What is Receivables Factoring?

Accounts receivable factoring, also known as invoice factoring, is when a business sells its invoices to turn that static asset into working capital. It requires working with a third party, known as a factoring company.

The fees usually include a percentage of the invoice the factoring company keeps and a fixed financing charge, called the discount rate or factoring fee. The exact rates and fees depend on the company and your factoring agreement.

The factoring company issues payment for a percentage of the total accounts receivable value minus the discount rate called the advance rate. Advance rates vary between companies. The company will retain a portion of the accounts receivable until the customer pays the invoice.

Invoice factoring differs from accounts receivable financing, despite similar sounding terms. With accounts receivable financing, you retain ownership of the invoices. The accounts receivable financing company provides you with an upfront amount based on your invoices, which you repay with interest.

Why do companies Factor Receivables?

Companies use invoice factoring when they need immediate access to funds to solve issues like cash flow shortages or reinvesting in their business. Accounts receivable represents an asset to a company, but in some cases, businesses need to “cash in” on that asset early.

While accounts receivable ultimately become future cash flows, the amount of time it takes could result in lowered profitability. Factoring invoices turns the static asset into immediate cash flow.

How does Accounting for Factored Receivables work?

When a company provides goods or services on credit, known as credit sales, the accounting department enters it into the general ledger as an account receivable. When the company sells accounts receivable to a factoring company, it must also enter additional information.

Companies must also account for the fees paid to the factoring company when accounting for factored receivables. The final accounting component is to enter the credit for when you receive the remittance amount.

So, there are 3 separate accounting entries for factored receivables:

- The journal entry is added to accounts receivable when the invoice is issued.

- When the company receives the advance amount from the factoring company.

- When the company receives the remittance amount from the factoring company.

Let’s look at each journal entry with an example.

Accounting for Factored Receivables Example

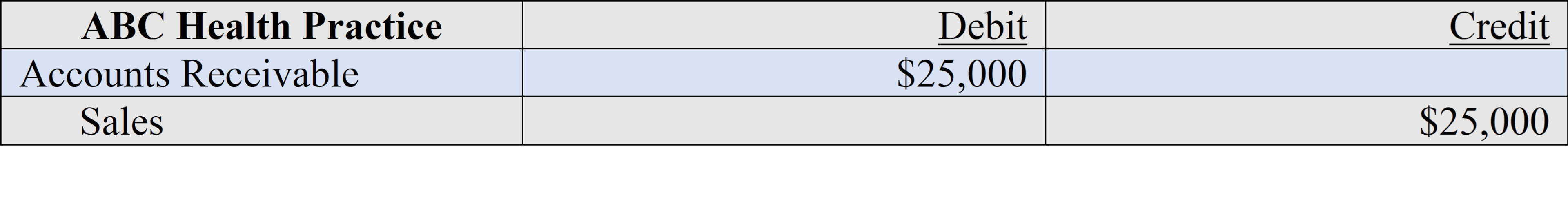

ABC Health Practice’s accounts receivable total $25,000. The amount is added to the ledger as follows:

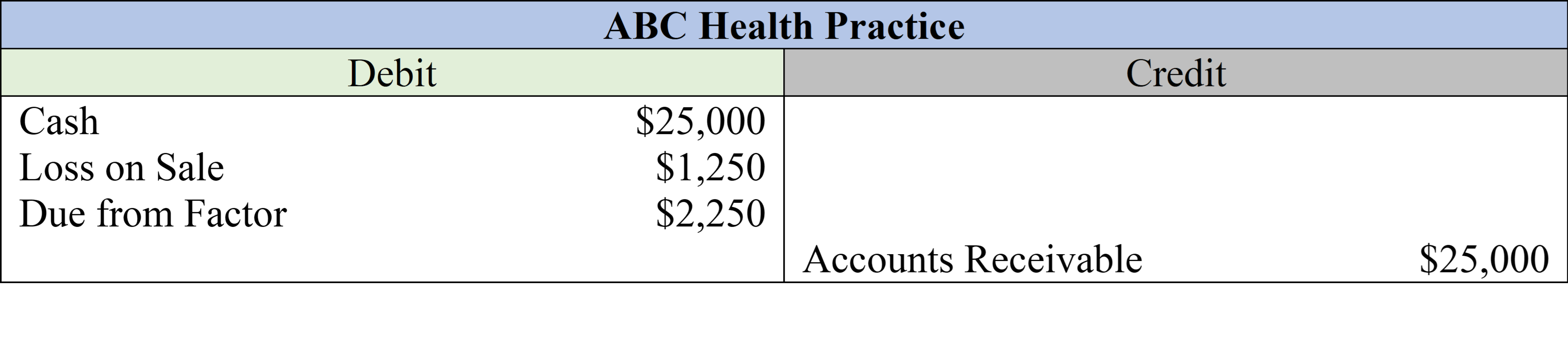

ABC Health Practice signed a factoring agreement with XYZ Factoring Company. XYZ offers the following factoring terms:

- Advance rate: 85%

- Factoring fee: 5%

- Remittance: 10%

The next step is removing the accounts receivable from your books since the factoring company owns the invoices. Set the journal entry up as follows:

The factoring fee is considered an interest expense, while the due-from factor amount is added to the reserve account.

