What is an Online Business Checking Account?

Online banks have become an increasingly popular alternative to traditional brick-and-mortar banks due to their convenience and lower costs. They do not have physical branches and instead provide services through websites and mobile apps. Customers can manage their accounts anytime, anywhere. Online banking offers convenience for busy business owners.

This setup allows them to offer lower fees because online banks usually have lower overhead costs than traditional banks. These savings can be passed on to customers through lower fees. For instance, many online banks offer free or low-cost accounts compared to many conventional options that charge a monthly service fee.

A business checking account is essential for small businesses. It helps separate personal and business finances, which is crucial for tracking expenses and income accurately. A dedicated account simplifies tax preparation and builds credibility with customers and vendors. Many prefer a business name on checks rather than a personal name.

Small businesses often face challenges managing their finances. A basic business checking account can help address these challenges. It provides features like online bill pay and easy access to transaction data, which streamline operations and save time.

Many online banking products cater to new small business checking accounts. These products might include merchant services that allow businesses to accept credit cards easily. Business owners can apply for these accounts quickly and receive information almost instantly.

The application process for an online business checking account is often straightforward. Applicants typically need to provide basic information about their business, such as its structure and registration details. Some banks might require additional documentation, like identification or tax information.

Using an online bank can also improve cash flow management for small businesses. Since transactions are processed quickly, funds become available sooner than with traditional banks. This speed benefits businesses that rely on timely payments.

How do Online Business Checking Accounts work?

Online banks operate differently than traditional banks. They do not have physical branches. Instead, they rely on technology to provide services. This means customers can manage their accounts from anywhere with internet access.

Transactions happen through websites or mobile apps. Customers can usually deposit checks through mobile deposit technology rather than at a physical brand or ATM. They can also transfer money and pay bills online. This convenience makes online banking appealing to many business owners.

A business receives a statement cycle when it opens an online checking account. A statement cycle is a specific period during which transactions are recorded. At the end of each cycle, the bank provides a summary of all activity, including deposits, withdrawals, and any fees charged.

Online business accounts usually offer features like:

- Easy access to funds.

- Free business debit card.

- Quick transfers between accounts.

- Tools for tracking expenses.

- Integration with accounting software.

- Low or no monthly service fees.

These account features simplify managing business finances. Business owners can see how much money is available at any time.

Many online banks also provide additional services. For example, they may offer savings accounts or credit options. These services help businesses grow and manage cash flow better.

While some might miss in-person service, online banking has its advantages. Customers can access their accounts 24/7 without waiting in line, and customer support typically occurs through chat or phone calls.

Online banks often use enhanced encryption to protect customer data. Most are also FDIC-insured, but ensuring this is the case to protect your money is crucial.

Many business owners appreciate the ease of managing their finances online. They find it efficient to handle everything from one platform. It allows them to focus more on running their businesses than banking logistics.

What are the Best Free Online Business Checking Accounts?

Free online business checking accounts allow companies to manage their finances without monthly fees. Many of these accounts provide essential features like online banking, mobile access, and integration with accounting software. They help business owners easily keep track of expenses and income.

Here are some of the best free eligible business checking accounts online to consider. Deposits are FDIC-insured for all options in this list.

Bluevine Business Checking

Bluevine Business Checking is a popular option for small businesses seeking a free online business checking account. This account has no monthly fees, no minimum balance requirements, and no transaction fees.

Bluevine also offers an impressive 2.00% APY on balances up to $250,000, making it a competitive choice for businesses looking to earn some interest on their funds. Additionally, Bluevine provides unlimited transactions, mobile check deposit capabilities, and free ATM access through the MoneyPass Network, making it a convenient and user-friendly option for business owners.

Novo Business Checking

Novo Business Checking offers a fee-free business checking account with no minimum balance requirement. It offers unlimited transactions, free ACH transfers, and free incoming wires.

Novo also offers integrations with popular accounting software like QuickBooks and Xero, making managing finances easier for business owners. Additionally, Novo provides access to a network of ATMs nationwide, allowing for easy cash withdrawals.

While Novo does not offer an APY on its business checking account, its focus on low fees and user-friendly features make it a popular choice for small businesses and freelancers.

Mercury Business Checking Account

With no monthly fees, minimum balance requirements, or transaction fees, Mercury offers a straightforward and cost-effective banking solution for small businesses. It’s an ideal option for startups.

