What is an Amortized Loan?

Amortized loans are typically used for medium-term and long-term financing, usually over three years. The amount you pay remains the same for the loan term, but the amount applied to both the principal and interest changes with each payment.

Interest gets paid first, with the remaining amount of the payment applied to the principal. The first payment will have the highest percentage applied to the interest and the lowest percentage applied to the principal amount.

With each subsequent payment, the remaining balance decreases. As a result, the percentage of payment that goes to the interest decreases as the percentage applied to the principal increases.

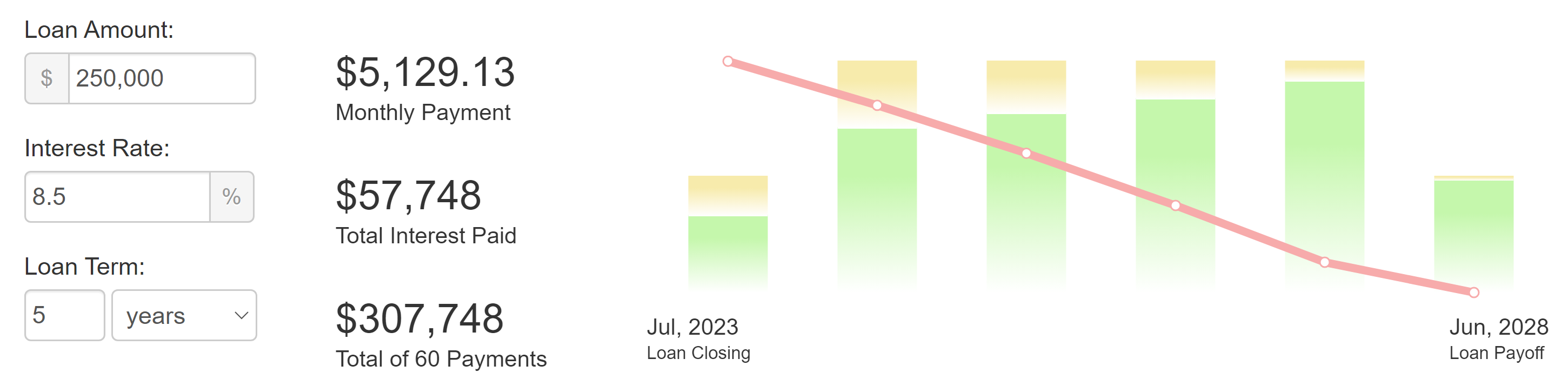

Amortized Interest Loan Example

Say you borrowed $250,000 at an interest rate of 8.5% for a five-year term. Based on a monthly amortization loan schedule, your monthly payment would be $5,129.13. During the loan, you’d pay $57,748 in interest.

With the first month’s payment, $1,771 is applied to the interest owed, and $3,358 is applied to the principal. The subsequent payment reflects the new balance of $246,642, with $1,747 applied to the interest and $3,382 towards the principal.

As the outstanding balance decreases, the interest applied decreases, and more of your payment goes to the principal loan amount for your monthly payments.

Sample amortization schedule:

Source: amortization-calc.com

What is a Simple Interest Loan?

As its name suggests, simple interest loans are much easier to calculate. These loans are typically used for short-term funding solutions.

Borrowers still have fixed payments and a fixed interest rate, but the principal and interest payments are divided equally. Interest payments do not change over time.

Simple interest rates are often expressed in decimals, called factor rates. Most factor rates range from 1.05 – 1.5 but could be higher with more aggressive lenders.

You can also express it as a percentage. A factor rate of 1.10 = a 10% interest rate. 1.20 = 20%, and so on.

Unlike an amortized loan, where the amount of interest owed fluctuates with each payment, simple interest is applied at the beginning of the loan and becomes the new loan balance. You then repay that in equal payments for the length of the loan.

Simple Interest Loan Example

Say you borrowed $250,000 on an interest-only loan at an interest rate of 8%. To calculate the annual simple interest, multiply the principal by the interest rate:

$250,000 x .08 = $20,000.

