What is a Cash Flow Statement?

A cash flow statement, also called a statement of cash flows, is a financial document that summarizes cash inflows and outflows over a specific period. It shows how money moves in and out of a business and helps understand the company’s liquidity.

The cash flow statement plays a vital role in assessing operational efficiency. It reveals how well a company generates cash to pay its debts and fund its operations. Investors use this information to evaluate a company’s performance. They want to know if the business can maintain positive cash flow.

This statement is one of the three primary financial statements. The other two are the income statement and the balance sheet. Each serves a different purpose, but together they provide a complete picture of a company’s financial health.

What goes on a Cash Flow Statement?

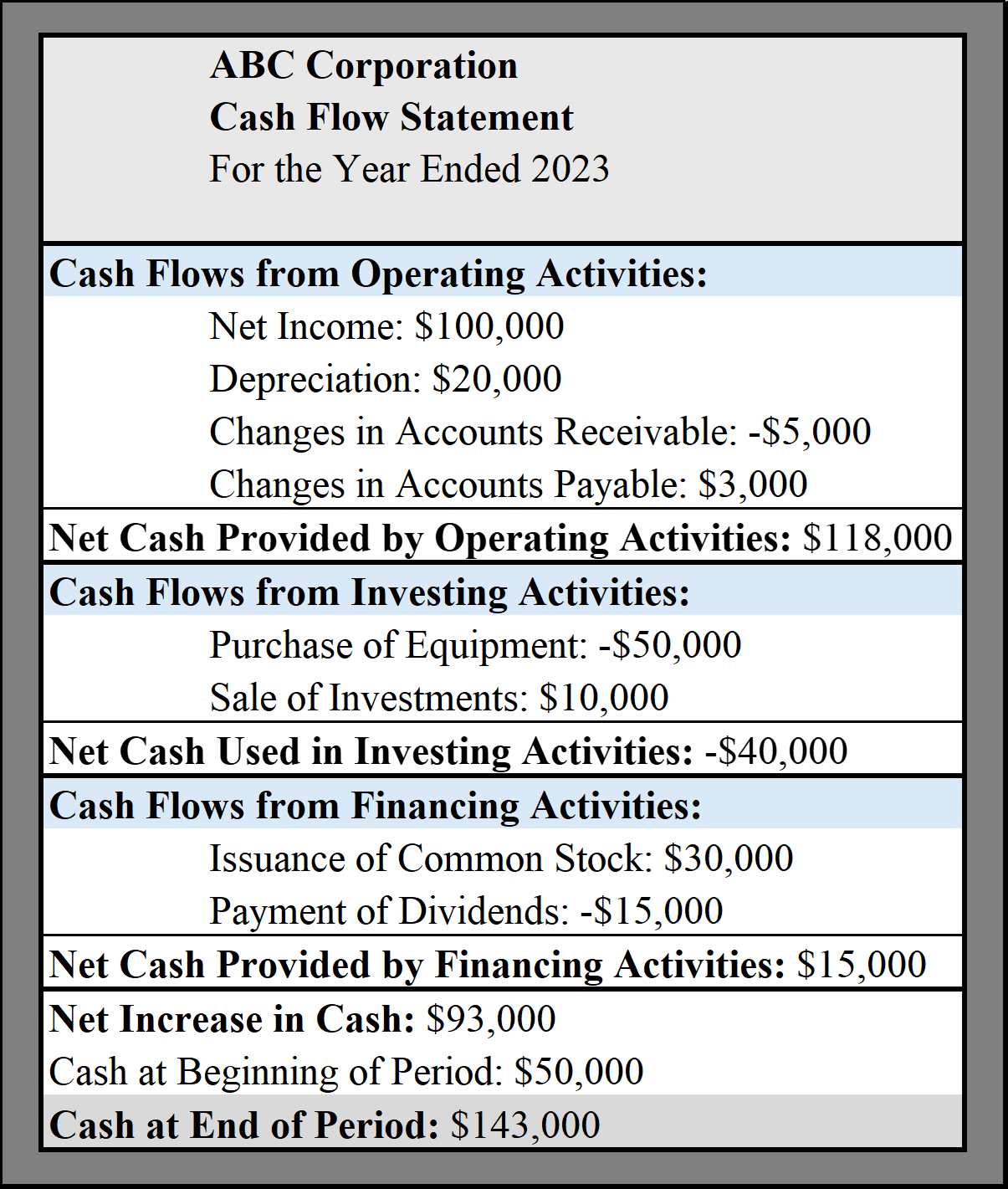

Cash flow statements typically have three primary categories: operating activities, investing activities, and financing activities. Each section aggregates essential information about cash management.

The cash flow statement calculations provide insights into how well a company manages its cash. By analyzing the inflows and outflows, investors can assess overall performance.

Operating Activities

Operating activities show the cash generated from daily business operations. This includes sales receipts from customers and payments made to suppliers. For example, cash received from accounts receivable counts as an inflow. Payments for operating expenses like rent and salaries are outflows.