The Mercury Business Bank Account includes a free business checking account and a free business savings account. The digital platform includes tools to track expenses and purchases for easy management. In addition, users can create virtual debit cards to manage team member spending. Like many online banking options, it also integrates with other business apps and accounting software.

Lili Basic Business Checking Account

The Lili Basic Business Checking Account is an ideal option for small business owners looking for a simple and efficient banking solution. With no monthly fees, minimum balance requirements, or hidden fees, this account offers transparency and affordability.

It also features an early payment feature that benefits freelancers and independent contractors. Paid plans start at $9 per month and include enhanced features for tax prep, expense management, and more.

Axos Bank® Basic Business Checking

Axos Bank Basic Business Checking is designed to meet the needs of small businesses with straightforward banking requirements. This account offers unlimited domestic ATM fee reimbursements, no monthly maintenance fee, and no minimum balance requirements.

With online and mobile banking capabilities, managing your business finances is convenient and efficient. Axos Bank provides 24/7 customer support to assist with banking needs or inquiries. The Basic Business Checking account is a cost-effective solution for businesses looking for simple and reliable banking services.

Relay Business Checking

Relay Business Checking is designed for small businesses looking for a simple and affordable checking account option. With features like no monthly maintenance fees, no minimum balance requirements, and unlimited transactions, it offers convenience and flexibility for businesses of all sizes.

Additionally, this account includes online and mobile banking capabilities, making it easy to manage finances on the go. For businesses seeking a straightforward checking solution with no frills, Relay Business Checking may be the perfect fit.

What are the benefits of Free Online Business Checking Accounts?

Free online business checking accounts provide many benefits for managing finances. Lower costs are the most significant advantage. Traditional banks often charge account fees, but many online options do not. This means businesses can save money that they can use elsewhere. Lower fees usually lead to better financial health for small businesses.

Another significant benefit is that free online business checking accounts offer a lower barrier to entry than other options. This can help new and younger businesses establish a bank account to separate personal and business finances.

Some online banks offer advanced features that help manage business finances. These features often include transaction categorization and real-time alerts, allowing businesses to track their cash flow more effectively. Many online banks also offer mobile apps that allow users to deposit checks and make payments quickly.

Most options offer convenience checks, making it easy to pay bills or vendors without leaving your office. You can access your account anytime, anywhere. This flexibility helps businesses stay organized and efficient.

Syncing with accounting software is a crucial benefit of online banking. This feature allows businesses to automate their financial operations. By linking bank accounts with accounting tools, transactions update automatically, reducing manual entry errors and saving time for business owners.

Businesses can also take advantage of various services offered by online banks. Some institutions provide rewards programs for using their services. For example, businesses may earn cash back on certain transactions or receive bonuses for maintaining a minimum balance.

What are the drawbacks of Free Online Business Checking Accounts?

Free online business checking accounts have some drawbacks. One major issue is the lack of physical branches. Online banks operate entirely on the internet. This means customers cannot visit a branch for in-person service. Some people prefer face-to-face interactions. They find it easier to ask questions and resolve issues in person.

Another drawback is that these accounts may have hidden fees. While many online banks advertise no monthly fees, they might charge transaction fees. These fees can add up quickly, especially for businesses that make many transactions. Additional costs could include ATM, wire transfer, or overdraft fees. Some options also charge a cash deposit processing fee. Understanding all potential charges is crucial before choosing an account.

Customer complaints often focus on customer service. Many users report difficulties reaching support when they need help. Online banks usually offer support through chat or email. Some customers feel this is less effective than speaking with someone in person. Delays in response can frustrate business owners who need quick solutions.

Security is another concern for some users of online banking. People worry about their sensitive information being at risk. Cybersecurity threats are real and can affect any online platform. Businesses must take extra precautions to protect their data.

Many users also mention technology issues with online banking platforms. Glitches can happen, making it hard to access accounts or complete transactions. If a system goes down, businesses may struggle to manage their finances. This can lead to delayed payments or lost sales.

Businesses that deal with cash may find online banks limiting. Depositing cash can be challenging without physical branches nearby. Some online banks partner with retail locations for cash deposits, which may not be convenient for all customers.

