What are Credit Scores?

Credit scores are three-digit numbers that measure your overall credit history. Most credit scores range from 300-850. The higher your credit score, the better your credit.

Credit scores are based on metrics like payment history, credit mix, credit utilization rate, and more. They’re based on your credit history, recorded in your credit report.

The three major consumer credit bureaus – Experian, Equifax, and TransUnion – each produce credit reports and calculate your credit scores.

What are the benefits of Good Credit?

A good credit score provides increased access to cash and extended lines of credit. Excellent credit increases the lender’s confidence in your ability to repay borrowed money owed to your creditor, also called your creditworthiness.

You can apply for business loans for bad credit, but you can access more options in the funding market with a good credit score. You’ll also get lower-cost options, as business loans for bad credit carry higher interest rates and fees.

How are Credit Scores calculated?

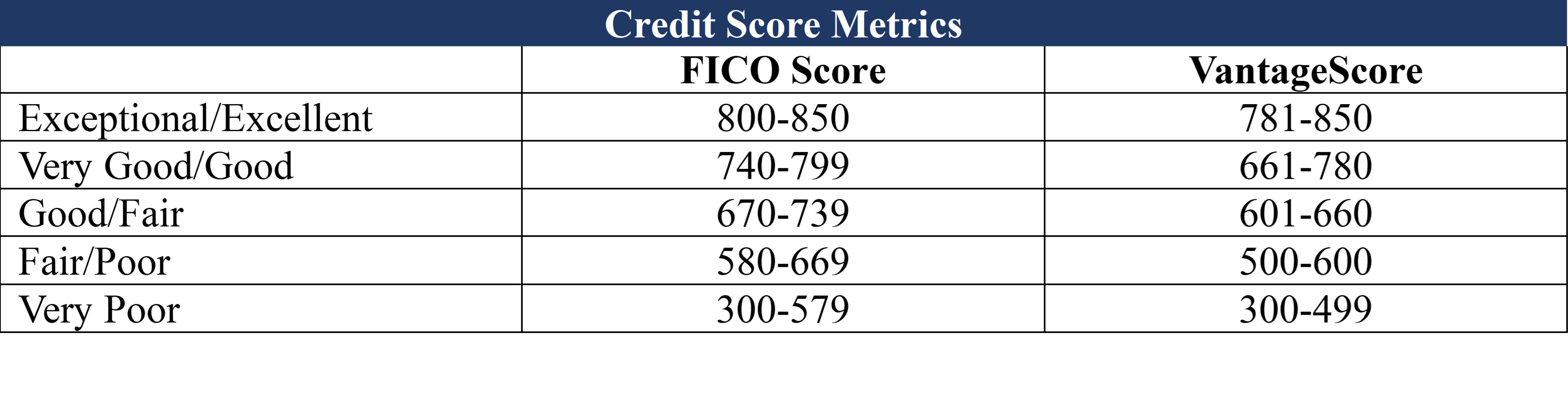

The two primary credit scoring models to evaluate and rate credit are FICO scores and VantageScores. While different, their ranges are similar.

Both scoring models have a range of 300-850. Scores between 800 are 850 are in the Exceptional range for FICO scores, while VantageScores between 781-850 are rated Excellent. Here are the rest of their metrics:

There are five key factors for calculating FICO scores:

- Payment history: 35%.

- Amounts owed: 30%.

- Length of credit history: 15%.

- Credit mix: 10%.

- New Credit: 10%.

VantageScores calculate your credit score on similar metrics but weighted differently. VantageScore factors are:

- Payment history: 40%.

- Depth of credit: 21%.

- Credit utilization: 20%.

- Account balances: 11%.

- Recent credit: 5%.

- Available credit: 3%.

What are the top ways to Fix Bad Credit Scores?

Repairing bad credit or establishing good credit with no credit history requires committing to good credit behavior. There are also funding options for low-credit or no-credit borrowers that could help you quickly boost your score.

Here are some of the best practices you can use to improve your credit score quickly.

-

Monitor Your Credit Reports Regularly

Many people think checking their credit score through credit reports is difficult, but it’s actually relatively easy. And best of all, you can access your credit reports for free!

Under the Fair Credit Reporting Act (FCRA), each individual is entitled to a free annual credit report from each of the three major credit bureaus. You can get your free credit reports at www.AnnualCreditReport.com, authorized by the U.S. government.

Checking your credit reports at least once yearly (if not more regularly) helps identify incorrect information. You can dispute any erroneous reports to have them removed from your credit history. It also enables you to identify the issues negatively affecting your credit score so you can devise a plan of action to counteract it.