Investing Activities

Investing activities involve cash used for investments in long-term assets, such as equipment or real estate. For instance, if a company buys new machinery, it is a cash outflow, while selling old equipment generates cash inflows. These transactions help track how much a company invests for future growth.

Financing Activities

Financing activities reflect how a company raises funds using debt or equity financing. This includes issuing stocks or borrowing money. Cash inflows occur when a company receives loans or sells shares. Conversely, paying dividends to shareholders or making loan payments is an outflow. Understanding these transactions helps evaluate a company’s financial health.

Why is a Cash Flow Statement important?

Calculating cash flow is vital in evaluating a company’s ability to generate cash. It shows how much cash comes in and goes out over a specific period. Understanding the cash flow statement helps businesses know if they can meet their financial obligations, like paying bills and salaries.

Stakeholders find this statement significant. Creditors use it to assess the risk of lending money, and investors look for signs of growth potential. Both groups rely on cash flow insights to make informed decisions. For instance, a company that consistently generates positive cash flow may be more attractive to investors or lenders.

Analyzing cash flow trends reveals important insights into a company’s financial health over time. For instance, a steady increase in cash flow indicates strong performance. Conversely, declining cash flow might signal trouble ahead. Companies can use this information to adjust their strategies.

Investors often examine specific areas within the statement. They look at operating cash flow, which shows the cash generated from core business activities. They also consider investing and financing cash flows to understand how the company manages its resources.

What is the Cash Flow Formula?

The basic cash flow formula is simple. It states: Cash Flow = Cash Inflows – Cash Outflows. This formula helps businesses see their net cash flow for a specific time.

Cash inflows include money received from sales, investments, or loans. These are the actual cash inflows that increase the cash balance. On the other hand, cash outflows are expenses like rent, salaries, and materials. Companies can figure out their total cash flow by subtracting outflows from inflows.

This formula applies to various activities in the cash flow statement. For example, a company tracks its current cash flow from daily activities during operations. They monitor how much money comes in and goes out. In investing activities, they look at future cash flows from buying or selling assets. Financing activities show how net cash flows change due to loans or equity.

Analyzing these numbers yields key cash flow metrics. Companies can optimize their cash flow by effectively managing inflows and outflows. They aim for a healthy cash balance to ensure they can meet obligations.

Understanding this formula is crucial for any business owner. It provides insight into financial health and guides decision-making.

Cash Flow Statement Example

Here is an example cash flow statement for the fictional company ABC Corporation.

How do I prepare a Cash Flow Statement?

Here are the crucial steps to preparing a cash flow statement.

Gather Financial Statements

To prepare a cash flow statement, gather the necessary financial statements such as the income and balance sheets. These statements will provide the information needed to calculate the cash flows for the reporting period.

Choose Reporting Period

Decide on the reporting period for which you will prepare the cash flow statement. Standard reporting periods include monthly, quarterly, or annually. Consistency in reporting periods is essential for accurate financial analysis.

Choose Methods: Direct or Indirect

Next, choose between the direct and indirect methods of preparing the cash flow statement.

Direct Method: The direct method of cash flow statements involves listing the actual cash inflows and outflows from operating, investing, and financing activities. This method provides a clear and straightforward breakdown of how a company generates and uses cash, making it easier for stakeholders to understand the sources and uses of cash.

Indirect Method: The indirect method of preparing cash flow statements starts with net income and adjusts for non-cash expenses, changes in working capital, and other items to arrive at the net cash provided by operating activities. This method focuses on reconciling the differences between net income and cash flow from operating activities to provide a clearer picture of a company’s cash position and financial health.

Prepare the Cash Flow Statement

With the financial statements in hand and the reporting period and method chosen, start preparing the cash flow statement.

Cash Flow from Operating Activities

Direct Method:

- List all incoming cash and cash equivalents from customers.

- List all outgoing cash payments, such as payments to suppliers and employees, interest payments, and taxes.

- Subtract total cash payments from total incoming cash to calculate net cash flow.

Indirect Method:

- Start with net income from the income statement.

- Add back depreciation and amortization for non-cash items.

- Account for changes in working capital, including accounts receivable, inventory, and accounts payable.

- Combine adjusted net income with changes in working capital to calculate net cash flow from operating activities.

Cash Flow from Investing Activities

Identify cash transactions related to investments, such as purchasing fixed assets and selling assets. Include cash flows from investing in securities in the analysis. Calculate net cash flow from investing activities by subtracting cash payments for investments from cash receipts from sales of investments.

Cash Flow from Financing Activities

Identify cash transactions related to financing, such as cash received from issuing stock or debt and cash spent on repaying debt or buying back stock. Calculate the net cash flow from financing activities by subtracting cash payments for financing activities from cash receipts from financing activities.

Combine Cash Flow Statement Sections

Once you have calculated the cash flows for each section (operating, investing, financing), combine them to create a comprehensive cash flow statement. Ensure that the cash flows are categorized correctly and accurately reflect the business’s financial activities.

