What is a Commercial Real Estate Loan?

A commercial real estate loan is a financial product used to purchase, refinance, or develop commercial properties, such as office buildings, apartment buildings, and industrial properties. These loans are tailored for businesses rather than individuals and have different terms from residential mortgages. Other asset classes, such as office, retail, industrial, and multifamily properties, also influence loan terms and lender preferences.

Various types of commercial real estate loans are available in the market, tailored to meet the borrower’s specific needs. Some common loan products include traditional bank loans, alternative business loans, and specialized loans for particular types of properties, such as retail spaces or industrial facilities. Some loans are designed for owner-occupied properties, while others are tailored for investment properties, such as apartment buildings. Loan amounts and maximum loan limits vary by lender and loan type. Fannie Mae and the Small Business Administration offer specialized loan programs for multifamily and small business properties.

The approval process for commercial real estate loans plays a crucial role in securing funding for business properties. Commercial loan lenders carefully assess several key factors, including the property’s value, potential income generation, asset class, and the borrower’s creditworthiness, before approving a loan application. This process ensures that both parties enter into an agreement that is beneficial and feasible.

Private lenders also play a significant role in commercial real estate financing, offering alternative options to traditional banks. Credit unions and debt funds are additional sources of commercial real estate financing, providing borrowers with more choices and potentially more flexible terms. These lenders provide flexibility regarding loan structures and requirements, making it easier for some borrowers to secure funding for their commercial ventures.

