What is a PAYDEX Score?

A PAYDEX score measures how well a business pays its creditors. The business credit bureau Dun & Bradstreet reports PAYDEX scores ranging from 0 to 100 in your business credit report. It measures your business’s past payment performance. You’ll sometimes see it called the Dun and Bradstreet business credit score.

Higher scores indicate prompt payments and lower scores reflect late payments. For instance, if a company consistently pays its bills on time or early, it can achieve a high PAYDEX score.

This scoring system helps lenders assess the risk of offering credit to businesses. A good PAYDEX score can open doors for companies to qualify for favorable terms on credit builder or business credit card accounts. Late payments have the opposite effect, lowering the business’s PAYDEX score and making it more challenging for companies to secure financing from lenders.

PAYDEX Score Pros & Cons

Pros:

- Provides a quick snapshot of a business’s creditworthiness.

- Helps lenders and suppliers make informed decisions.

- Can be used to negotiate better terms with suppliers.

- Shows a history of on-time payments, which can improve a business’s reputation.

Cons:

- Only focuses on payment history, not overall financial health.

- Limited to businesses with credit accounts.

- Not as widely used or recognized as personal credit scores like FICO.

- Can be influenced by factors outside of the business’s control, such as late payments from customers.

How do I establish a PAYDEX Score?

To establish a PAYDEX score of 80, you must understand the scoring system and take specific steps. One crucial step is obtaining a D-U-N-S number, which helps potential lenders assess your business’s creditworthiness. This unique identifier for your business is essential for establishing a business credit file.

Timely payments are vital for achieving a high PAYDEX score. When you pay your creditors and suppliers on time or early, it demonstrates responsible financial management. This positive payment experience can significantly impact your score, helping you move towards an impressive PAYDEX rating.

Opening a business credit card is another way to build your credit profile and work towards an excellent PAYDEX score. Using this card responsibly and making timely payments demonstrates reliability in managing credit accounts, which contributes positively to your PAYDEX rating.

Consistently meeting due dates on invoices and accounts can also significantly impact building a favorable PAYDEX score. When you consistently fulfill these obligations without late payments, it builds trust with potential lenders who review your PAYDEX scores when considering extending credit to your business.

Benefits of a high PAYDEX score include:

- Increased Credibility: A high PAYDEX score reflects positively on the credibility of your business.

- Access to Better Financing Options: Lenders are more likely to offer favorable terms when they see that you have managed previous credit responsibilities well.

- Competitive Advantage: With an impressive PAXEDX rating, you may gain advantages over competitors with lower scores.

How are PAYDEX Scores calculated?

Dun & Bradstreet calculates PAYDEX scores to assess a company’s creditworthiness. It examines how promptly a company pays its bills to suppliers and vendors.

The score is based on payment experiences reported by trade suppliers and reflects whether a company pays its bills on time, early, or late. A score of 80 indicates that a company pays its bills within the agreed terms, while a score of 100 means it pays its bills earlier than the agreed terms.

On the other hand, scores below 80 indicate late or delinquent payments. The PAYDEX score is essential for potential lenders and business partners to evaluate a company’s financial reliability.

Who uses PAYDEX Scores?

Several entities you do business with may want to review your PAYDEX scores. Here are some of the most likely reasons why:

- Landlords: Commercial property landlords typically review a company’s PAYDEX score when evaluating a lease application in the same way a residential landlord reviews your FICO score when you apply to lease an apartment or rental property.

- Lenders: When applying for business credit, such as a loan or business credit card, financial institutions review your PAYDEX score as part of the underwriting process. They look to ensure your company is reliable in paying its bills on time.

- Suppliers: When seeking to open a tradeline or vendor credit, suppliers will review your PAYDEX to determine approval and terms.

- Insurance companies: Some commercial insurance companies base premiums on PAYDEX scores to mitigate risks.

- Customers: PAYDEX scores typically don’t impact customer transactions, but some may review your score to determine if your company is reliable. This is particularly true in the business-to-business (B2B) environment.

