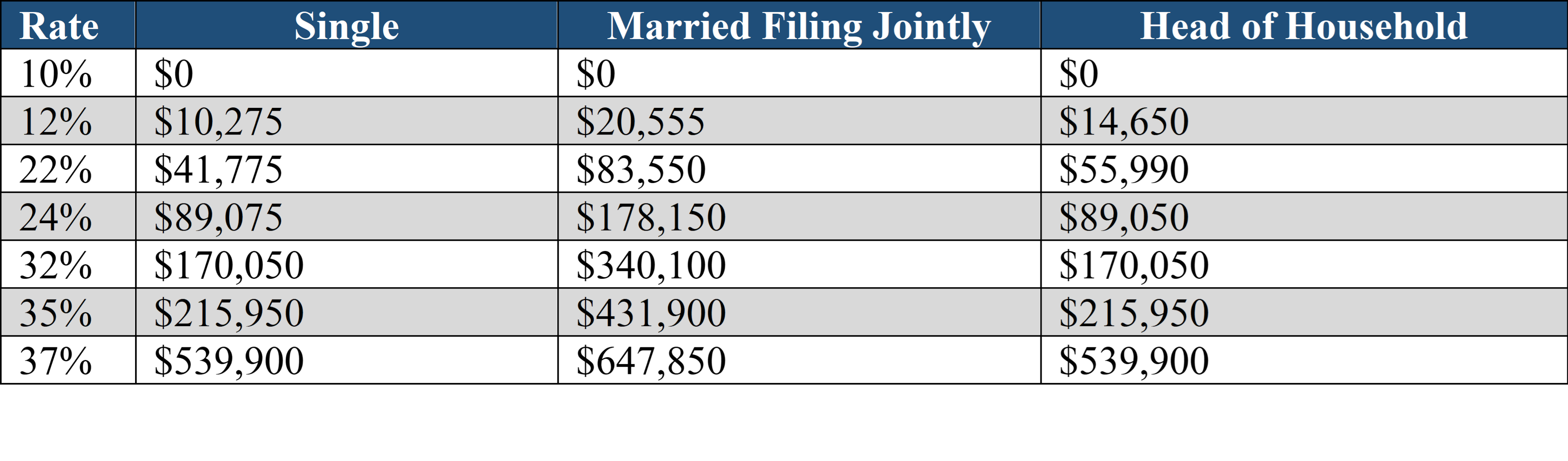

The 2022 progressive tax bracket is:

Source: IRS

As you can see, if your business and other income put you in the highest bracket, you’ll pay the maximum personal income tax rate of 37%. Conversely, if your business lost revenue, you can deduct the loss from your federal income taxes.

What other taxes must small businesses pay?

These are additional taxes most small businesses pay in addition to federal tax.

Payroll Tax

The business is responsible for collecting payroll tax from its employees. You must withhold FICA (Federal Insurance Contributions Act), social security, and Medicaid. Unemployment and worker’s compensation withholding may be extra. The current payroll tax for an individual’s wages is 15.3%, half of which the employee pays, and the employer pays the other half.

Excise Tax

Some small businesses must pay an excise tax if they meet certain IRS requirements. Excise taxes include taxes for manufacturing certain products or using special equipment.

Property Tax

You may be subjected to property tax if your business owns the land, buildings, or vehicles used for business purposes. Whether or not you will owe property tax depends on the state and local tax laws where your business is located.

Sales Tax

You will pay sales tax if you sell items or offer services in a state with a sales tax. 45 states and Washington DC all have sales tax.

In most cases, your customers will pay the sales tax, or at least most of it. In some cases, the business ends up paying the tax, however.

State Income Tax

Most states charge a corporate and individual income tax in addition to the federal tax. Check with your state to see what taxes your business will owe.

What are the small business tax rates by state?

Business tax rates vary significantly by state. Some states offer more favorable tax structures to attract businesses.

For example, Nevada does not have an individual or corporate tax. Florida does not have an individual tax, and New Hampshire doesn’t have a sales tax.

On the other hand, some states charge high taxes. New York, California, and New Jersey all have high tax rates.

How do small businesses pay taxes?

The forms you will use to file your taxes depend on your business structure. LLCs can opt to be taxed as a C-Corp, S-Corp, partnership, or sole proprietorship if there’s only one owner.

