What is Credit Karma Credit Builder?

Before diving into the Credit Builder product, let’s examine Credit Karma and its history. Credit Karma is a financial technology company offering free credit scores and reports to its users. It was founded in 2007 by Kenneth Lin, Ryan Graciano, and Nichole Mustard.

The service provides users with credit scores from two major credit bureaus, Equifax and TransUnion. Users can also access personalized recommendations to help improve their credit scores and tools to monitor their credit reports for suspicious activity.

Additionally, Credit Karma helps match users to various financial products, such as credit cards and loans, tailored to each user’s credit profile. Overall, Credit Karma aims to empower individuals to take control of their financial health by giving them easy access to important credit information and resources.

Credit Builder by Credit Karma

Credit Karma Credit Builder is a financial product offered by Credit Karma that aims to help individuals improve their credit scores. Unlike other credit building products, Credit Karma’s Credit Builder is not an installment loan or secured credit card.

The service creates a revolving line of credit that automatically transfers funds to a locked savings account. As you repay the line of credit, your payment history and credit utilization improve, which should increase your credit score.

By making on-time payments, users can demonstrate responsible borrowing behavior and potentially see an increase in their credit score. Credit Karma Credit Builder also offers educational resources and tools to help users better understand and manage their credit. It’s designed to be a helpful tool for those looking to build or rebuild their credit history.

How does Credit Builder from Credit Karma work?

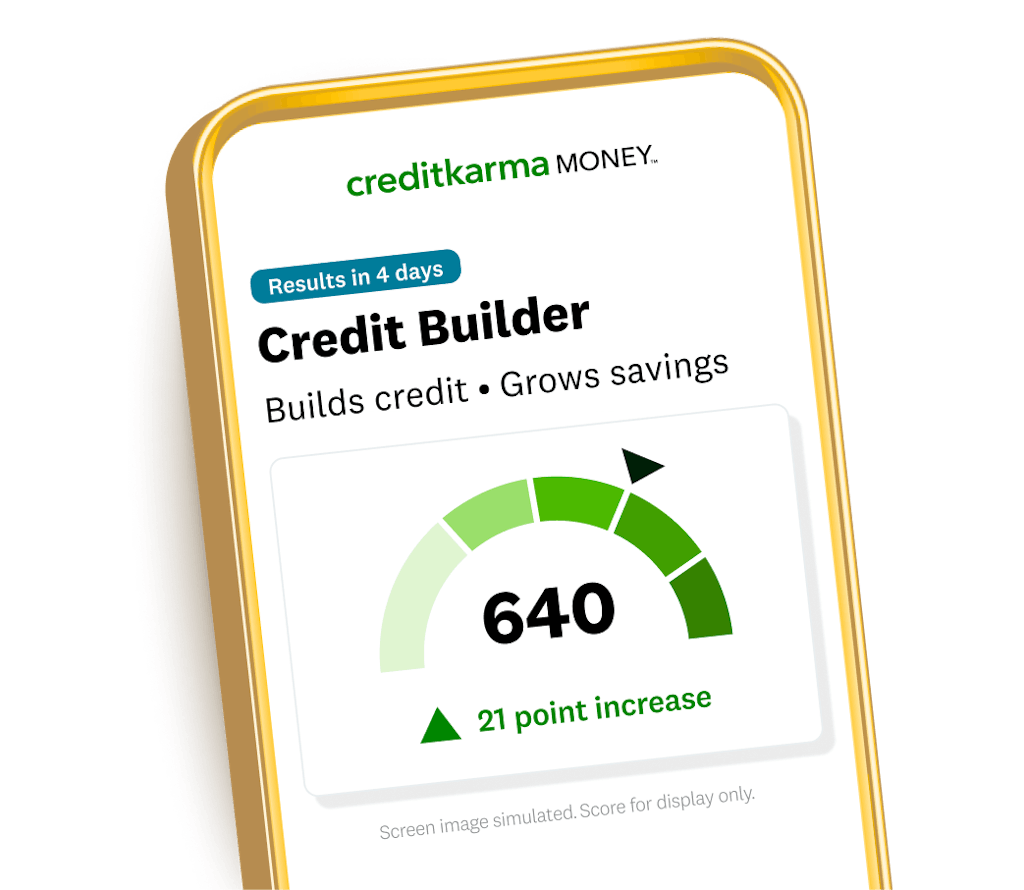

Credit Builder aims to help users build credit and savings simultaneously. The website advertises that users raise their score by an average of 21 points in four days.

Here are the specific steps of how the program works.

