What is a Healthcare Group Purchasing Organization (GPO)?

A Group Purchasing Organization (GPO) in healthcare helps members buy medical supplies and services. These organizations use the collective purchasing power of GPO members to negotiate better prices.

Collective Price Negotiations

GPOs negotiate prices for various healthcare products, such as surgical instruments, medical devices, and pharmaceuticals. By pooling the purchasing needs of multiple members, they secure discounts and favorable terms, which saves money for hospitals and clinics.

Supply Chain Efficiency

Another aspect of GPOs is improving efficiency in the medical supply chain. They streamline purchasing processes, reducing the time spent on procurement. Members benefit from standardized contracts and simplified ordering systems, which leads to quicker access to necessary supplies.

Additional Services

GPOs also offer additional services beyond negotiating prices. They provide innovative technology integration and data analytics to help healthcare providers improve operations. This analysis helps facilities understand their spending patterns and guides them in making informed purchase decisions. Some GPOs even support members with educational resources and training programs, which enhance the staff’s overall knowledge of best procurement practices.

How do Healthcare GPOs work?

GPOs are vital in the healthcare industry. They facilitate cost-effective purchasing and improve operational efficiency. Here are some specifics of how GPOs work in the healthcare system.

Role of GPOs

GPOs serve as intermediaries. They help healthcare providers buy medical supplies and services at lower prices. Healthcare organizations join these groups to benefit from collective purchasing power. This collaboration reduces costs significantly. GPOs aim to lower purchasing costs in two primary ways: negotiating lower prices and increasing transaction volume.

Vendor Approval Process

When it comes to approving vendors, GPOs have a rigorous vetting process in place to ensure quality and reliability. Specific criteria typically include evaluating the vendor’s compliance with industry regulations, such as FDA approvals and certifications.

GPOs also assess the vendor’s track record for product quality, delivery timeliness, and customer service. Financial stability and pricing competitiveness are additional factors considered during the vendor approval process. GPOs prioritize selecting vendors that can consistently meet healthcare facilities’ needs while upholding high performance and reliability standards.

National GPOs vs. Regional GPOs

National GPOs (tier 1) and regional GPOs (tier 2) differ in their scope and reach within the healthcare industry. National GPOs operate on a larger scale, representing a wide range of healthcare facilities nationwide. They have significant purchasing power and negotiate contracts with diverse vendors to serve their member facilities.

In contrast, regional GPOs focus on a specific geographic area or type of healthcare facility, such as hospitals or clinics within a particular state or region. While regional GPOs may have more specialized knowledge and tailored contracts for their members, they may not have the same level of leverage in negotiations as national GPOs. Overall, both types of GPOs play a crucial role in helping healthcare facilities streamline their purchasing processes and achieve cost savings.

Joining a GPO

Joining a GPO as a healthcare business can be a strategic decision to streamline procurement processes and achieve cost savings. The process typically involves researching and identifying GPOs that align with the healthcare business’s specific needs.

Once a suitable GPO is selected, the next step is to submit an application for membership. This application may require detailed information about the healthcare business, such as annual purchasing volume, types of products or services needed, and current suppliers.

After the application is reviewed and approved, the healthcare business can start benefiting from the negotiated contracts and discounts offered by the GPO. Additionally, joining a GPO allows healthcare businesses to access a network of suppliers, gain market insights, and collaborate with other members to improve purchasing efficiency and drive savings.

Contract Length and Costs to Healthcare Facilities

When joining a Group Purchasing Organization (GPO), healthcare facilities typically enter into contracts with varying lengths. These contracts can range from one to five years, most commonly being three-year agreements. The contract length often depends on the specific GPO and the healthcare facility’s needs.

Healthcare facilities can expect to pay membership fees to the GPO. These fees can vary depending on the size of the facility and the services provided by the GPO. On average, membership fees can range from 0.5% – 4% of the purchase price of supplies. Additionally, healthcare facilities may incur additional costs for accessing GPO contracts and services, such as administrative fees or implementation costs.

Financial Savings

GPOs help healthcare providers save substantial amounts on medical supplies. Some estimates suggest GPOs save affiliated hospitals between 10% and 18% on supplies. This translates to an estimated savings of $55 billion annually for healthcare businesses as a whole. These savings can be passed on to patients, making care more affordable.

GPO Example

In the bustling world of healthcare, a small clinic struggled to keep up with the demand for medical supplies. With limited resources and a tight budget, they turned to a Group Purchasing Organization (GPO) for assistance.

The GPO leveraged its collective buying power to negotiate discounted rates with suppliers on behalf of the clinic. As a result, the clinic could access high-quality supplies at a fraction of the cost, allowing them to allocate their budget more effectively towards patient care and other essential needs. Thanks to the GPO, the clinic was able to streamline its purchasing process, save money, and ultimately improve the overall efficiency of its operations.

