What is Schedule K-1?

Schedule K-1 is a tax document used to report income, deductions, and credits from pass-through entities such as partnerships, S-corporations, and trusts or estates. Unlike traditional corporations that pay taxes on their earnings, pass-through entities allocate their income, deductions, and credits directly to their owners or beneficiaries. Each individual then reports their share on their personal income tax return.

The purpose of Schedule K-1 is to ensure that taxable income generated by the business or entity is properly reported and taxed at the individual level. This approach aligns with the tax code’s emphasis on pass-through taxation. Schedule K-1 is submitted alongside the partnership’s tax return to the IRS, detailing each partner’s share of income, losses, and deductions.

If you own part of a company, Schedule K-1 lets the IRS know how much of that company’s profits belong to you. This information is used to let you know how to report it on your individual return. This approach saves the business time and money regarding tax preparation. It allows the business income to be taxed at the owner’s individual rate – which is usually lower and more favorable.

Understanding Schedule K-1

Schedule K-1 is an essential tax form for individuals invested in a pass-through entity. It is pivotal in reporting the income taxation on pass-through entities to the IRS and providing each partner or shareholder with their share of the entity’s taxable income.

Typically, the entity’s accountant prepares the Schedule K-1, which is then included in the entity’s tax return. This form ensures that each partner or shareholder accurately reports their share of income, deductions, and credits on their personal tax return, fulfilling their tax responsibilities.

Factoring in Partnership Agreements

A partnership agreement is a contract between two or more individuals who decide to work together as partners. This agreement is fundamental in determining how profits, income, losses, deductions, and credits are shared among the partners, which directly impacts the information reported on Schedule K-1.

The partnership agreement outlines the specific allocation of these financial elements, ensuring that each partner’s share is accurately reflected on Schedule K-1. This allocation is crucial for partners to report their share correctly on their personal income tax returns.

Basis Calculation

The basis calculation is a critical aspect of Schedule K-1. It refers to a partner’s investment or ownership stake in the enterprise. A partner’s basis is adjusted over time, increasing with capital contributions and their share of income and decreasing with their share of losses and any withdrawals.

This calculation is essential for determining the partner’s tax liability and is reported on Schedule K-1 in the partner’s capital account analysis section. Understanding and accurately calculating the basis ensures that partners correctly report their financial position and tax obligations.

Who has to File a Schedule K-1 Tax Form?

Filing a Schedule K-1 tax form is required for individuals involved in certain types of business entities or trusts and estates. You’ll typically file your Schedule K-1 with your annual tax return.

Here’s a breakdown of who files a K-1:

Schedule K-1 Form 1065: Partnerships

Business partnerships, which involve at least two individual partners, use Schedule K-1 Form 1065 to report each partner’s share of the partnership’s income, deductions, and tax credits. Partners are responsible for including this information on their own tax returns, paying self-employment tax on their share of the ordinary business income, and reporting guaranteed payments.

Schedule K-1 Form 1120-S: S-Corporations

S-corporations are business entities that pass income, losses, and deductions through to their shareholders. The Schedule K-1 Form 1120-S reports each shareholder’s share of these amounts. Unlike partnerships, shareholders of S-corporations typically do not pay self-employment tax on their income.

Schedule K-1 Form 1041: Trusts and Estates

Trusts and estates use Schedule K-1 Form 1041 to report income distributed to beneficiaries. Trusts may pay tax at the trust level for certain types of income while allowing other types to pass through to the beneficiaries.

Trust and estate beneficiaries receive a K-1 detailing their share of the income, deductions, and credits they must include on their individual tax returns. This form ensures that taxable income generated by the trust or estate is appropriately taxed.

When is the Schedule K-1 Tax Form Due?

Knowing when the Schedule K-1 tax form is due will help all partners to file their partnership plan on time. If your partnership operates on the calendar year, circle March 15 on your calendar. This timeline gives partners just under a month to prepare their returns by the April 15 deadline.

If a partnership’s fiscal year ends on a different date, such as April 30, it must deliver the Schedule K-1 by July 15. This deadline gives partners enough time to factor that information into their tax strategies.

If you require additional time, file a six-month extension ahead of time with Form 7004. Each partner will use the information from Schedule K-1 to complete their 2024 returns, filed in 2025. Since the IRS already turns around refunds quickly, in an average of just over 21 days, filing on time suits everyone.

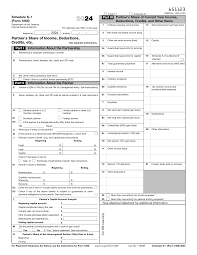

How do I complete the Schedule K-1 Tax Form?