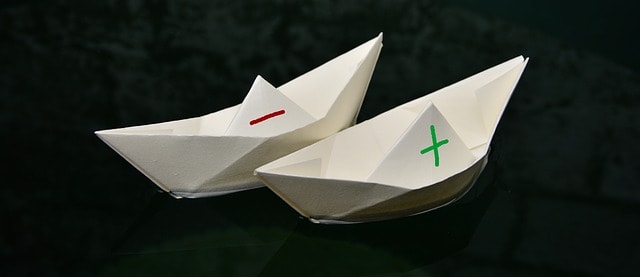

Free Online Business Checking Account Pros & Cons

Pros:

- No monthly maintenance fees.

- Convenient online access to account information.

- Ability to easily transfer funds between accounts.

- Often come with features like mobile check deposit.

Cons:

- May have hidden fees such as transaction or cash deposit fees.

- May have restrictions on the number of transactions allowed per month.

- Potential for higher fees for services not included in the free account.

- Limited availability of physical branches & customer service.

How do I choose the Best Free Online Business Checking Account for my needs?

Choosing a business bank account is a significant decision. Here are some critical considerations when deciding.

Assess Needs

Small business owners should first assess their needs. Think about how often you will use the account and whether you need to make a lot of transactions each month. Some accounts limit the number of free transactions, which can lead to extra fees if you exceed those limits.

Consider your spending habits. Identify what types of purchases you make regularly. Are they primarily online or in-store? Knowing this helps you find a suitable account.

Compare Features

Next, compare features across different banks. Look for tools that can help manage your finances. Many online banks offer budgeting tools and expense tracking. These features can save time and keep your records organized.

Check for eligible purchases. Some accounts may offer rewards for specific purchases. For example, cash back on office supplies could benefit your business.

Review Fees

Review all potential fees associated with each account. Even free accounts may have hidden costs. Look for maintenance fees, ATM fees, or charges for wire transfers. Understanding these fees helps avoid surprises later.

Some banks waive fees if you meet certain conditions. This might include maintaining a minimum balance or making a set number of monthly transactions.

Evaluate Accessibility

Evaluate the accessibility of the bank’s services. Ensure that you can easily access your money when needed. Online banking should be user-friendly and secure.

Check if the bank has a mobile app. A good app allows you to manage your account on the go. Ensure it has features like mobile check deposits and easy fund transfers.

Customer Support

Customer support is crucial when choosing an online bank account. Research the availability of support options. Look for 24/7 assistance through chat, phone, or email.

Read reviews from other small business owners about their experiences with customer service. Good support can make a big difference during challenging times.

Security Measures

Security is another vital factor to consider. Ensure that the bank uses robust security measures to protect your information. Look for features like two-factor authentication and encryption technology. A secure platform gives peace of mind when managing finances online. You should also ensure your chosen option is FDIC-insured.

Make Your Decision

After considering all these factors, it’s time to make a decision. Choose an account that best fits your business needs and goals. Remember to review your choice regularly as your business grows.

How do I get a Free Online Business Checking Account?

Here’s a step-by-step guide on how to open a free online business checking account.

Research Options

Start by researching different banks that offer free online business checking accounts. Many banks provide various options. Some may have specific requirements, while others might not. Look for features that suit your needs. Check for things like transaction limits and fees.

Gather Documents

Next, gather the necessary documents. Most banks require basic information to open an account. You typically need:

- Your business license.

- Employer Identification Number (EIN).

- Personal identification, such as a driver’s license.

Having these documents ready will speed up the process.

Choose Your Bank

After researching, choose a bank that fits your needs. Look for one with good customer service and easy online access. Read reviews to see what other customers say about their experiences. Make sure the bank has a user-friendly website or app.

Complete Application

Once you select a bank, start the application process. This can usually be done online. Fill out the application form carefully. Provide all the required information accurately. Double-check for any mistakes before submitting it.

Fund Your Account

After approval, you need to fund your account. Most banks allow you to transfer money electronically from another bank account. Some may require an initial deposit to activate the account. Confirm the minimum amount needed.

Set Up Online Banking

Now, it’s time to set up online banking. This feature helps you manage your finances easily. Create a username and password for secure access, and enable two-factor authentication for added security.

Order Checks and Cards

You may want to order checks or debit cards linked to your business checking account. These tools help in managing expenses and payments. Some banks provide checks for free, while others might charge a fee.

Monitor Your Account

Finally, keep an eye on your account regularly. Check for any unauthorized transactions or fees. Use the budgeting tools provided by your bank to track spending. Staying informed helps you manage your finances better.