What types of Healthcare businesses join GPOs?

Healthcare businesses join Group Purchasing Organizations (GPOs) to save money and streamline operations. These partnerships benefit many types of organizations.

- Hospitals: These are the largest users of GPOs. They purchase medical supplies and equipment through GPOs to reduce costs.

- Nursing homes: These facilities need a variety of products. GPOs help them get essential items at lower prices.

- Home health agencies: These providers deliver care at home. They rely on GPOs for affordable medical supplies and equipment needed for patient care.

- Healthcare systems: Large networks of hospitals and clinics use GPOs to manage purchasing across multiple locations. This strategy helps them gain better deals.

- Healthcare organizations: Various non-profit and for-profit entities join GPOs to improve their purchasing power and access to resources.

- Healthcare providers: Individual doctors, private practices, and clinics also benefit from GPOs. They can buy supplies more affordably, which helps keep services accessible.

Joining a GPO allows these businesses to focus on their core mission. They can provide better healthcare services without worrying about high costs.

What are the benefits of a Healthcare GPO?

Healthcare providers benefit significantly from working with a Group Purchasing Organization (GPO). These organizations help hospitals and clinics buy supplies together, leading to cost savings. By pooling their needs, members can negotiate better prices with suppliers.

Efficiency also improves when healthcare businesses join a GPO. They save time on purchasing processes. Instead of each provider negotiating separately, they share resources. This collective purchasing power allows them to focus more on patient care than procurement.

GPOs offer access to a wide range of products. Members can find everything from medical equipment to office supplies. This variety helps healthcare providers meet their specific needs without searching multiple vendors.

Evidence shows that GPOs enhance financial performance. Many studies indicate that hospitals using GPOs report lower operational costs. They benefit from standardized pricing and reduced administrative work.

Healthcare GPOs also provide valuable data. They analyze market trends and supplier performance, helping members make informed decisions about their purchases.

What are the drawbacks of a Healthcare GPO?

Joining a GPO can have some drawbacks for healthcare providers. One major issue is the fees associated with membership. Many GPOs charge fees that can add up over time. These costs may reduce the savings that hospitals and clinics hope to achieve.

Contract length also poses a challenge. Most GPO agreements last several years, locking providers into long-term contracts. This situation makes it hard for healthcare facilities to switch suppliers or negotiate better deals.

Another significant disadvantage is that GPOs often exclude smaller suppliers. Many large companies dominate GPO contracts, limiting healthcare providers’ choices and reducing competition in the market. When fewer suppliers compete, prices can remain high.

Nearly all healthcare professionals use GPOs today. This widespread use makes it challenging for individual providers to negotiate directly with vendors. They may not get the best deals because they lack leverage against larger organizations.

The debate around GPOs continues as many weigh these disadvantages against their benefits. Providers must consider if joining a GPO aligns with their financial goals and patient care standards.

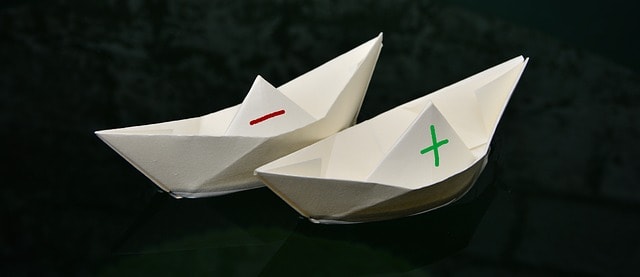

Healthcare GPO Pros & Cons

Pros:

- Cost savings through group purchasing power.

- Access to a wider range of suppliers and products.

- Streamlined procurement process.

- Standardization of products and services.

- Increased bargaining power with vendors.

Cons:

- Loss of control over purchasing decisions.

- Potential for limited product choices.

- Membership fees and administrative costs.

- Contract restrictions with specific vendors.

- Lack of flexibility in the customization of contracts.

How do I choose the Best GPO for my Healthcare Business?

The following steps can help you choose the best GPO for your healthcare business.

Step 1: Assess Your Needs

Before choosing a Healthcare GPO, it is essential to assess your business’s specific needs. Consider factors such as your organization’s size, the types of products and services you regularly purchase, and your budget constraints. This initial assessment will help you narrow your options and find a GPO that aligns with your requirements.

Step 2: Research Potential GPOs

Once you clearly understand your needs, start researching potential Healthcare GPOs. Look for GPOs that specialize in the healthcare industry and have a strong track record of working with businesses similar to yours. Consider factors such as the range of suppliers they work with, their discounts, and any additional services they provide.