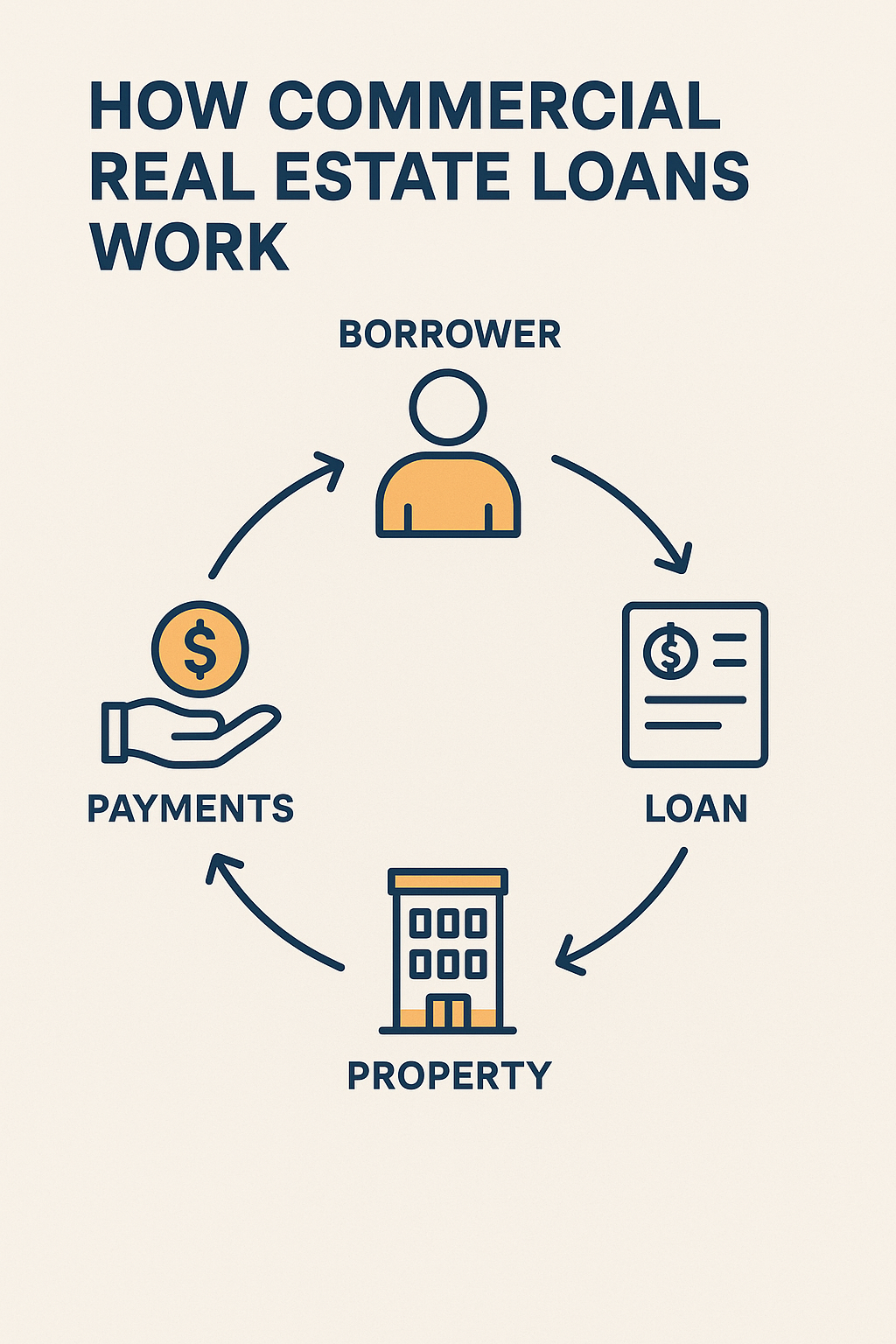

How do Commercial Real Estate Loans work?

Commercial real estate loans are tailored for commercial properties, including office buildings, retail spaces, and other business properties. When seeking a commercial real estate loan, borrowers can choose between different lending institutions, such as banks or private lenders, based on their specific needs. Loan terms and interest rates can vary depending on the type of property being financed, such as office, retail, industrial, or warehouse properties.

Commercial Mortgage: A commercial mortgage is a type of loan that uses the financed property as collateral, providing security for the commercial loan lender in case of default. Its structure is similar to a residential mortgage, but for a company financing commercial property instead of a consumer buying a residential home. Loan terms for commercial mortgages typically range from 5 to 30 years, depending on the loan type. Some commercial mortgages, such as certain CMBS or agency loans, may be non-recourse, limiting the borrower’s personal liability. Additionally, some loans may require a balloon payment at the end of the term, which is a lump-sum payment due when the loan matures. Compare rates from various commercial mortgage lenders to fund the best deal for your small business.

Business Term Loans: A business term loan can be a practical financing option for acquiring commercial real estate, providing businesses with the capital needed to purchase properties for expansion or investment purposes.

SBA 7(a) Loans: An SBA 7(a) loan can be used to purchase commercial property, providing small business owners with financing options for real estate acquisitions. SBA 7(a) loans typically offer lower monthly payments compared to other financing options.

SBA 504 Loans: An SBA 504 loan is a type of commercial real estate loan that offers small businesses long-term, fixed-rate financing for purchasing land, buildings, or equipment.

There are also specialized loans available for multifamily properties, which are suitable for financing residential complexes with five or more units.

Hard Money Loans: Hard money loans for commercial real estate are typically short-term, high-interest loans secured by the property itself.

Approval Process for Commercial Real Estate Loans

Approval for a commercial real estate loan involves evaluating the borrower’s creditworthiness and determining the most suitable loan product or type. Before approving a loan, lenders assess various factors, including the borrower’s credit score, financial history, property details, and their ability to repay the loan based on income, cash flow, and overall financial stability. In some cases, especially when the loan-to-value ratio is high or the borrower’s credit profile is weaker, lenders may require the borrower to provide additional collateral, such as personal assets, to mitigate risk.

Before granting a commercial real estate loan, lenders also consider the purpose of the loan – whether it is for purchasing new properties, refinancing existing loans, or funding property improvements. This ensures that borrowers receive financing tailored to their specific requirements.

Using Commercial Real Estate Loans

Commercial real estate loans serve various purposes in the real estate market, including acquiring new properties to expand businesses or investing in property upgrades to increase value. These loans provide businesses with essential financial support to achieve their growth objectives.

Additionally, some commercial real estate loans are used to finance urban development projects, supporting growth and revitalization in city areas.

What are Commercial Real Estate Loan Rates?

The interest rate on a commercial real estate loan is the cost of financing. The average interest rate range on a commercial real estate loan typically falls between 3.5% and 12%. As of July 23, 2025, commercial mortgage rates start at 5.29%.

