Chime is a financial technology company that offers personal banking services through a user-friendly mobile platform. While it offers banking features similar to traditional banks, it is not a bank. Instead, it partners with FDIC-insured institutions: The Bancorp Bank and Stride Bank. This partnership ensures account holders receive the same level of deposit insurance as they would with a traditional

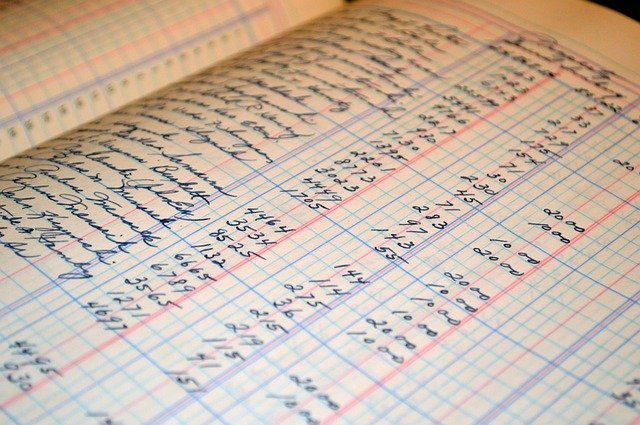

A business bank account is a financial account used to manage a company’s funds. Unlike a personal checking account, a business account separates personal and professional finances, essential for accurate recordkeeping, tax reporting, and liability protection.

ChexSystems is a consumer reporting agency governed by the Fair Credit Reporting Act. It collects data on closed bank accounts, unpaid overdraft fees,

Cash-back business credit cards are tailored explicitly for business owners. They offer a smart and straightforward rewards-earning solution for all your business basics. These cards give cash back on eligible business purchases, helping business owners save money and reinvest in their businesses. Cash-back rewards are different from traditional rewards cards. Most importantly, they keep it simple, delivering businesses a clear-cut

LegalZoom, Incfile, and ZenBusiness are three top providers of business formation and management services designed to assist entrepreneurs with their ventures. Each platform simplifies tasks such as LLC formation, business compliance management, and more to help you build and manage your business. Though they’re all similar at their core, their features, pricing, and additional offerings vary greatly.

Tradeline Supply Company LLC, founded in 2017 and based in San Diego, California, has established itself as a trusted marketplace for buying and selling authorized user tradelines. The company’s mission is to help individuals improve their credit scores by offering a variety of tradelines for purchase.

With a user-friendly online platform, customers can browse available tradelines and choose the

Accounts receivable management is a crucial part of selling on credit. Businesses benefit from selling on credit because it expands their customer base, but they must be careful to avoid losing money.

Effectively implementing A/R management strategies helps companies reduce errors, accurately bill customers, and improve payment collection.

Invoice factoring is best for small businesses that need working capital and have reliable customers. Factoring invoices costs run high, but it’s worth it if it keeps your company afloat.

It’s essential to know the costs before signing a factoring agreement. Ensure you run the numbers and see what makes the most sense for your business.

Receivables factoring is best for small businesses that need immediate working capital to cover expenses. It’s more expensive than traditional financing but easier to qualify and lets you access the assets in A/R sooner than waiting for your customers to pay.

When selecting an invoice factoring company, check out customer reviews and look for transparency. You want to avoid any

Certain small businesses, like wholesalers, trucking owner-operators, and medical practices, don’t get paid for weeks or months. The company delivered the goods or services, invoiced the customer, and now waits to get paid.

While waiting for payment, the business still needs to cover expenses like rent or purchasing inventory. Payment delays can cause significant cash flow shortages, jeopardizing the business.

SBA loan requests are notorious for the rigorous application process. The SBA examines your business financials and looks at the character and background of all principals in the business.

SBA Form 1919, “Borrower Information Form,” is a significant part of that process. The SBA uses the form to collect information about your business, the loan request, ownership, criminal background (if

Fraud Disclosure:

Please be aware that individuals have been fraudulently misrepresenting to business owners (and others) that United Capital Source, Inc. (“UCS”) can assist small businesses in receiving government grants and other forgivable business loans, when in fact those grants or loans do not exist or are not available. These individuals have ulterior motives and are engaging in the unauthorized use of the names, trademarks, domain names, and logos of UCS in an attempt to commit fraud upon unsuspecting small business owners.

UCS will never communicate with a prospective client on Facebook, Facebook Messenger, or any other type of social media. Further, any email communications will always come from an official UCS email address and not a Gmail, Yahoo, or other email domain. If you believe you have been contacted by someone posing as an employee of UCS, please email [email protected].