Open a Credit Karma Money™ Spend Account

The Credit Karma Money Spend Account is an FDIC-insured online checking account serviced by MVB Bank. It has no checking account fees and offers a debit card with cash-back rewards. Users are not required to use the bank account, but you must make at least one direct deposit of $750 or more to proceed with Credit Builder.

Begin Transferring Funds

Once you open the checking account and enroll in Credit Builder, Credit Karma opens a Credit Builder Savings account and line of credit in your name. Cross River Bank services both the line of credit and savings accounts.

At this point, you can select how much to transfer from your line of credit to your savings account each pay period, with $10 being the lowest you can transfer. Users can transfer the funds manually or set up automatic transfers. Credit Karma recommends using the Autosave Program. You can adjust the amount for Autosave payments at any time by logging into your account and changing your Autosave Program Payment amount.

Users can also decide to transfer funds per paycheck, monthly, or semimonthly and can pause transfers at any time. However, you must make at least one transfer every 90 days to keep your account active.

Make Payments

Pay off the line of credit each statement period before the due date. To build a positive payment history, don’t miss any payments. Late or missed payments will negatively impact your credit score. As you make your payments, Credit Karma reports the payment activity to the three major credit bureaus: Experian, Equifax, and TransUnion.

Collect Your Savings

Once the total amount transferred from your line of credit to your Credit Builder Savings account reaches $500, you can transfer the money to your Credit Karma Money Spend Account. While you can keep the money in your savings account, it’s probably best to transfer it since the savings account does not accrue interest.

At this point, the funds are yours to use however you see fit. For example, you can go on a spending spree to celebrate your credit journey, save money for a rainy day, or invest it. Rinse and repeat to continue building credit. There are no term limits on how long you can use the Credit Builder account.

Credit Builder Impact on Credit Score Factors

Credit Builder is designed to help users improve their credit scores by addressing the most significant factors influencing credit scores:

- Payment History: Making on-time payments is the most significant factor, comprising 35% of FICO scores. Credit Builder helps users establish a positive payment history when used responsibly.

- Credit Utilization: Your credit usage, or credit utilization, comprises 30% of your FICO score. Establishing a revolving credit line with a $1,000 limit increases your available credit, lowering your credit utilization ratio and potentially improving your credit.

- Length of Credit History: Generally, the longer a credit account is open, the better its impact on your credit. This factor comprises 15% of your FICO credit score. The longer your Credit Builder account remains active, the more it adds to the length of your credit history.

- Credit Mix: At 10% of your FICO score, credit mix refers to having different types of credit accounts. Since Credit Builder is a line of credit, it can improve your credit mix alongside installment loans and credit cards.

- New Credit: Credit Karma Credit Builder doesn’t use a hard credit inquiry, so it won’t negatively impact your score to enroll. Many new credit account applications use a hard credit pull, which can lower your FICO score by 5 points for up to a year, but this isn’t a concern with Credit Builder.

Who qualifies for Credit Karma Credit Builder?

To be eligible users:

- Must have a TransUnion credit score below 619.

- Must have a valid US address.

- Must have a Social Security Number.

There is no minimum credit score requirement to apply. The program doesn’t use a hard credit pull, and there are no fees or interest rates, making it a cost-effective credit-building option.

What are the benefits of Credit Karma Credit Builder?

Credit Karma Credit Builder offers a range of benefits for individuals looking to improve their credit scores. It provides a very accessible opportunity to build credit history through the responsible use of this tool. Users can demonstrate positive payment habits by making timely payments, which is crucial for boosting credit scores.

One of the most significant advantages is that the program doesn’t cost users anything. There are no fees or interest charges for the line of credit. The only “cost” is that your funds are tied up in the savings account until you reach the $500 threshold.

Another key advantage is that it doesn’t require a credit check and has no minimum credit score cutoff. Credit Builder doesn’t have a set term, allowing users to utilize the credit line indefinitely. This makes it a very attractive option for users with severely damaged credit to begin the repair process.

Since Credit Builder also requires using Credit Karma, users gain access to valuable tools provided by Credit Karma, such as free credit reports and credit monitoring services. These tools enable users to track their progress in building credit and receive personalized feedback on how they can further improve their financial standing.

What are the drawbacks of Credit Karma Credit Builder?

While the program advertises that it can raise TransUnion scores by as much as 21 points in four days, credit score improvement is not guaranteed. This is largely because it can’t overcome significant negative factors impacting credit, such as foreclosures, bankruptcies, or severely delinquent accounts.

The $1,000 credit limit on the line of credit won’t make a significant difference for users with high credit limits and high balances. It’s best suited for users with limited credit histories who don’t have high credit limits.

You cannot access the funds until you reach the $500 threshold, which can be a burden for users in a tight financial spot. The only way to get your money back before reaching the threshold is to close your account or contact customer support.