Based on a monthly payment schedule for one year, you’d divide the annual interest amount by the 12 months in a year:

$20,000 ÷ 12 = $1,666.67 is your monthly interest-only payment.

What are the key differences between Amortized Interest & Simple Interest?

There are several important differences between the two loan types that you should consider when determining the best small business loan structure for your company.

Terms

An amortizing loan is typically for medium- to long-term loans, usually 3 – 10+ years. Some examples include auto loans, equipment financing, and term loans.

Simple interest usually applies to much shorter funding arrangements, typically 3 – 24 months. Some examples include merchant cash advances, short-term business loans, and lines of credit. An example of a simple interest loan for commercial or residential real estate loans would be an interest-only loan.

Rates

Amortizing loans convert into a lower annual percentage rate (APR) in most cases. But you carry the debt for a more extended period, so you end up paying more total interest in the long term. Interest typically accrues on a monthly basis.

Simple interest loans convert into a higher APR, but it’s for a shorter term, and you usually pay less total interest.

Factor rates can also be considered a form of simple interest financing. However, since the rates are much higher and terms shorter than the average amortized or interest-only commercial/real estate loan, payments will be much higher and have a more noticeable effect on business cash flow.

Prepayment

One of the main benefits of an amortized loan is the ability to pay down the principal sooner and reduce your total interest. Borrowers can make extra payments toward the principal or even pay off the loan early and save significant interest.

Simple interest loans don’t allow you to reduce your interest with early prepayment because the interest is all applied at the beginning of the loan and then equally divided over the payment schedule. Some funders will charge a prepayment penalty if you try to pay it off early (although some might offer early payment discounts, especially if you’re renewing financing).

Collateral

Most amortized loans are secured loans, meaning they require some form of collateral. Sometimes the asset you’re financing, such as a vehicle in an auto loan or equipment in an equipment loan, serves as the loan collateral. Other times, you must pledge a fixed asset such as commercial real estate or business equipment your company already owns.

Simple interest loans are usually unsecured, meaning they do not require collateral. Lenders view these loans as riskier, so the effective APR is typically higher.

Approval Requirements

Since amortized loans are for longer terms, lenders usually take more precautions to ensure a business is sustainable enough to support repayment. That means your business will usually need at least 1-2 years in operation, and you must have good personal and business credit to qualify.

Shorter-term financing is usually more flexible. Some lenders will approve businesses with only 4 – 6 months in operation, and credit score requirements are more lenient.

Since many of these loans are repaid directly from your revenue, funders care more about your sales history and projected sales than traditional factors like time in business and credit score.

Funding Times

The underwriting process for amortized loans is more time intensive, so it takes longer to close and fund the loan. Lenders will review your cash flow and other financial statements to ensure your ability to repay. If collateral is required, there could also be extra time for asset appraisal.

Underwriting requirements for simple interest loans are much more flexible and lenient. In addition, many simple interest loan funders are online alternative lenders using fintech tools to quickly analyze a business’s sales history.

Funders can usually approve and fund these loans within 1 – 3 business days. Same-day funding could sometimes be possible.

What are the pros & cons of Amortization?

Here’s a quick summary of the benefits and drawbacks of amortized loans:

Pros:

- Lower effective APRs in most cases.

- Typically for higher borrowing amounts.

- Longer terms & lower payments.

- Can save interest costs by paying the loan early.

Cons:

- More total interest is paid over the lifetime of the loan.

- More difficult to qualify.

- Usually requires collateral.

- Difficult to calculate.

- Longer underwriting & funding times.

What are the pros & cons of Simple Interest?

Here’s a quick summary of the benefits and drawbacks of simple interest loans.

Pros:

- Easier to qualify.

- Doesn’t require collateral in most cases.

- Fast funding times.

- Less total interest paid over the life of the loan.

Cons:

- Typically for lower borrowing amounts.

- Higher effective APRs.

- Higher payments could strain your cash flow.

- No way to save interest with prepayment – might have a prepayment fee.

Frequently Asked Questions

Here are the most common questions about simple interest vs. amortization.

Are Amortized Loans or Simple Interest loans better for my business?