Knowing what goes into each section of the Schedule K-1 Tax Form is essential for correctly completing it and reporting everything properly.

Filing a Schedule K-1 tax form involves three main parts:

Part 1: Information About the Entity

This section includes:

- The entity’s name, address, and EIN (Employer Identification Number).

- The type of entity (partnership, S-corporation, trust, or estate).

Part 2: Information About the Partner or Beneficiary

Details required include:

- Name and address of the individual receiving the K-1.

- The individual’s Social Security Number or Taxpayer Identification Number.

- Their ownership stake or share in the entity.

Part 3: Partner’s or Beneficiary’s Share of Current Year Income, Deductions, Credits, and Other Items

This section lists:

- Ordinary business income: Income generated from business activities.

- Interest income and bond interest: Passive income such as dividends or bond interest.

- Capital gains and losses: Short-term and long-term gains from asset sales.

- Other income: Includes rental income, guaranteed payments, or income distributed.

- Deductions and credits: Tax deductions and credits applicable to the partner or beneficiary.

Step-by-Step Guidance to Complete Schedule K-1

- Gather Necessary Documentation: Collect all relevant financial records, including profit and loss statements, capital account summaries, and any documentation detailing distributions or allocations for the tax year.

- Accurately Identify All Parties: Ensure that the entity’s details (EIN, name, and address) and the recipient’s details (Social Security Number, ownership percentage, and contact information) are correct. Errors here can delay processing or trigger audits.

- Break Down Income and Deductions: Categorize all income types, such as ordinary business income, interest, dividends, or capital gains. Similarly, organize deductions like depreciation, guaranteed payments, and contributions.

- Allocate Shares Based on Ownership: Use the partnership or shareholder agreement to determine the allocation percentages. For example, if a partner owns 30% of the business, they should receive 30% of all relevant income, deductions, and credits unless the agreement specifies otherwise.

- Complete the Form Using Tax Software or a Professional: Use tax preparation software that supports K-1 forms or consult with an accountant to input the data accurately. The software will guide you through reporting specific items, such as Section 179 deductions or foreign transaction income.

- Review the Completed Form Thoroughly. Verify that all entries align with the supporting documentation and that the totals are consistent with the entity’s financial reports.

- Submit the Form to the Appropriate Parties: Provide copies of Schedule K-1 to all partners, shareholders, or beneficiaries by the deadline. Additionally, retain copies for your records and file them with your business tax return if required.

- Address The partnership agreement typically guides the allocation of income and deductions on Schedule K-1 compliance with both federal and state-level requirements.

By following these steps, you can ensure the accurate and timely completion of Schedule K-1 forms, avoiding potential penalties or discrepancies.

How to Allocate Income and Deductions

The allocation of income and deductions on Schedule K-1 is typically guided by the partnership agreement. This agreement specifies how income, losses, deductions, and credits are distributed among the partners.

The Schedule K-1 will then report each partner’s share of these financial elements, which the partner must include on their personal income tax return. Proper allocation ensures that each partner pays taxes on their fair share of the partnership’s income and can claim appropriate deductions and credits, thereby accurately reflecting their tax liability.

Do I need an accountant to File a Schedule K-1 Tax Form?

You do not necessarily need an accountant to file a Schedule K-1 tax form, but it can help reduce errors and stress, especially if you have a complex tax situation. The IRS recommends that partners obtain professional assistance to help them accurately prepare and file the form.

An accountant’s guidance for new partners can be invaluable in understanding your new tax obligations. Schedule K-1 has complex tax laws; a professional can help you file it correctly.

If you have a significant interest in a partnership, working with an accountant ensures you take full advantage of the tax benefits and deductions available. In addition, an accountant can save you from penalties and fines for incorrect or late filing.

On the other hand, accounts and tax professionals come at a cost. You might be able to reduce your expenses by filing on your own.

Hiring an Accountant Pros & Cons

Pros:

- Ensures accuracy and compliance with the tax code.

- Saves time during tax season.

- Provides advice on maximizing tax deductions and credits.

- Helps navigate complex tax filing scenarios.

Cons:

- Adds to the cost of filing taxes.

- May require coordination and communication.

- Might not be necessary for straightforward tax situations.

- Takes time to find and hire an accountant

Frequently Asked Questions

Here are the most common questions about filing Schedule K-1.

Does Schedule K-1 impact personal taxes?