Several factors influence commercial loan interest rates, including the borrower’s creditworthiness, loan term, and prevailing market conditions. Rate hikes by the Federal Reserve can lead to higher interest rates on commercial real estate loans. Lenders assess the risk involved with each loan, which can impact the interest rate offered. The purchase price and total value of the property are key factors in determining the loan-to-value ratio and interest rate. Lenders consider the risk associated with commercial properties, which results in higher interest rates compared to those for residential mortgages.

Interest Rate Benchmarks

Industry benchmarks play a crucial role in determining commercial real estate loan rates. Index rates are commonly used in commercial real estate lending to adjust interest rates in response to market conditions.

The Secured Overnight Financing Rate (SOFR) is increasingly used as a benchmark for commercial real estate loans, offering greater transparency and reliability as a replacement for LIBOR. Commercial mortgage rates are also influenced by benchmark rates, such as the 5-year and 10-year Treasury yields.

These benchmarks serve as a standard for lenders and borrowers to assess the competitiveness and stability of loan rates in the commercial real estate market. By tracking these industry benchmarks, borrowers can make informed decisions when seeking financing for their commercial properties.

Comparison with Residential Mortgages

Unlike residential mortgage loans, which typically have lower interest rates due to the stability associated with homes as collateral, commercial properties pose a higher risk factor that influences their loan pricing. The potential income from rent generated by a commercial property plays a significant role in determining the borrower’s ability to repay the loan promptly.

Who qualifies for a Commercial Real Estate Loan?

To qualify for a commercial real estate loan, individuals or businesses must meet specific criteria set by lenders. Typically, lenders consider factors such as credit score, financial stability, and the property’s value. Borrowers must demonstrate their ability to repay the loan.

For instance:

- A good credit score is often required.

- Lenders may assess the property’s potential income.

- Financial documents, such as tax returns and bank statements, are typically required.

- A minimum down payment is generally required, often ranging from 20% to 30% of the purchase price.

Borrowers should calculate their estimated monthly payments, including principal, interest, and any additional fees, to ensure they can afford the loan.

Types of Borrowers Eligible for Commercial Real Estate Loans

Various borrowers, including experienced investors, small business owners, and corporations, can apply for commercial real estate loans. Many borrowers, including first-time investors and experienced commercial property investors, can access a variety of commercial real estate loan options. Each borrower type has different requirements based on their financial situation and experience in managing commercial properties.

Debt Service Coverage Ratio (DSCR)

The Debt Service Coverage Ratio (DSCR) is crucial in determining whether a borrower qualifies for a commercial real estate loan. Lenders use the DSCR to assess the borrower’s ability to cover the loan payments based on the property’s income. The debt service coverage ratio (DSCR) is important, with most lenders requiring a minimum of 1.25 to ensure borrowers can meet debt obligations.

A higher DSCR indicates that the property generates sufficient income to comfortably cover its debt obligations, making the borrower appear less risky to the lender. Typically, lenders look for a DSCR of 1.25 or higher to approve a commercial real estate loan, ensuring the property can generate sufficient cash flow to meet its financial obligations.

Loan-to-Value Ratio

The loan-to-value ratio in commercial real estate loans is a crucial factor that lenders consider when determining the risk of financing a property. This ratio is calculated by dividing the loan amount by the property’s appraised value.

A lower loan-to-value ratio indicates less risk for the lender, as the property has more equity to cover potential losses in case of default. Lenders typically prefer to see a lower loan-to-value ratio to ensure they are adequately protected if the borrower cannot repay the loan.

Higher market rates in 2025 have led to maximum LTV ratios of around 65%-70%, resulting from restricted cash flow. Loans with a lower loan-to-value (LTV) ratio and higher debt service coverage ratio (DSCR) are considered less risky and have better pricing.

How do I apply for a Commercial Real Estate Loan?

You can apply for a commercial real estate loan through our network of lenders using an SBA or business term loan. Follow these steps to apply.

Step 1: Ensure You Qualify

You’ll need a credit score between 650 and 700, as well as a healthy and consistent cash flow. You will also need documentation of the property you’re interested in, such as the address, property type, owner-occupancy ratio, total sale price, plans for renovation, and a list of revenue-generating tenants (if any).

