What is Owner’s Equity?

Owner’s equity refers to the percentage of the company’s value allocated to the owner or owners of the business. It represents how much of the company the owner retains after all liabilities are subtracted from its assets.

Equity = Total assets – total liabilities.

As a small business owner, it represents the value you own in your company. However, it shouldn’t be confused with the company’s total value. Ultimately, if you liquidate the company by selling all its assets and paying off all liabilities, it’s how much you would retain.

Owner’s equity is used when the business is a sole proprietorship. If multiple business partners own the company, it might be called Owners’ Equity or Partnership Equity. These are privately held companies. In the case of a corporation, it becomes Shareholder’s Equity.

What is included in Owner’s Equity?

Owner’s equity tracks the company’s value belonging to the owner, owners, or shareholders in the case of a corporation. It provides a snapshot of what the owner, or owners, can claim.

Money Invested

The owner’s equity includes the initial investment and any additional investments since the company’s creation. This is the money the owner paid into the company to get it up and running.

Plus Business Assets

Business assets include anything the company owns of value. Examples include factory equipment, software, vehicles, buildings, etc.

Minus Liabilities

Any money the company owes is a liability. This could include any debt owed from business loans, accounts payable, or operating expenses.

Plus Net Income

Net income, also called net profit, is the money left over after subtracting all business expenses from total revenue. The net earnings from the company’s inception are added to the owner’s equity.

Minus Owner Withdrawals

When an owner withdraws money from the company, the amount withdrawn is a liquidation of the portion of the owner’s equity and is removed from the final total.

How do you calculate Owner’s Equity?

The owner’s equity accounting equation information is found on your balance sheet. Make sure you include all assets and liabilities.

Follow these steps when calculating owner’s equity:

- Add up your total current and fixed assets.

- Add up all the liabilities, including any debt owed.

- Subtract all the liabilities from total assets.

- The remaining total is the owner’s equity.

Let’s look at the owner’s equity on the balance sheet.

How is Owner’s Equity shown on the balance sheet?

A company’s balance sheet shows the total business assets versus the company’s liabilities and money owed during the accounting period.