Choosing the best financing structure for your business depends on various factors, such as how much you need to borrow, how you intend to use the funds, what collateral you have available, and whether your business can pay the loan off early. It also depends on what you can qualify for and what stage your business is at.

Amortized loans are best for longer-term financing goals. As mentioned, these loans are excellent for financing equipment or acquiring needed business vehicles. You should also consider amortized term loans for expansion or acquisition goals.

Suppose you feel confident that your business will generate the revenue to pay the loan off early, whether by making extra principal payments or a lump sum payoff, then amortized loans are also more advantageous. You’ll get a lower payment total until you pay it off early and can then save a significant amount of interest.

Simple-interest loans are best for short-term urgent funding needs. These loans are primarily used for working capital expenses or covering a cash flow gap.

For example, if you need financing help to stock up on inventory or run a seasonal business and need to gear up before the busy season, these loans can help. Another example would be funding for hiring staff or covering payroll.

Simple interest loans are also a good option for bridge financing. An example might be a business with nine months in operation that wants a long-term loan, such as an SBA loan for growth goals.

But you don’t have enough business history or credit to qualify and need working capital help in the interim. A simple interest loan could provide the necessary funds to keep you in operation while building business credit until you qualify for a longer-term loan.

Is amortization the same as compound interest?

Amortization and compound interest are two different ways to calculate interest. Amortization is usually for medium-term financings, such as auto loans. Compound interest is typically for much longer loans, like a 30-year mortgage (it’s also possible to get an amortizing or simple interest mortgage).

With amortization, the interest amount is based on the principal at the time you took out a loan. With compounding interest, the accumulated interest is added to the principal balance again and again, whether monthly, quarterly, or annually.

The interest compounds in correlation to your payment frequency. Compounding interest is an ever-increasing event.

Where can I find an Amortized or Simple Interest Small Business Loan?

Whether you’re seeking an amortized business loan or a simple interest loan, there are two types of small business lenders: traditional and alternative. Traditional lenders include commercial banks and credit unions.

Alternative lenders are non-bank funders that typically offer loans online, powered by fintech tools.

While traditional and alternative lenders can offer both types of loans, you’ll find that banks primarily only offer loans with amortization. Alternative lenders usually specialize in simple interest loans but many offer amortization as well.

If you have a business bank account with a commercial bank or credit union, that could be an excellent place to start. However, you should know that traditional lenders usually have strict eligibility requirements and take a long time to fund.

There are many alternative lender options to consider. It can be a little overwhelming researching them each on your own. One place to start could be reading lender reviews to see what loans lenders offer and what borrowers have to say about the funders.

Another option would be to work with a small business lending marketplace, like UCS, that can help match you with lenders that best fit your qualifications and funding needs. Many marketplaces and brokerages maintain relationships with lenders and can help negotiate the best deals on your behalf.

It also helps simplify and streamline the process. You only have to complete one application and can get multiple offers from lenders.

Available small business loan options through our lender network include:

- Business term loans.

- Business lines of credit.

- SBA loans.

- Equipment financing.

- Merchant cash advances.

- Invoice factoring.

- Working capital loans.

- Bad credit business loans.

- ERTC advances.

Amortization vs. Simple Interest – Final Thoughts

Effective debt management for your business requires understanding how different financing arrangements work and which are most conducive to your goals and cash flow. As a small business owner, you should equip yourself with the tools and knowledge to make informed decisions and ask relevant questions when taking out small business loans.

Understanding the differences between amortization and simple interest helps you determine the best structure for your goals and needs. You should be able to compare costs, terms, and repayment effectively. Before signing any loan agreement, you must understand how the repayment process works and whether your cash flow can bear it.

To summarize, amortization means the interest accrues over time while the principal decreases. The percentage of each payment that goes toward the interest decreases as the percentage toward the principal increases.

On the other hand, simple interest is a one-time interest charge that you pay in equal part with the principal in every payment. Amortization is used for longer-term funding, while simple interest is mainly for short-term funding options.

Contact us if you have questions about amortization and simple interest or want to apply for a small business loan. Our loan experts can help you find amortized or simple interest loans that best meet your needs.