What are the PAYDEX Score ranges?

The PAYDEX score ranges from 0 to 100; a higher score indicates a better payment experience. This scoring system evaluates how promptly a company settles its bills based on its payment history.

In general, PAYDEX score ranges are:

- Low Risk – 80-100: The company averages prompt payments.

- Medium Risk – 50-79: Averages 30 days or less beyond terms.

- High Risk – 0-49: Pays invoices 30-120 days beyond terms.

Here’s a complete breakdown of PAYDEX score ranges:

| PAYDEX Score | What it Indicates |

|---|---|

| 100 | Pays sooner than 30 days from terms. |

| 90-99 | Pays sooner than 20 days from terms. |

| 80-89 | Pays terms on time. |

| 70-79 | Pays 15 days beyond terms. |

| 60-69 | Pays 22 days beyond terms. |

| 50-59 | Pays 30 days beyond terms. |

| 40-49 | Pays 60 days beyond terms. |

| 30-39 | Pays 90 days beyond terms. |

| 20-29 | Pays 91-119 days beyond terms. |

| 10-19 | Pays 120 days beyond terms. |

| 0-9 | 120+ beyond terms. |

What’s a good PAYDEX Score?

A good PAYDEX score is typically considered to be 80 or above. This score indicates that a business consistently pays its bills on time or early, which is a positive sign to potential lenders and suppliers.

A higher PAYDEX score can help a business secure better terms on loans and credit and improve its overall financial reputation. It’s crucial for businesses to actively monitor and maintain their PAYDEX score to ensure they have access to the best financing options available.

How can my business get a PAYDEX Score of 80?

Getting a PAYDEX score of 80 or higher is all about paying on time or early. It’s also a dollar-weighted average, so the more significant the invoice and the earlier the payment, the greater the impact.

Here are several strategies to establish or raise your PAYDEX score.

On-Time or Early Payments: Similar to a personal credit score, the most critical action you can take is never missing a payment. This includes credit payments like loans, credit cards, lines of credit, and tradelines. On-time payments for supplier credit will only achieve a max PAYDEX score of 80. To get a score higher than 80, pay trade credit off early.

Look for Vendors That Report to Dun & Bradstreet: Paying off trade credit only helps your PAYDEX score if the vendor reports to Dun & Bradstreet. Look for vendors who already report or ask your vendors if they will report to the business credit bureau.

Open New Tradelines or Credit Accounts: Opening new tradelines (vendor credit) can help build business credit history and raise your score. You can also consider opening other credit accounts, such as a business credit card, if the issuer reports to Dun & Bradstreet.

Separate Business and Personal Credit: It’s vital to create separation from business and personal finances so that your business’s financial activity gets reported. Ensure you establish a DUNS number, use a business bank account, and open trade lines in your business’s name.

Frequently Asked Questions

Here are the most common questions about how to get a PAYDEX score of 80.

How do I look up my company’s PAYDEX Score?

To look up your business’s PAYDEX score, you can visit Dun & Bradstreet’s website and navigate to the section where you can enter your company details. After entering the required information, such as your company name and location, you can view your PAYDEX score. This process lets business owners stay informed about their financial standing and take necessary steps to maintain or improve their scores.

Monitoring your PAYDEX score regularly helps you understand how creditors perceive your payment experience. A high score indicates that companies will likely offer better credit terms when doing business with you. At the same time, a low one may raise questions about whether it is wise for other companies or lenders to extend lines of credit or accounts receivable terms.

What are Business Credit Bureaus?

Business Credit Bureaus are organizations that monitor and evaluate the creditworthiness of businesses, much like personal credit scores do for individuals. They collect data from various sources, including creditors, suppliers, and vendors, to form a comprehensive view of a business’s credit history. For many business owners, utilizing business credit cards and accounts payable is a common strategy to establish their business’s credit file.