While it doesn’t set a minimum credit score requirement, Credit Builder has a maximum credit score limit. Eligible users must have a TransUnion score below 619 to use the service. This differs from most credit builder products.

Another significant drawback is that Credit Karma has largely negative online reviews. Many negative reviews of Credit Karma Credit Builder highlight issues with customer service, inaccuracies in credit reporting, and delays in updating credit scores. Users have also expressed frustration with the lack of transparency regarding fees and service limitations.

Credit Karma Credit Builder Pros & Cons

Pros:

- Accessible option to build credit and savings.

- Doesn’t require a credit check & no minimum credit score requirement.

- No interest or fees to use the service.

- Provides a revolving line of credit rather than an installment loan or secured credit card.

- Access to other Credit Karma services, such as credit monitoring and free credit reports.

Cons:

- Might have a limited impact on credit for users with severely damaged credit histories.

- No guarantee of credit improvement.

- Maximum credit score cutoff of 619.

- Cannot access funds until reaching the $500 threshold.

- Credit Karma has many negative online reviews.

How do I sign up for Credit Karma Credit Builder?

To sign up for Credit Karma Credit Builder, follow these steps:

- Visit the Credit Karma website and create an account or log in if you already have one.

- Navigate to the “Credit Karma Credit Builder” section on the website.

- Click the “Enroll Now” or “Get Started” button to begin enrollment.

- Enter the required personal information, including your name, address, and Social Security number.

- Agree to the terms and conditions of the Credit Karma Credit Builder program.

- Follow any additional prompts to complete enrollment and start building your credit with Credit Karma.

Frequently Asked Questions

Here are the most common questions about Credit Karma Credit Builder.

Is Credit Karma Credit Builder worth it?

Whether Credit Karma Credit Builder is worth it depends on the individual’s specific financial situation and credit goals. It can be a valuable tool for those needing credit-building assistance, but it may not be necessary for everyone.

It can be worth it for individuals looking to improve their credit score and establish a positive credit history. However, it won’t benefit individuals with a strong credit history and score. In this case, the tool may not offer significant value beyond what users do to maintain good credit.

Its effectiveness is also limited for individuals with severe credit issues or very high credit balances. On the other hand, it’s free to use and doesn’t hurt your credit score when enrolling.

Does Credit Karma offer a Business Credit Account?

Credit Karma primarily focuses on personal credit profiles rather than business accounts. It doesn’t offer business credit accounts, but it provides various tools to help individuals manage their personal finances effectively. If you’re looking to build your business credit, exploring other financial institutions that specialize in business banking services is advisable.

Does Credit Builder from Credit Karma help build Business Credit?

Like all Credit Karma services, the Credit Builder platform focuses on consumer credit, meaning you cannot use this product to build business credit. The company doesn’t offer any services or products for establishing or building business credit.

However, small business owners can still potentially improve their business loan approval odds using Credit Karma. This is because many business loan lenders use your personal credit score when reviewing small business loan applications.

What are my alternatives to Credit Builder from Credit Karma?

There are various credit-building alternatives to Credit Karma to consider.

Credit Repair Services

Credit repair services are companies that help individuals improve their credit scores by identifying and disputing inaccurate or outdated information on their credit reports. These services review your credit report, identify errors, and then work with the three credit bureaus to remove or correct the inaccurate information. Additionally, they may provide guidance on building a positive credit history and managing debt effectively.

Credit-Builder Loans

A credit-builder loan is like a loan in reverse. Instead of issuing a lump sum disbursement to a borrower, the lender sets the loan funds aside in a secured savings account or certificate of deposit (CD). The borrower then makes regular loan payments, plus interest, until the amount is paid in full.

The lender then releases the funds to the borrower. This helps build positive payment history and savings, similar to Credit Karma’s Credit Builder. However, most credit-builder loans are installment loans, whereas Credit Builder is a revolving line of credit.

Secured Credit Cards

Secured credit cards require a cash deposit as collateral, which typically determines the credit limit. This deposit reduces the lender’s risk, making it easier for individuals with limited or poor credit history to qualify. As cardholders make on-time payments and manage their credit responsibly, they can gradually improve their credit score.

Credit Karma Credit Builder Review – Final Thoughts

Credit Karma Credit Builder offers a valuable tool for improving credit scores. While there may be some limitations, overall, it can be a beneficial resource for those on the path to better credit health.

However, some other products and services can help establish or build credit. Consider your specific needs when choosing a credit repair option.

Contact us if you have more questions about credit repair or to apply for a small business loan. Our alternative business lending experts can help you find the most advantageous financing options for your business needs.