Step 2: Gather Your Documents

Be prepared to provide:

- Driver’s License.

- Business license or certificate.

- Voided Business Check (for business bank account information).

- Bank Statements.

- Credit Report/Statement of Personal Credit History.

- Business Tax Returns.

- Credit Card Processing Statements.

- Personal Tax Returns – 3 Years.

- Business Tax Returns – 3 Years.

- Business Plan (Not in all cases).

- Personal Financial Statement.

- List of Real Estate Owned or Business Leases, if applicable.

- Debt Schedule/Loan/Rent/Lease Documentation

- Deeds/Title/Ownership documentation for any collateral/Security.

- Current Profit & Loss Statements and Balance Sheet Year-to-Date.

- A/R and A/P Reports.

- United Capital Source 1 Page Application.

Step 3: Fill Out the Application

You can begin the application process by calling us or filling out our one-page online application. Either way, you’ll be asked to enter the information from the previous section along with your desired funding amount.

Step 4: Speak to a Representative

Once you apply, a representative will contact you to explain the repayment structure, rates, and terms of your available options. This way, you won’t have to worry about any surprises or hidden fees during repayment.

Step 5: Receive Approval

Commercial Real Estate Loans through our network generally take 3-5 weeks to process. Once your file is approved and closed, funds should appear in your bank account within a few business days.

If and when approved for a business term loan, funds should appear in your bank account in 1-2 business days.

What are the benefits of Commercial Real Estate Loans?

Commercial real estate loans offer numerous benefits for businesses looking to invest in property. In particular, commercial mortgage benefits include favorable interest rates, flexible terms, and the potential for significant cost savings, making them an attractive financing option. One advantage is the access to capital these loans provide, allowing companies to acquire or improve properties and expand their operations. Commercial real estate loans typically come with longer repayment terms, providing businesses with more flexibility in managing their finances and potentially reducing monthly payments.

Another benefit is the tax advantages of commercial real estate loans, as interest payments are often tax-deductible, leading to potential tax savings for businesses. Furthermore, investing in commercial real estate can lead to asset appreciation over time, thereby increasing the overall value of a business’s assets. Owning commercial real estate can help diversify a business’s investment portfolio, spreading out risk and potentially enhancing financial stability.

What are the drawbacks of Commercial Real Estate Loans?

Commercial real estate loans have some disadvantages that borrowers should consider before applying. High interest rates and fees are common drawbacks of these types of loans. Borrowers often pay more in interest over time, increasing the overall cost of borrowing.

Approval for commercial real estate loans can be challenging due to strict lending criteria imposed by lenders. Meeting these requirements can be difficult, especially for small businesses or individuals with less established credit histories. This hurdle makes it harder for some borrowers to secure financing for their commercial properties.

Refinancing a commercial property through a new loan may pose challenges, particularly when market conditions change. The fluctuating nature of the real estate market can affect a borrower’s ability to refinance their property at favorable terms, potentially leading to long-term financial strains.

Closing costs involved in obtaining a commercial real estate loan can also add up quickly. These costs include various fees such as appraisal fees, title insurance, and other expenses related to securing the loan. Engaging a real estate attorney during the process adds another expense that borrowers need to account for when considering a specific loan product. To avoid high fees and secure more favorable loan terms, borrowers should compare offers from multiple lenders, as shopping around can help identify better rates and reduce overall costs.

Commercial Real Estate Loan Pros & Cons

Pros:

- Provides access to large amounts of capital for purchasing commercial properties.

- Can offer flexible repayment terms to suit the borrower’s needs.

- Interest rates on commercial real estate loans are typically lower than those on other types of financing.

- Potential tax benefits include deducting interest payments from taxable income.

Cons:

- Requires a significant down payment, typically around 20-30% of the property value.

- Strict eligibility requirements, including a strong credit score and financial history.

- Risk of foreclosure if the borrower is unable to make loan payments.

- Possible fluctuation in interest rates, leading to higher monthly payments.

Frequently Asked Questions

Here are the most common questions about commercial real estate loans.

Who sets Commercial Real Estate Loan rates?