You can also create an account at one or all three credit bureaus. Some credit reporting agencies offer services to help repair credit. For example, Experian offers Experian Boost®. The service scans your bank accounts to detect on-time payments that could add to your Experian credit report. Examples include rent payments, utility or cell phone bills, and even some streaming services. While there’s no guarantee, approved payments could immediately raise your credit score by several points.

-

Dispute Credit Report Mistakes

It’s surprising how often credit reports reflect false or erroneous information. According to a FICO study from 2013, nearly 25% of participants had incorrect information on their credit reports that adversely affected their credit scores.

Failing to check and dispute errors or adverse reports when applying for business loans will undoubtedly lower your chances. Common causes for credit report errors include:

- Merchants reporting incorrect details.

- Accounts mistakenly added to your report due to similar names.

- Incorrect payment history.

- Inflated account balances.

- Reporting incorrect credit limits.

- Closed and duplicate accounts filed on your credit report.

The DIY method for dealing with false reports is to submit a written dispute with accompanying documentation to the three credit bureaus. The written statement should explain the erroneous reports. It would be best to dispute the claims before they impact your credit score.

-

Make On-time Payments

You should always pay bills on time. It’s vital that you avoid late payments and defaults. As mentioned, payment history is the most significant factor impacting your credit. Creditors want to see a positive payment history as it demonstrates you’re less likely to miss payments in the future.

Late or missed payments hit your credit the hardest. The longer a missed payment remains unpaid, the more it lowers your credit score. When late payments lead to defaults or charge-offs, your credit score could take an even bigger nosedive.

Ensure you budget for payments before taking out any form of credit. Consider setting up automatic payments from your bank account or scheduling payment reminders to avoid missing payments.

Don’t Fall for Minimum Payments Scams

Credit card companies set a minimum balance you must pay each due date. While it varies, most minimum payments are roughly 1-2% of the account balance on the last day of the billing cycle.

Making your minimum payment saves you from late payment penalties and missed payments on your credit report, so it’s better than paying nothing. However, the minimum balance payment does not save you interest.

Some credit card companies will provide your minimum balance payment but also include an “interest-saving balance,” which is what your balance must be to avoid incurring interest for charges during the previous billing period.

Ideally, paying your entire balance off before the billing date each month is best. If you cannot pay off the total balance, pay as much as possible to reduce the interest you’ll owe. Credit cards are notorious sources of high debt, so paying off your balances quickly can help improve your credit.

-

Keep your credit utilization rate low

The credit utilization ratio measures how much credit you’re using. The credit bureaus take your current credit balances over your total credit limit and convert them to a percentage. For example, if you have a $2,000 balance with a $10,000 credit limit, your credit utilization ratio is 20%.

Your credit usage makes up 30% of your FICO score. Low credit utilization means you successfully manage and pay back your finances. It also indicates you have the capacity to take on more debt.

The common recommendation is to get credit utilization below 30% to improve credit scores. However, individuals with the highest credit scores have credit utilization rates in the single digits. So, getting your credit usage below 10% will help repair your credit even quicker.

-

Don’t Close Old Credit Accounts

Paying off a credit card debt may make you want to cancel the credit card account. Perhaps you don’t want the temptation of adding new debt to the credit line after working so hard to pay it off. Or perhaps the original reason you got the card is no longer important.

For example, say you opened a store card to pay for new furniture. You carried the credit card balances for a few years, making regular monthly payments. Now it’s paid off, and you no longer have use for the card. Closing it seems like the best idea.

However, closing old credit card accounts could adversely affect your credit in two ways. One is that length of credit history makes up 15% of your FICO score. The credit bureaus use the average age of all your credit accounts for this metric. Closing an old account decreases the average age of accounts, which could lower your score.

Secondly, credit utilization is 30% of your credit score. Closing an old account removes that credit limit, which lowers your total available credit. That will increase your credit utilization ratio.

-

Avoid Applying for New Credit Unless Necessary

Creditors pull your credit report any time you apply for a new loan, line of credit, or credit card. This is called a hard credit inquiry, hard pull, or hard credit pull.

Each new hard inquiry lowers your credit score by a few points. While applying for new credit doesn’t represent a credit risk, applying for many credit cards or loans in a short period can still lower your credit score. Some lenders might view that activity as trying to take out more credit than you can afford.

Hard inquiries stay on your credit report for two years, but the negative effect on your credit score only lasts one year. So, it’s important to avoid too many new credit applications too close together. It’s also important to check your credit report for hard pulls to ensure there are no incorrect or double-reported hard inquiries.

