What is a Business Line of Credit?

Business lines of credit through UCS’s lender network offer the following features:

- Amounts: $1k – $1 million.

- Factor Rates: Starting at 1% p/mo.

- Term: Up to 36 months.

- Speed: 1-3 business days.

A business line of credit is a financial tool that provides businesses with access to funds up to a predetermined credit limit. It operates similarly to a credit card, allowing business owners to borrow money when needed and repay it with interest. Unlike traditional loans, where you receive a lump sum upfront, a business line of credit lets you draw funds as required.

This type of financing offers flexibility, enabling businesses to manage cash flow fluctuations and address immediate financial needs. A business line can cover various expenses, including purchasing inventory, covering payroll costs during slow seasons, or investing in marketing campaigns. It can help businesses bridge gaps between accounts receivable and payable, ensuring smooth operations without disrupting cash flow.

A business line of credit is particularly beneficial for small businesses that may experience irregular income patterns or unexpected expenses. By having access to this revolving credit option, companies can navigate financial challenges more effectively and seize growth opportunities as they arise.

How does a Business Line of Credit work?

A Business line of credit operates on a revolving basis, allowing businesses to borrow up to a predetermined limit. The borrower can withdraw funds as needed and only pays interest on the amount used.

Interest rates for business lines of credit are typically lower than those for credit cards. Repayment terms vary based on the lender and can be flexible, ranging from monthly to annually.

Businesses must manage their credit utilization responsibly by only using what they need and ensuring timely repayments. This practice helps maintain a positive payment history and keeps the balance in check.

Does a Business Line of Credit Affect Personal Credit Scores?

In most cases, a business line of credit won’t directly impact your personal credit score. Most commercial lenders only report the business credit bureaus, such as Dun & Bradstreet or Experian Business.

That means business line of credit activity won’t appear on your consumer credit reports from the three major consumer credit bureaus: Experian, Equifax, and TransUnion. This is also true for most business financing options, such as small business loans, business term loans, working capital loans, and more.

However, there are some instances where a business line of credit can indirectly affect your score.

Business Structure: Most business structures create a separate legal entity from the business owner(s), clearly separating business and personal finances. However, sole proprietorships and partnerships are not separate entities. Sole proprietors can still access business lines of credit, but the nature of the business structure increases the chances of it being reported on personal credit reports.

personal guarantees: When a business owner provides a personal guarantee for a business line of credit, it can indirectly affect their personal credit score. If the business defaults on payments, it reflects poorly on the individual’s credit score, impacting their borrowing capabilities in the future.

Lender Credit Assessment: Many commercial lenders review the business owner’s personal credit history when evaluating a business line of credit application. In fact, personal credit plays a role in assessing creditworthiness for most business financing products. When lenders conduct a hard credit pull, it can temporarily lower your personal credit score.

What are the benefits of a Business Line of Credit?

Accessing a business line of credit offers numerous advantages for small business owners. It provides a safety net during financial emergencies, ensuring the business’s financial health.

A key benefit is the ability to manage cash flow efficiently, ensuring businesses can meet their financial obligations without delays. By utilizing a business line of credit wisely, business owners can navigate through challenging times and seize growth opportunities when they arise.

Another advantage is the convenience it offers. Businesses can draw funds as needed and only pay interest on the funds they use. Revolving business lines of credit replenish as you repay the funds, allowing you to utilize the credit line as often as needed.

The flexibility a business line of credit provides allows businesses to adjust their spending based on their needs and revenue cycles. This ensures they maintain an optimal utilization rate, maximizing the benefits and minimizing costs.

What are the drawbacks of a Business Line of Credit?

While beneficial, business lines of credit also have drawbacks that business owners should be aware of. One significant disadvantage is the potential for high interest rates, which can add to the overall debt burden.

Another drawback is that some lenders may charge fees for maintaining a line of credit, impacting the overall cost of borrowing. Sole proprietorships are personally liable for any debts incurred through a business line of credit, potentially risking personal assets if the business defaults.

Defaulting on a business line of credit can have far-reaching consequences, affecting the company’s ability to secure future financing and potentially damaging the owner’s credit score. Therefore, it is crucial for businesses to carefully manage their debts and credit obligations to avoid these negative outcomes.

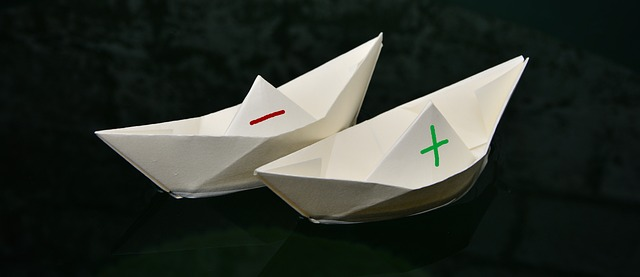

Business Line of Credit Pros & Cons

Pros:

- Flexibility in borrowing and repayment.

- Access to funds when needed.

- Can help with cash flow management.

- Interest is only charged on the amount borrowed.

Cons:

- High interest rates compared to traditional loans.