Reconcile Ending Cash with Beginning Cash

Finally, reconcile the cash flow statement’s ending cash balance with the previous period’s beginning cash balance. Any discrepancies should be investigated and resolved to ensure the accuracy of the cash flow statement.

Frequently Asked Questions

Here are the most common questions about small business cash flow statements.

What is Cash Flow Financing?

Cash flow financing is a method of funding that relies on a business’s cash flow. This type of financing helps companies manage their cash effectively to secure loans or investments based on their cash inflows.

Companies often use cash flow financing to obtain loans. They present their cash flow statements to lenders, which show how much cash the business generates from operations. Lenders assess this information to decide on loan approval. Investors may also consider cash flow when deciding where to put their money.

Cash flow financing offers several benefits. It provides flexibility in funding options. Companies can access funds quickly without the need for extensive collateral. Interest rates can be lower compared to traditional financing methods. This makes it easier for businesses to manage repayment and maintain liquidity.

Cash Flow Financing Pros and Cons

Pros:

- Flexible funding options.

- Quick access to funds.

- Based on actual cash generation.

Cons:

- Risk of over-reliance on cash flow.

- May not cover all expenses.

- Requires meticulous cash flow management.

How often should I prepare a Cash Flow Statement?

A company should ideally prepare a cash flow statement monthly to monitor its financial health closely and make timely decisions. Monthly statements provide a more detailed and up-to-date picture of the company’s inflows and outflows than quarterly or annual statements.

While quarterly and annual statements are essential for long-term planning and reporting purposes, monthly statements help identify any immediate cash flow issues and take corrective actions promptly. Understanding monthly cash flow is crucial for managing working capital effectively, ensuring sufficient liquidity, and avoiding cash flow shortages that could impact the company’s operations.

Can I use a Cash Flow Statement for forecasting?

Yes, you can use a cash flow statement for forecasting. You can predict future financial performance and make informed decisions by analyzing past cash flows. This statement helps in understanding the sources and uses of cash within a business, aiding in planning for potential fluctuations and ensuring financial stability. Utilizing a cash flow statement for forecasting can provide valuable insights into a company’s financial health and help in strategic decision-making.

Is a Cash Flow Statement required for all businesses?

A cash flow statement is not required for all businesses, but it is highly recommended to have one. A cash flow statement provides valuable insights into a company’s liquidity, solvency, and overall financial health. It helps businesses track how cash flows in and out of the company, making it an essential tool for financial planning and decision-making.

What does Negative Cash Flow mean?

Negative cash flow occurs when cash outflows are greater than cash inflows during a specific period. This situation can create challenges for a business, as it signals that the company is spending more money than it earns.

Several factors can lead to negative cash flow. Increased expenses often contribute to this issue. For example, if a company has higher costs due to rising material prices, it may struggle to maintain positive cash flow. Declining sales also play a major role. If customers buy less, the company’s income decreases, which can quickly lead to financial trouble.

Addressing negative cash flow is crucial for maintaining financial stability. Companies must monitor their cash flow regularly. They should identify the causes of poor cash flow management. Understanding these issues helps businesses make better decisions. Strategies might include cutting unnecessary expenses or finding new revenue sources.

Maintaining positive cash flow is essential for operations and growth. It allows companies to invest in new projects and pay employees on time. Without proper attention, negative cash flow can lead to serious consequences, like bankruptcy.

What are the other important Financial Statements for small business?

The cash flow statement is an essential financial document but doesn’t create a complete picture of your company’s finances. Here are the other essential financial statements you should know.

Income Statement

The income statement, also called a profit and loss statement or P&L statement, is a crucial financial report. It shows a company’s profitability over a specific period. This statement lists revenues and expenses. The difference between the two reveals the net income or loss. Small businesses rely on this statement to track performance.

Balance Sheet

The balance sheet provides a snapshot of a company’s financial health. It details assets, liabilities, and equity at a specific date. Assets include cash, inventory, and property. Liabilities cover debts and obligations. Equity represents the owner’s interest in the business. This statement helps owners understand their financial position.

Statement of Retained Earnings

The statement of retained earnings tracks changes in equity over time. It starts with the previous period’s retained earnings. Then it adds net income from the income statement and subtracts dividends paid to shareholders. This report shows how profits are reinvested in the business.

Small businesses need all these financial statements. They provide vital information for decision-making. Accountants often prepare these reports to ensure accuracy. Business owners use them to analyze performance and manage finances effectively. Each statement plays a unique role in understanding overall financial health.

What is a Cash Flow Statement – Final Thoughts

Understanding and analyzing a cash flow statement is crucial for businesses of all sizes. Companies can make informed decisions to improve their financial health and stability by examining cash inflows and outflows.

A well-prepared cash flow statement provides valuable insights into a company’s liquidity, solvency, and overall financial performance. Regularly monitoring and interpreting this financial statement helps small business owners manage their cash flow, plan for future investments, and navigate challenging economic times.

Contact us if you have more questions about small business financial statements or to apply for a small business loan. Our alternative financing experts can help you find the best business funding program for your cash flow.