Banks and private lenders determine commercial real estate loan rates, taking into account various factors that influence their decisions. When applying for a commercial real estate loan, the borrower’s creditworthiness and the type of loan they are seeking significantly influence whether they will be approved for the loan. Interest rates for commercial real estate loans typically fall 3% above the effective federal funds rate.

The prime rate and the London Interbank Offered Rate (LIBOR) are standard benchmarks for establishing commercial real estate loan rates. The Federal Reserve sets the prime rate based on the cost of lending money, while LIBOR represents the average interest rate at which central banks borrow from one another globally. These benchmarks serve as reference points for determining interest rates on commercial property loans.

In addition to these benchmarks, capital markets also play a significant role in setting commercial real estate loan rates. Capital markets encompass various financial institutions and systems that facilitate long-term borrowing and lending activities. Changes in capital market conditions can impact interest rates on commercial property loans, affecting borrowers looking to secure financing for their ventures. Several commercial mortgage lenders offer a commercial mortgage calculator to help you determine costs for a mortgage payment. The actual interest rate you receive could vary depending on several factors.

Do Commercial Mortgage Rates ever change?

Commercial real estate loan rates are not fixed and can vary over time. Fluctuations in the capital markets significantly influence the determination of these rates. Factors such as prime and index rates directly impact how much borrowers will pay for commercial loans. Most commercial mortgages are based on the 5-, 7-, or 10-year Treasury rates rather than the prime rate.

Lenders consider various factors when setting commercial mortgage rates, including credit scores and the specific type of loan being applied for. Borrowers with higher credit scores might be offered lower interest rates than those with lower credit scores. Different types of loans come with varying interest rates based on their risk levels and terms.

What lenders offer the lowest Commercial Mortgage Interest Rates?

Regarding commercial mortgages, banks typically offer the most competitive interest rates. However, these lower rates often come with stricter requirements, such as higher credit scores, larger down payments, and more extensive financial documentation.

On the other hand, alternative lenders may have slightly higher interest rates but offer more flexibility in terms of qualification criteria. This can benefit borrowers who may not meet the stringent requirements set by traditional banks.

Higher interest rates can make refinancing challenging, often requiring borrowers to inject cash. It’s essential to weigh the pros and cons of each option to find the best fit for your commercial real estate financing needs.

Do Commercial Real Estate loans have simple or amortized interest?

Commercial real estate loans can have simple or amortized interest. The type of interest depends on the loan product and lender. Simple interest is commonly used for short-term financing, while amortized interest is typically employed for long-term funding.

Simple interest loans are often seen in bridge loans or short-term financing solutions. They are straightforward, with the borrower paying only the principal amount borrowed along with the predetermined interest rate.

On the other hand, amortized interest loans involve regular payments that cover both the principal amount and the accrued interest over time, commonly used for long-term commercial property purchases or refinancing. Understanding the amortization period is crucial for long-term financial planning.

When considering a commercial real estate loan, understanding whether it carries simple or amortized interest is crucial. Borrowers should assess their financial goals and repayment capabilities to choose between these two types of interests wisely.

Can I get a Commercial Real Estate Loan with bad credit?

Commercial real estate loans are available for borrowers with bad credit. Alternative business lenders might be more willing to approve these loans than traditional banks or credit unions. While having bad credit can make securing a commercial real estate loan challenging, there are still options available to consider.

However, having a low credit score would result in higher fees and a higher interest rate. It also limits your purchasing power, so you may not be able to acquire as much as you need for the property.

Some small business owners use bad credit business loans as bridge financing. It could provide high-cost, short-term funding while you repair your credit and qualify for a more advantageous, long-term loan.

Commercial Real Estate Loan Rates – Final Thoughts

When shopping for commercial real estate loan rates, it is essential to research and compare offers from different lenders thoroughly. Consider factors such as interest rates, terms, fees, and repayment options to find the best loan for your specific needs.

Additionally, don’t hesitate to negotiate with lenders to secure better rates or terms, potentially. By being diligent and proactive in your search for commercial real estate loan rates, you can save money in the long run and set yourself up for success in your investment ventures.

Contact us if you have more questions about commercial real estate loan rates or to apply for a small business loan. Our alternative business financing experts can help you find the best financing options for your commercial real estate needs.