- C-Corps: Use Form 1120 to report business income and expenses.

- S-Corps: Use From 1120-S to report business income and expenses, then issue a Schedule K-1 to each shareholder reporting profits or losses.

- Partnerships: Use Form 1065 to report business income and expenses. The completed Form 1065 includes a Schedule K-1 for each shareholder.

- Sole proprietorships: Report business income and expenses on Schedule C when completing your individual tax return on Form 1040.

When are taxes due for small businesses?

Business taxes are generally filed quarterly. Corporations file their taxes on the 15th day of the fourth, sixth, ninth, and 12th month of their fiscal year.

The individual owners or shareholders of a pass-through entity make estimated tax payments. Those are generally due on April 15, June 15, Sept. 15, and Jan. 15 of the following year.

Frequently Asked Questions

Here are some of the most common questions about small business tax rates.

Is it better to file as an S-Corp or C-Corp?

Deciding between an S-Corp or C-Corp should depend on more than just your tax structure, but it is an important consideration. Let’s look at the pros & cons of each.

C-Corp Pros & Cons

Pros:

- Default tax status for corporations.

- No limit on shareholders.

- Less IRS scrutiny.

- Limited liability protection.

Cons:

- Double taxation.

- More rigid structure.

- No write-offs on personal income tax for business losses.

S-Corp Pros & Cons

Pros:

- Avoids double taxation.

- Able to write off business losses in some cases.

- Limited liability protection.

- Ideal for small businesses.

Cons:

- Can’t become a publicly traded company.

- Limited to 100 shareholders.

- Strict shareholder requirements.

- Can only have one class of stock.

- Increased IRS scrutiny.

- More rigid structure.

How much does the average small business pay in taxes?

Tax liabilities vary significantly depending on the structure of a business and where it’s located. Taking all small business taxes as an average works out to 19.8%, but your small business could be taxed anywhere from 13% to 37%.

What Tax Credits exist for small business owners?

Several tax credits can help reduce the amount of taxes you owe or increase your tax return. Some of the most beneficial small business tax credits include:

- Foreign tax credit.

- Work opportunity credit.

- Research and development credit.

- Small-employer pension plan start-up cost credit.

- Alternative motor vehicle credit.

- Alternative fuel vehicle refueling property credit.

For pass-through entities, the tax credit will pass to their individual tax return. Other individual tax credits include:

- Earned income tax credit.

- Child and dependent care credit.

- American opportunity credit.

- Adoption credit.

What are small business Tax Deductions?

Another way to reduce your tax liability is with deductions. Several tax deductions reduce your taxable income on a dollar-for-dollar basis.

- Itemized deductions: These are deductions for individual expenses that reduce the taxes you owe. Some examples include the Section 179 deduction for purchased equipment, interest deductions, and charitable donations.

- Standard deduction: This is a flat rate deduction you can use instead of itemized deductions.

- Qualified business income (QBI) deduction: A deduction for some owners of pass-through entities for up to 20% of the business’s net income.

How much should my business set aside for taxes?

Generally, you should set aside 30%-40% of your business income for taxes. Remember, you pay your business taxes quarterly, so you should set aside your revenue frequently.

Setting up a separate bank account and transferring the funds regularly is advisable. You might even want to set up automatic transfers.

Safe Harbor Rule

Under the IRS safe harbor rule, you won’t be penalized for underpaying your taxes if you pay the same amount for the same quarter from the previous year.

How much can my business make before having to pay taxes?

Per the IRS, every business must file an annual tax return except partnerships, which must file an information return instead. If you made less than $400, you don’t need to pay the self-employment tax, but that’s the only avoidable tax.

The IRS probably won’t audit your business until you start making a profit, but it’s still a good idea to file a return. You can get tax deductions if your business is operating at a loss. In addition, you will avoid any potential legal issues further down the line.

Small Business Tax Rate Final Thoughts

Small business taxes can get complicated. As a small business owner, you must focus on your business, but you can’t let paying your taxes fall by the wayside.

The IRS taxes business according to their entity type, not their size. Understanding how your business gets taxed is the first step in ensuring you pay your taxes on time and in full.

You should set aside business revenue to pay any taxes due when you file quarterly. You should also be aware of any and all tax credits and deductions that can help reduce what you must pay.

This article is meant for informational purposes only. Consult your accountant or tax professional before filing taxes to ensure accuracy.