Yes, Schedule K-1 significantly impacts personal taxes. The income, deductions, and credits reported on the K-1 must be included on your personal tax returns. For example:

- Ordinary business income may be subject to self-employment tax for partnerships.

- Capital gains and dividends affect your overall taxable income and tax liability.

- Deductions and credits can reduce your tax bill.

Do I report business losses on Schedule K-1?

Yes, business losses are reported on Schedule K-1 and passed through to individual taxpayers. These losses can offset other income on your tax return, subject to certain limitations such as the passive activity loss rules and the at-risk rules. For instance:

- Passive Activity Loss Rules: These rules limit the ability to deduct losses from passive activities unless you have passive income to offset them. Passive activities often include rental properties or businesses in which you do not materially participate. Any disallowed losses can usually be carried forward to future tax years.

- At-Risk Rules: The at-risk rules prevent taxpayers from deducting more losses than the amount they have at risk in the activity. This includes the money you’ve invested and any loans for which you are personally liable. If your losses exceed your at-risk amount, the excess is deferred until you increase your at-risk amount.

Reporting business losses accurately is essential to avoid potential issues with the IRS. While these losses can provide tax benefits by reducing your taxable income, they must be calculated and documented correctly. Consulting a tax professional is advisable to ensure compliance with these rules and to maximize the benefit of any allowable deductions.

What’s the difference between a K-1 and 1099?

When it comes to tax season, knowing the difference between a K-1 and a 1099 is very important.

Schedule K-1

A K-1 is most commonly known as the form used to report income distributions from trusts and estates to beneficiaries. Common pass-through entities, like partnerships and S-corporations, typically issue a K-1.

These annual reports detail each partner’s income, losses, and other financial transactions attributed to them. This form is comprehensive and divided into three parts: information about the partnership, the partner, and the partner’s share of the current year’s financial details.

1099

A 1099 summarizes other income streams, such as self-employment income and interest income. You typically get it no later than the end of January. While most major tax software can easily accommodate a 1099, they will need additional calculations for a K-1.

When do I get a Schedule K-1 Tax Form?

Entities must provide Schedule K-1 forms to their partners, shareholders, or beneficiaries by the due date of their tax return (including extensions). Typically, this means March 15 for partnerships and S-corporations and April 15 for trusts and estates.

Who sends out Schedule K-1 Forms?

Tax filing can be confusing, especially regarding specialized forms such as Schedule K-1. Partnerships, S corps, estates, or trusts usually send out these forms. If you’re part of a business entity that passes income, credits, deductions, and other items to its shareholders or beneficiaries, you might receive a K-1.

For instance, if you’re an investor in a partnership, the partnership entity produces the K-1. They must do this to report your share of the partnership’s income, deductions, and credits.

The burden is on the entity’s tax advisor or accountant. They collect all required financial information and adequately complete the form. The limited liability company (LLC) accountant will handle this chore if you’re in an LLC taxed as a partnership.

They will make sure that all of this is done in a seamless and precise manner. They help ensure each member correctly reports their share of the entity’s items. By doing this, you ensure that each partner files their individual income tax return accurately.

Can I file for an Extension for Schedule K-1?

Yes, you can file for an Extension for your Schedule K-1. This is commonly needed if you are waiting on data from a partnership, S corp, or estate.

Individual taxpayers can file Form 4868 to automatically extend their personal tax return filing deadline. This extension provides an extra six months, extending the deadline from April 15 to October 15. Business entities file either Form 7004 or 8736, depending on the entity type. Both forms give you the same amount of extension time.

Here’s a simple breakdown:

| Entity Type | Form for Extension | Original Deadline | Extended Deadline |

|---|---|---|---|

| Individual Taxpayer | Form 4868 | April 15 | October 15 |

| Partnership | Form 7004 | March 15 | September 15 |

| S Corporation | Form 7004 | March 15 | September 15 |

| Estate/Trust | Form 8736 | April 15 | October 15 |

Extensions can afford the time to ensure complete and accurate information.

Filing Schedule K-1 Tax Form – Final Thoughts

Filing a Schedule K-1 tax form may seem intimidating, but it doesn’t have to be. This vital form is the primary document for reporting income, deductions, and credits from business partnerships, S corporations, estates, and trusts.

Determine who you need to file for and the deadline date. Understanding the steps involved ensures that you stay on track and in compliance with tax laws. Whether you’re handling it yourself or enlisting an accountant, grasping the impact of Schedule K-1 on your personal taxes is crucial.

Contact us if you have more questions about business taxes or if you want to apply for a small business loan. Our alternative financing experts can help you find the best business loan for your needs.