Step 3: Evaluate Cost Savings

One of the primary reasons for joining a GPO is to access cost savings on products and services. When evaluating potential GPOs, compare the discounts they offer on the products and services you regularly purchase. Calculate the potential cost savings you could achieve by joining each GPO to determine which one offers the best value for your business.

Step 4: Consider Contract Terms

Before committing to a Healthcare GPO, carefully review the contract terms. Pay attention to factors such as the length of the contract, any fees or membership dues, and any exclusivity requirements. Ensure you fully understand the terms of the agreement before signing to avoid any surprises down the line.

Step 5: Seek References and Reviews

Lastly, don’t forget to seek references and reviews from other businesses that have worked with the GPOs you are considering. Reach out to current GPO members for their feedback on their experience, including the level of customer service, the quality of suppliers, and the overall cost savings achieved. This information can help you make an informed decision when choosing the best Healthcare GPO for your business.

Healthcare GPO Frequently Asked Questions

Here are the most common questions about GPOs for healthcare businesses.

Is my Healthcare business required to join a GPO?

While joining a Group Purchasing Organization (GPO) is not mandatory for healthcare businesses, many choose to participate for cost savings and efficiency benefits. GPOs help healthcare providers leverage collective buying power for better prices on medical supplies and equipment.

Negotiated contracts through GPOs can lead to significant savings, making it easier for businesses to manage budgets effectively and provide quality care while keeping expenses low. Some businesses may opt not to join GPOs and negotiate contracts directly with suppliers, but this can be less efficient.

Can my Healthcare business be in more than one GPO?

Yes, healthcare businesses can join more than one Group Purchasing Organization (GPO). This practice is common among various providers. Joining multiple GPOs can help organizations access different contracts and pricing options. Most hospitals belong to 2-4 GPOs.

How do Group Purchasing Organizations impact the Healthcare Supply Chain?

Group Purchasing Organizations (GPOs) streamline the healthcare supply chain by negotiating contracts with suppliers, reducing members’ costs through bulk purchasing, and minimizing transaction expenses. By leveraging their purchasing power, GPOs enable healthcare providers to focus on patient care while accessing a wide range of products tailored to their needs.

This efficient procurement process saves time and money, benefiting hospitals and clinics that may not have the same buying power individually. Regional GPOs further enhance the medical supply chain by catering to specific areas, ensuring that healthcare providers receive the products necessary for their communities.

Are there Healthcare financing options for purchasing Medical Supplies?

It’s important to note that GPOs don’t make the actual purchases. These organizations serve as intermediaries between healthcare businesses and the vendors, suppliers, manufacturers, etc. that provide necessary materials.

While GPOs can help lower costs, some medical practices may still require financial assistance to acquire needed materials and supplies. Here are a few of the leading small business loans for healthcare to consider.

Medical Practice Loans: Medical practice loans are a standard financing option for healthcare professionals looking to expand their practice, purchase new equipment, or invest in technology upgrades. These loans can provide the necessary capital to cover expenses such as medical supplies, office renovations, and staff training, helping healthcare providers improve patient care and grow their business. Interest rates and terms for medical practice loans can vary depending on the lender and the borrower’s financial history.

Medical Equipment Financing: Medical equipment financing is a viable option for healthcare providers looking to purchase costly medical supplies without a large upfront payment. This type of financing allows for acquiring essential equipment while spreading out payments over time, making it more manageable for budgeting purposes. Many financial institutions offer medical equipment financing at competitive rates and with flexible terms to meet the needs of healthcare facilities.

Medical Factoring: Medical factoring is a financial option in which a healthcare provider sells its accounts receivable to a third-party company at a discount in exchange for immediate cash. This can help providers access funds quickly to purchase necessary medical supplies or cover other expenses while waiting for insurance payments. Factoring companies then collect the full amount owed from the insurance companies or patients.

Other Small Business Loans

Healthcare business owners can also look into small business loans aside from financing programs specifically for medical practices. You may be interested in one of the following small business loans:

- Bad credit business loan.

- Business line of credit.

- Business loans for women.

- Business term loans.

- Merchant cash advance.

- Revenue-based loan.

- SBA loans.

- Working capital loans.

- ERTC advance.

What is a GPO in Healthcare – Final Thoughts

Healthcare Group Purchasing Organizations (GPOs) play a crucial role in the healthcare supply chain. They help you save money, streamline purchasing, and improve access to essential medical supplies. Understanding how GPOs work and their benefits can empower your healthcare business to make informed decisions.

Before joining a GPO, consider your organization’s unique needs. Weigh the pros and cons carefully. Explore options that best suit your goals.

Contact us if you have more questions about running a small healthcare business or applying for a business loan. Our alternative business financing experts can help you find the best funding programs for your healthcare business needs.