- Risk of overspending and accumulating debt.

- May require a personal guarantee.

- Late payments or defaults could affect personal credit in some cases.

How do you apply for a Business Line of Credit?

You can apply for a business line of credit through UCS by following these steps.

Step 1: Determine How Much Funding You Need

Unlike other loans, business lines of credit are often not pursued with specific investments in mind. After all, you’re supposed to apply before you need the money. For this reason, aspiring borrowers might not know exactly how much funding to request. So, think about how you’ll most likely use your funding and why you are applying in the first place. This will help us understand why you’re requesting this amount.

Step 2: Gather Your Documents

You might not need all of the following documents depending on your creditworthiness. However, it’s better to have them on hand just in case:

- Business bank account statements from the past three months

- Driver’s license

- Voided check

Step 3: Complete Application

You can begin the application process by calling us or filling out our one-page online application. Either way, you’ll be asked to enter the information from the previous section along with your desired funding amount.

Step 4: Speak to a Representative

Once you apply, a representative will contact you to explain the repayment structure, rates, and terms of your available options. This way, you won’t have to worry about surprises or hidden fees during repayment.

Step 5: Receive Approval

If and when you’re approved, funds should appear in your bank account in 1-2 business days.

How can I reduce the impact of a Business Line of Credit on my Personal Credit?

When considering the impact of a business line of credit on your personal credit history, you should also consider its potential impact on your business credit score. Both personal and business credit scores are crucial for securing business loans. Fortunately, many of the actions you take to protect your personal credit score can also help maintain or build a good business credit history and score.

Here are some essential steps to help ensure your business line of credit doesn’t negatively impact your credit scores.

Separate Finances: Separating personal and business finances is crucial to prevent your personal credit from being affected by your business activities. By maintaining distinct accounts, you can avoid mixing transactions that could impact your personal credit score.

Timely Payments: Ensuring timely payments on your business line of credit is essential. Late payments can negatively affect your business and personal credit scores. Setting up automatic payments or reminders can help you stay on track with repayments.

Manage Credit Utilization: Monitoring your credit utilization ratio is critical to minimizing the impact on your personal credit. Keeping this ratio low by not maxing out your credit limit can positively influence your credit score. Regularly reviewing and adjusting your spending habits can help in this regard.

Frequently Asked Questions

Here are some of the most common questions about the impact of business lines of credit on personal credit scores.

What’s the relationship between Business Credit and Personal Credit?

Business credit and personal credit are separate entities. Business credit reporting agencies collect information about your business and produce your business credit score. These differ from consumer credit reporting agencies, which collect and report information about personal credit.

Both business and personal credit reports detail payment history, credit utilization, and types of credit. However, business credit reports also focus on payment history with vendors and suppliers, the age of the business, and the risk level associated with the company’s industry.

Lenders may also require a personal guarantee from the business owner, linking personal credit to the business’s financial obligations. Understanding the differences and connections between personal and business credit is essential for managing finances effectively and securing favorable loan terms.

Is a Business Line of Credit the same as a Business Credit Card?

A business line of credit and a business credit card serve distinct purposes in business financing. While both provide access to funds, they differ significantly in their features and usage.

A business line of credit offers flexibility in borrowing money up to a predetermined limit and makes it easier to liquidate the funds. This financial tool allows businesses to withdraw funds when needed and pay interest only on the amount used.

On the other hand, a business credit card functions similarly to a personal credit card but is tailored for business expenses. It provides convenience for making purchases, tracking expenses, and earning rewards or cash back on transactions.

Do Business Credit Cards Affect Personal Credit?

Business credit card activities typically do not directly impact personal credit scores. Separate credit reports are maintained for business and personal finances.

However, when a cardholder provides a personal guarantee, they become personally liable for the debt. If the business defaults, it reflects on the individual’s personal credit report. Responsible usage of both business and personal credit cards is crucial for maintaining good credit health.

It’s important to note that while business credit card activities usually don’t affect personal credit, missed payments or defaults can have repercussions. Keeping up with payments on both types of cards is essential in safeguarding one’s overall financial well-being.

Does Personal Credit impact my ability to Get a Business Line of Credit?

Personal credit plays a significant role in determining whether you can secure a business line of credit. Lenders often review personal credit scores and history when evaluating your eligibility for a business line of credit. If your personal credit is poor, it may hinder your chances of getting approved.

Approved businesses we work with here at UCS typically meet the following minimums for a business line of credit:

- Credit Score: 625+.

- Time in Business: 6+ months.

- Annual Revenue: $200k+.

Will a Business Line of Credit Impact My Personal Credit – Final Thoughts

Understanding how a business line of credit impacts your personal credit is crucial for managing your financial health. By grasping the nuances between business and personal credit, you can make informed decisions that benefit both aspects of your financial life.

Being proactive in monitoring your credit scores and practicing responsible borrowing habits can help you navigate the complexities of business financing without jeopardizing your personal creditworthiness.

Contact us if you have more questions about business and personal credit or to apply for a small business loan. Our alternative funding experts can help you find the best financing options for your credit history and business goals.