Chime is a financial technology company that offers personal banking services through a user-friendly mobile platform. While it offers banking features similar to traditional banks, it is not a bank. Instead, it partners with FDIC-insured institutions: The Bancorp Bank and Stride Bank. This partnership ensures account holders receive the same level of deposit insurance as they would with a traditional

A business bank account is a financial account used to manage a company’s funds. Unlike a personal checking account, a business account separates personal and professional finances, essential for accurate recordkeeping, tax reporting, and liability protection.

ChexSystems is a consumer reporting agency governed by the Fair Credit Reporting Act. It collects data on closed bank accounts, unpaid overdraft fees,

Cash-back business credit cards are tailored explicitly for business owners. They offer a smart and straightforward rewards-earning solution for all your business basics. These cards give cash back on eligible business purchases, helping business owners save money and reinvest in their businesses. Cash-back rewards are different from traditional rewards cards. Most importantly, they keep it simple, delivering businesses a clear-cut

LegalZoom, Incfile, and ZenBusiness are three top providers of business formation and management services designed to assist entrepreneurs with their ventures. Each platform simplifies tasks such as LLC formation, business compliance management, and more to help you build and manage your business. Though they’re all similar at their core, their features, pricing, and additional offerings vary greatly.

Tradeline Supply Company LLC, founded in 2017 and based in San Diego, California, has established itself as a trusted marketplace for buying and selling authorized user tradelines. The company’s mission is to help individuals improve their credit scores by offering a variety of tradelines for purchase.

With a user-friendly online platform, customers can browse available tradelines and choose the

Effective project management requires keeping all team members engaged and on pace to complete their tasks. One team member falling behind can cause significant delays for other deliverables that depend on that task completion.

Whether you’re a small business owner or project manager, you must maintain communication and collaboration between team members and stakeholders. Project management software solutions provide the

As a small business owner, you want to ensure you’re set up to handle customer payments. For many retail, restaurant, eCommerce, or other merchant businesses, that means the ability to accept credit card payments.

Plastic is beginning to rival cash, with 87% of Americans owning a debit card and consumers using a credit card for 28% of transactions. Online sales

Square is an excellent option for most small business merchant needs. It provides affordable payment processing with flexible plans and no monthly fee.

While the service can cover most general retail, restaurant, or other merchant requirements, it lacks some features and tools. Square might meet your needs initially, but expanding businesses might need to upgrade to a full-service merchant account

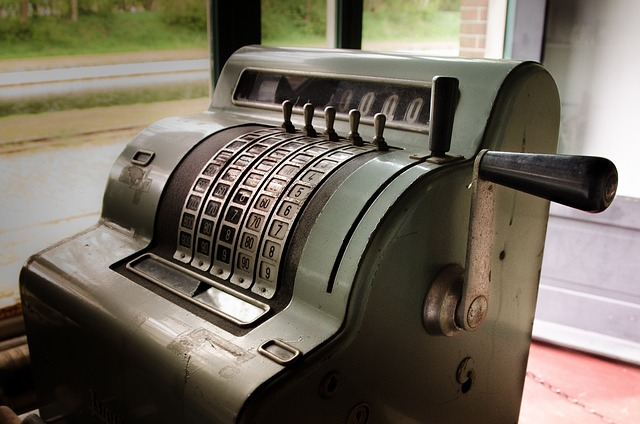

A point-of-sale (POS) system allows your business to process payments. It can also help centralize sales monitoring and reporting, enhance customer relationships, and manage inventory efficiently. The available POS solutions, hardware, software, add-ons, and features are very diverse.

Choosing the best system for your business requires identifying which tools and features will best facilitate transactions and help you achieve your

Whether you’re a seasoned small business owner or an aspiring entrepreneur trying to launch a startup, you’ve probably explored all business funding opportunities. Business credit cards are one of the more accessible options for small business owners at all levels.

However, the most advantageous business credit cards typically require good to excellent personal credit. There are also many business credit

Fraud Disclosure:

Please be aware that individuals have been fraudulently misrepresenting to business owners (and others) that United Capital Source, Inc. (“UCS”) can assist small businesses in receiving government grants and other forgivable business loans, when in fact those grants or loans do not exist or are not available. These individuals have ulterior motives and are engaging in the unauthorized use of the names, trademarks, domain names, and logos of UCS in an attempt to commit fraud upon unsuspecting small business owners.

UCS will never communicate with a prospective client on Facebook, Facebook Messenger, or any other type of social media. Further, any email communications will always come from an official UCS email address and not a Gmail, Yahoo, or other email domain. If you believe you have been contacted by someone posing as an employee of UCS, please email [email protected].