The scoring system employed by these bureaus assesses several factors, such as payment history, debt levels, and any adverse information on invoices. This evaluation helps lenders and creditors gauge the risk associated with extending credit or offering financing to a particular business entity. By maintaining positive payment records and keeping debt levels in check, companies can work toward achieving an impressive PAYDEX score.

One significant aspect business credit bureaus consider is the management of accounts payable. Timely settlement of bills reflects positively on a company’s financial discipline and contributes to building a favorable PAYDEX score. Conversely, instances of late payments or delinquencies can hurt the overall rating.

In addition to prompt bill payments, another crucial factor influencing a company’s PAYDEX score is its utilization of available credit. Keeping this within reasonable limits demonstrates responsible financial behavior while maximizing available resources for operational needs.

How long does it take to get a PAYDEX Score?

You could potentially get a PAYDEX score within three to six months after getting your D-U-N-S number. However, that requires reporting at least three trade experiences (or trade references) from at least two different parties.

To build a high PAYDEX score, timely payments on accounts are crucial. As with personal credit cards, meeting payment due dates is essential for improving your PAYDEX score. This means consistently paying within terms or earlier if possible.

Consistency in making timely payments is vital when aiming for a high PAYDEX score. For instance, if you consistently pay your business invoices within 30 days over several months, this positive payment behavior will reflect positively in your PAYDEX rating.

In contrast, late or missed payments can have a detrimental effect on your PAYDEX rating. Even one late payment can cause a significant drop in the score and may take additional time and effort to recover from.

It’s important to note that while consumer credit scores consider various aspects, such as credit utilization ratio and length of credit history, when determining the overall score, PAYDEX scores focus primarily on how promptly bills are paid.

What’s considered a bad PAYDEX Score?

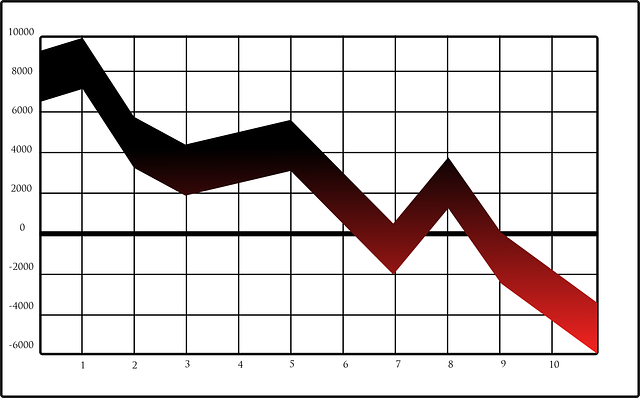

A bad PAYDEX score is typically considered below 40, while any score of 75 or lower indicates higher risk and limits your business credit options. This means your business should aim for a score of at least 80 to access the most advantageous lending options.

Low scores indicate a history of late payments and high risk to creditors. For example, if a company consistently pays its bills late or carries a large debt, it will likely have a lower PAYDEX score.

Negative information such as debt and late payments can significantly impact the score, just like how getting good grades in school reflects positively on your academic performance. Unlike personal credit scores, which are based on various factors, including payment history, amounts owed, length of credit history, new credit accounts, and types of credit used, PAYDEX scores are based solely on payment experience with business accounts.

A low PAYDEX score indicates that the business may not be reliable. It’s like having an ‘F’ grade regarding financial responsibility because it shows a significant risk in extending credit to this particular business entity. On the other hand, businesses with high scores demonstrate their ability to manage their finances responsibly.

What other Business Credit Scores should I know?

When it comes to business credit, several other types of credit scores besides PAYDEX are essential for business lending options. Dun & Bradstreet (D&B) evaluates other aspects of a business’s credit profile with various scoring metrics. These include:

- D&B Delinquency Predictor Score (DPS): Predicts the likelihood of a business being delinquent on its payments on a scale of 1-5. Unlike other credit scores, the lower the score, the higher the risk, so a score of 1 means a low chance of delinquency while a 5 suggests a high possibility.

- D&B Failure Score: Measures a company’s likelihood of experiencing financial stress over a 12-month period, such as filing for bankruptcy. This also uses a scale of 1-5, with a lower number indicating a lower risk.