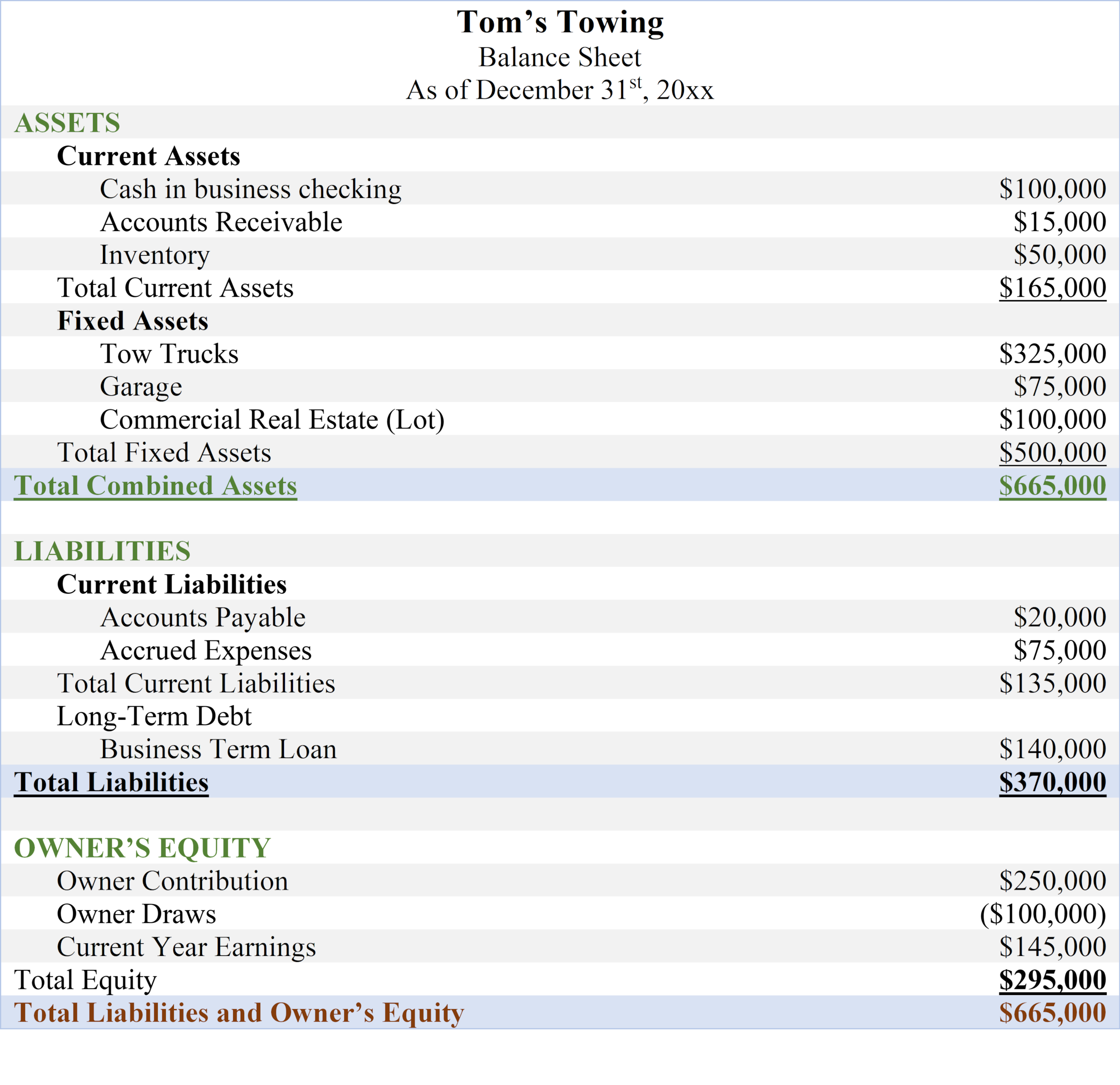

For this example, we’re using the fictional company, Tom’s Towing:

- Tom invested $250,000 of his own money.

- He received a business term loan of $350,000.

- He used the $600,000 in total capital to acquire a fleet of tow trucks, a garage, and a storage lot for cars and his tow trucks.

After three years in business, the company has $100,000 in the bank account. During that same time, Tom withdrew $100,000 in capital gains. The current balance sheet looks like this:

As you can see, Tom’s total owner’s equity is $295,000. That includes his $250,000 investment, the $100,000 he withdrew from the company, and the current earnings of $145,000. It is also the amount you get if you subtract total liabilities from total assets. Either way, you get the same total for owner’s equity.

As a business owner, you should know that owner’s equity doesn’t directly translate to the company’s total value. The book value of the owner’s equity plays a role in the total market value of the company, but it doesn’t create a complete picture.

If Tom wanted to sell his company, the actual selling price would depend on other factors such as:

- The fair market value of the company’s assets.

- The value of the company’s cash flow.

- The company’s revenue streams.

- Brand recognition & marketing collateral.

- Customer lists and any exclusive towing rights contracts.

Frequently Asked Questions

Here are some common questions about owner’s equity.

What is a statement of Owner’s Equity?

An owner’s equity statement is a financial statement that tracks the owner’s equity over an accounting period. It’s one of the four key financial statements, along with the balance sheet, income profit/loss statement, and cash flow statement.

It is a one-page report that shows the following:

- The amount of money the owner(s) invested.

- The amount of income being retained or reinvested.

- Changers to owner’s equity over time.

- Differences between assets and liabilities.

The owner’s equity statement includes information that is also included in the balance sheet. However, the owner’s equity statement mostly tracks changes in the value of the owner’s investment over time.

Small business owners should look at the statement of owner’s equity when making business decisions. Positive equity means the company is in a stable financial position, and negative equity means the company can’t cover expenses and faces potential bankruptcy.

Can Owner’s Equity be negative?

The owner’s equity is negative if a company’s total liabilities are greater than its assets. Businesses showing a negative owner’s equity face some tough financial decisions.

The first question is to identify why the owner’s equity is negative. Possible reasons could be high levels of debt, depreciation of assets, or a negative P&L statement.

Either way, a business owner needs to identify whether they can right the ship and get back into a positive equity situation or begin the process of bankruptcy.

What’s shareholder’s equity?

Shareholders’ equity, also called stockholder’s equity, is the same thing as owner’s equity, except it is for a corporation. The formula is still the company’s total assets minus liabilities, but you need to account for additional assets and liabilities.

Since corporations have more complicated ownership structures, there are additional components of owner’s equity for shareholders.

Retained Earnings

When a corporation turns a profit, some of the net earnings are paid out in dividends to the shareholders, which is like a sole proprietor withdrawing money. The net earnings that are not paid in dividends and instead reinvested into the company are called retained earnings. Retained earnings add to the shareholder’s equity.

Outstanding Shares

When a corporation sells shares to investors but does not purchase them back, they are known as outstanding shares. The number of outstanding shares is part of assessing shareholder equity value.

Treasury Stock

Treasury stock is the number of stocks the company repurchases from investors and shareholders. Treasury stock is subtracted from the company’s total equity to get the number of shares available to investors for purchase.

Additional Paid-In Capital

Additional paid-in capital comes from the money stockholders paid to acquire stock above the stated par stock value. To calculate paid-in capital, find the difference between the par value of common stock and the par value of the preferred stock, the selling price, and the number of recently sold shares.

Owner’s Equity Final Thoughts

Whether your business is a sole proprietorship, a partnership, or you’re a shareholder of a corporation, understanding owner’s equity is a key component of your finances. You invested a lot of money and want to ensure your money is working for you.

Tracking owner’s equity lets you know how much your investment grows. When owner’s equity increases, your company is making money and is in a good financial position regarding assets over liabilities. A negative owner’s equity is a critical warning sign that a business is over-leveraged and potentially failing.

As a business owner, you must keep track of your income statements, balance sheets, cash flow statement, and owner’s equity statements. Understanding these financial measurements helps when making decisions about the future of your business.

For example, if you are trying to sell your business, strong revenue, cash flow, and owner’s equity make your company more attractive to potential buyers. If you’re considering growing the business with a financing program, a positive owner’s equity indicates you can take on more liability. Just ensure your cash flow and revenue can handle any loan payments.