-

Seek Help from Credit Repair Companies

Credit repair companies can help credit-challenged individuals who have difficulty juggling all the details of credit reports or dealing with a credit reporting agency.

What are credit repair companies?

A credit repair company is a team that can help fix a poor credit score. Their primary service is helping remove inaccurate and harmful information from your credit reports. They also help communicate with the credit reporting agencies on your behalf.

Are these credit repair companies reliable?

There are many reputable credit repair companies, but there are also credit repair scams looking to take advantage of individuals with low credit scores. The scam credit repair services often make “too-good-to-be-true” promises of creating a positive payment history.

Legit credit repair agencies typically charge a fixed monthly fee or a fee per service. Companies that require an upfront fee are typically scammers.

A major red flag is any company that says it can remove accurately reported negative reports. There’s no way to remove negative marks from a credit report unless they were incorrect in the first place. Any company that says it can remove negative reports or encourages you to lie to the credit bureaus is untrustworthy.

Credit Repair Company Pros & Cons

Pros:

- Help remove incorrect information from your credit report.

- Advocates with credit card companies on your behalf.

- Can help you develop a credit repair strategy.

Cons:

- It can be costly and tricky.

- Some scam companies pose as legitimate credit repair companies.

-

Consider a Debt Consolidation Loan

A debt consolidation loan can help repair damaged credit if used properly. As its name implies, it allows you to consolidate multiple debts into a single monthly payment.

Debt consolidation loan scenario: you have multiple credit card balances with APRs between 20-30%, a car loan, and another personal loan. The monthly payments for each strain your budget. You can only make the minimum payments on credit cards, which means you’re paying a ton in interest and not reducing your overall credit card debt/credit utilization.

You take out a debt consolidation loan to pay off all your credit cards and loans. You now have a single monthly payment at a lower interest rate than your credit card APRs.

In this scenario, your credit utilization would improve, and you could pay off your debt in affordable, fixed payments. However, you must be disciplined in making those payments religiously and avoiding adding new credit card debt.

Some people who’ve used debt consolidation loans have made the mistake of not correcting their bad spending habits. In this case, the loan would exacerbate your bad credit situation, as you would end up still carrying high credit card balances while having to make loan payments.

Debt consolidation loans only work when you’re committed to not taking on new debt until the loan is paid off. Even then, it’s essential to always keep credit utilization below 30% or preferably below 10%.

-

Consider a Secured Credit Card

A secured credit card requires a cash deposit to guarantee the credit line. Offering the security deposit helps borrowers with bad credit get approved for the card.

Once approved, you can begin making purchases and paying them off to build your credit. Make sure the credit card company reports to the major credit bureaus.

-

Consider a Credit-Builder Loan

Credit-builder loans are special loans, usually for lower amounts, designed to help build or repair credit. Instead of disbursing the loan funds to you, the lender puts the money in a savings account or certificate of deposit (CD).

You make regular loan payments plus interest. The positive payment history helps build credit. Once you finish paying the loan off, the lender releases the loan proceeds to you.

How long does it take to Fix Bad Credit?

Repairing bad credit takes a while, and there are no “quick fixes.” Even if you follow every step, credit scores won’t go up in a brief period.

Paying your debts won’t be reflected in your credit score until those credit accounts report to the bureaus, which typically happens monthly. So, it takes at least one month for positive credit activity to hit your credit report.

It takes several months of positive actions filed in your credit report to move your score up. It can take years to fix severely damaged credit before getting a good credit score, as good credit requires having good credit habits for some time.

But the good news is that it’s never too late to repair credit. Negative reports like missed payments and even foreclosures only last on the credit report for seven years. Positive payments have no expiration date.

Can credit counseling help Raise Bad Credit Scores?

A credit counseling agency can’t directly help you create a positive credit history, but it can help you better understand and improve your spending habits. Fixing bad credit is a mental battle, and people who struggle to break the cycle of poor credit habits can benefit from a credit counselor.

Working with a credit counseling agency can help you get to the root causes of your debt, such as spending more than you’re making or living beyond your needs. You can use those insights to create a plan of action to pay off debt and repair credit.

10 Ways to Fix Bad Credit Scores – Final Thoughts

The best ways to repair bad credit are to make on-time payments and keep credit utilization below 30%. You can create payment plans to pay off your debt or consider using a debt consolidation loan or balance transfer card.

You should also avoid closing old accounts or opening new ones unless necessary. Fixing bad credit takes time. The best and fastest way to raise your credit score is to start using good credit habits today.

Contact us if you have more questions on repairing bad credit or want to apply for a small business loan. Our funding experts can help you find the best business loan options for your credit score.