Frequently Asked Questions

Here are the most common questions about free online business checking accounts.

Why do Small Businesses need a Business Checking Account?

Small businesses need a business checking account for several important reasons. First, it helps separate personal and business finances. This separation is crucial for tracking income and expenses accurately. It also simplifies accounting tasks and helps prepare taxes.

A business banking account is also essential when applying for business credit. Most lenders will want to review business bank account statements when you apply for a small business loan. Vendors and business credit card issuers are also more likely to extend credit to enterprises with a dedicated business account.

A small business checking account helps provide cash flow insight. Owners can see how much money is coming in and going out, which allows them to manage cash flow effectively. Knowing the company’s financial health is essential for making informed decisions.

Business owners regularly deal with customers and merchants. Having a dedicated account makes transactions smoother. Customers’ payments can be deposited directly into the business checking account, saving time and reducing errors. It also lends an air of professionalism to your business.

Another benefit is managing payables more effectively. Business checking accounts allow companies to pay bills on time. Late payments can harm relationships with vendors and suppliers. A dedicated account helps ensure funds are available when needed.

Can I get a Free Online Business Checking Account with no deposit?

Yes, some free online business checking accounts do not require a minimum deposit. This feature is helpful for small businesses that want to manage their finances without upfront costs. Many banks understand that new businesses may not immediately have large amounts of cash available.

A few options for free online business checking accounts with no deposit include:

- Bluevine.

- Novo.

- Mercury.

Do banks check credit scores when Opening a Business Account?

Many banks do not require a personal credit check for a business checking account, but some may still look at your credit history. This is especially true if you apply for a business credit card linked to the account. The bank wants to ensure they will get paid back if they give you credit.

However, many banks will review your banking history, typically using ChexSystems reports. This summarizes your banking history to help financial institutions decide whether or not to authorize a new bank account application.

What are my alternatives to Free Online Business Checking Accounts?

Small business owners have several banking options outside of online business checking accounts.

Traditional Banks

Many traditional banks offer free business checking accounts. American Express, for example, has a no-fee option that provides basic banking services. This can be an excellent choice for small businesses starting.

US Bank also offers businesses free checking accounts. They provide essential features like online banking and mobile deposits. These tools help manage finances easily.

Chase and Bank of America are other options. Both banks have free business checking accounts with specific requirements. For instance, maintaining a minimum balance might be necessary. These accounts often have added benefits, such as access to additional cash flow insight tools.

Savings & Investment Accounts

Business savings and investment accounts can be a great alternative to free online checking accounts for businesses looking to grow their funds. One option to consider is high-yield business savings accounts, which typically offer higher interest rates than traditional savings accounts. These accounts can help businesses maximize their savings over time.

Another option is business CDs (Certificates of Deposit), which are time deposits that offer higher interest rates in exchange for locking in funds for a specific period. This can be a good option for businesses looking for a low-risk investment with guaranteed returns.

Market accounts are also worth considering, as they offer a combination of high interest rates and the flexibility of a checking account. These accounts often require a higher minimum balance but can allow businesses to earn more on idle funds.

Banking with a financial institution that charges checking account fees may actually provide access to these other banking tools. While paying fees may seem like a disadvantage, it can open up opportunities for businesses to take advantage of higher-yield savings and investment options that can ultimately help them grow their funds more effectively.

Consider Paid Business Checking Accounts

In addition to the potential to access the banking products listed above, paid business checking accounts can come with various perks. Some banks offer rewards programs for transactions made through the account. This can lead to savings over time.

Paid accounts may have higher transaction limits. This is important for growing businesses with more activity. Companies can process payments without worrying about hitting limits.

Here are some benefits of considering these alternatives:

- Advanced Features: More tools for cash management.

- Personalized Support: Direct access to bank representatives.

- Rewards Programs: Earn rewards on transactions.

- Higher Limits: Allow more transactions without fees.

Free Online Business Checking Accounts – Final Thoughts

Free online business checking accounts can be a game-changer for your small business. They offer convenience, lower fees, and easy management of your finances.

You’ve learned how these accounts work, their benefits, and potential drawbacks. Choosing the right account means considering your specific needs and understanding what different banks offer.

Contact us if you have more questions about business banking accounts or to apply for a small business loan. Our alternative financing experts can help you find the best options for your business capital needs.