- D&B® Supplier Evaluation Risk (SER) Rating: The SER Rating is crucial for businesses and suppliers wanting to join supply chains. It helps evaluate if a supplier might stop working in the next year. If a supplier stops, it could significantly disrupt a company’s supply chain and business. The rating goes from 1 to 9, with 1 meaning low risk and 9 meaning high risk.

- D&B Maximum Credit Recommendation: Companies use this score as a guide when considering extending a line of credit to another business. D&B creates the score by analyzing a business’s size, industry, and payment history. Some banks and creditors may look at this recommendation when deciding to extend a business loan.

Another important business credit score is the Experian Intelliscore Plus, which evaluates the likelihood of a business becoming severely delinquent on payments. Additionally, the FICO Small Business Scoring Service (SBSS) is used by the Small Business Administration (SBA) to assess the creditworthiness of small businesses applying for loans.

Understanding these different business credit scores is crucial for businesses seeking financing, as they can impact the terms and availability of loans and other forms of credit. By maintaining strong scores across these various metrics, businesses can improve their chances of securing favorable lending options and growing their operations.

Does personal credit matter if my PAYDEX Score is high?

Understanding that both can impact your ability to secure financing is important. Lenders and creditors often consider both your personal and business credit when making lending decisions. Even with a high PAYDEX score, negative information on your personal credit report can still influence their decision-making process.

A high PAYDEX score does not erase the impact of negative information on your personal credit report. For instance, having a history of late payments or significant debt on your personal accounts could affect how lenders view your overall creditworthiness. Therefore, building a solid personal credit history is crucial as it can positively improve your overall creditworthiness, potentially leading to better financing options for you in the future.

What financing products can I get with a PAYDEX Score of 80?

Businesses with a PAYDEX score of 80 can qualify for various financing products that can help them thrive and grow. One significant benefit is securing business credit cards with higher limits and more favorable terms. These cards can provide essential funding for everyday business expenses, such as purchasing inventory or covering operational costs.

Moreover, lenders are more inclined to offer loans and lines of credit to businesses with a strong PAYDEX score. This means that companies with a score of 80 are likely to receive better terms on these financial products, including lower interest rates and more flexible repayment schedules. As a result, they can access the capital needed to expand their operations or invest in new opportunities without being burdened by high borrowing costs.

A high PAYDEX score opens doors to specialized credit builder products designed to further improve a business’s credit profile. These tools are invaluable for companies looking to strengthen their financial standing and increase their access to future funding options. By utilizing these credit builder solutions alongside their solid PAYDEX scores, businesses can enhance their overall creditworthiness and attract even more advantageous financing offers.

Furthermore, businesses boasting a robust PAYDEX score also access better cash flow solutions like invoice financing. With an 80 PAYDEX rating, companies may qualify for improved invoice financing terms that allow greater flexibility in managing their working capital needs. Invoice financing enables businesses to quickly unlock the value tied up in unpaid invoices, providing them with immediate funds that can be reinvested into the company’s growth.

You may be interested in one of the following small business loans:

- Bad credit business loan.

- Business line of credit.

- Business loans for women.

- Business term loans.

- Equipment financing.

- Invoice factoring.

- Merchant cash advance.

- Revenue-based loan.

- SBA loans.

- Working capital loans.

- ERTC advance.

How to Get a PAYDEX Score of 80 – Final Thoughts

Businesses need to know their PAYDEX score as it’s often used when establishing tradelines and other forms of business credit. Many lenders and credit card issuers consider PAYDEX scores in combination with personal credit when approving business loan applications.

Best practices state to separate personal and business finances, get a D-U-N-S number, and – most importantly – pay all invoices on time or early when possible. And since it’s dollar-weighted, prioritize paying off larger invoices early.

Contact us if you have more questions about PAYDEX scores or to apply for a small business loan. Our business funding experts can help you find the best financing options to help your company grow and thrive.