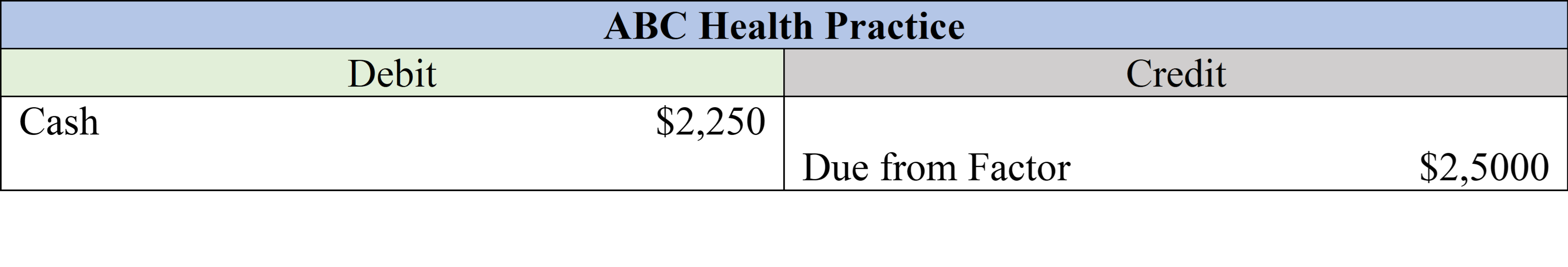

Then when your company receives the amount due from the factor, you’ll enter it as:

What is a Factoring Company?

A factoring company, sometimes called a Factor, purchases invoices for an agreed-upon fee so that companies can turn their accounts receivables into working capital. Once the factoring company owns the assets, it collects payment from customers.

In some ways, the factoring company acts as your accounts receivable back office. Most factoring companies follow up with your customers to collect payment and issue the remaining balance once the customer pays.

How do I find Factoring Companies?

There are plenty of factoring companies to choose from, and the question is, how do you find the right factoring company? There are several important factors to consider when looking for a factoring company.

Fees

The first thing to consider is the cost. Invoice factoring will always be an expensive way to secure financing – but some companies are far more expensive than others. You want to make sure that you can afford the fees and that the cost of financing is worth it for your business.

Recourse vs. Non-Recourse

Recourse factoring means your company is liable if your customers default on their invoices. In non-recourse factoring, you don’t have to pay if your customers default due to specific reasons such as bankruptcy. Non-recourse factoring is more expensive, but the added protection might make it worth it.

Notification Factoring

Some factoring companies will notify your customers when they purchase the invoices, and others will not. If you don’t want your customers alerted when you sell their invoices, look for a company that doesn’t notify them.

How to apply for Receivables Factoring:

You can apply to enroll in receivables factoring right through United Capital Source.

Step 1: Make sure your customer is reliable.

Factoring invoices only works when your customers pay their invoices on time and in full. Ensure you’re certain your customers will pay before contacting a factoring company.

Step 2: Gather your documentation.

When you apply, the factoring company needs to review the following documents:

- Driver’s license.

- Voided business check.

- Banks statements from the previous three months.

- Business tax return.

- Accounts receivable aging report, Accounts payable report, debt schedule.

Step 3: Apply.

You can complete our one-page application or give us a call to apply. Either way, you’ll need to provide the information above and the invoice amount you want to sell.

Step 4: Speak to a representative.

Once you apply, one of our representatives will reach out to discuss the factoring fee, factoring rate, and terms attached to the sale. You’ll get an upfront breakdown of all costs, so you don’t have to worry about hidden fees.

Step 5: Receive approval.

The entire process takes about two weeks to finalize. Funds will appear in your bank account 1-2 days after completing the application.

Frequently Asked Questions

Here are some of the most common questions about receivables factoring.

What is an Accounts Receivable Journal Entry?

An accounts receivable journal entry refers to recording information about an A/R transaction in the accounting ledger. A journal entry must include information about the transaction, such as the name of the company, the day of the transaction, and the amounts involved.

Accounts receivables have a minimum of two entries – the date the receivables were added as an asset and the date the money was received, turning that asset into cash. Companies need a third journal entry when they factor invoices.

What are the advantages of Factoring Receivables?

There are several advantages to factoring accounts receivable. It’s much easier to qualify for invoice factoring than other small business financing options, such as bank loans.

Receivables factoring isn’t a loan, so you don’t incur any debt. It’s a viable alternative for companies in urgent need of funding that don’t want to add to their debt.

When you factor invoices, the factoring company becomes responsible for collecting payment from your customers, saving you time and resources. And don’t worry – factoring companies won’t relentlessly pursue your customers, either. When you work with a company like UCS, your customers won’t even know you sold the invoice. Some factors do require notification factoring, however.

The most significant benefit is turning accounts receivable into working capital. Unpaid invoices are like unsold inventory – the longer it goes without converting into cash for your business, the less profitable it becomes.

What are the disadvantages of Factoring Receivables?

We’re not going to sugarcoat it – receivables factoring is expensive. Like most near-term and short-term financing, invoice factoring carries higher rates and fees than traditional long-term business financing.

Due to the complex nature of receivables factoring, it’s also difficult to compare costs to a loan or other forms of financing. Using the techniques described above, accounting for factored receivables helps understand the total costs involved.

While you don’t need good credit for approval, your customers do. If your customers are unreliable and already paying late, you are unlikely to get approved. Receivables factoring works best for established businesses with many partners.

Factoring accounts receivable is not the only way to avoid late payments and convert invoices into cash. Sometimes all you need to do is improve billing. You can try automating your invoices, giving customers more ways to pay, and improving your collections team’s efforts.

We prepared a pros and cons list for a quick summary.

Receivables Factoring Pros & Cons:

Pros:

- Turn unpaid invoices into cash.

- Easier to qualify for than other forms of business financing.

- You can use the funds for a variety of business purposes.

- Invoices and receivables are treated as collateral.

Cons:

- Higher rates & fees than traditional loans.

- Fees are based on how long customers take to pay their invoices.

Accounting for Factored Receivables – Final Thoughts

Accounts receivables factoring can help you grow your business by converting outstanding invoices into immediate working capital. While there are many benefits, you must also consider the costs and risks involved.

Managing your books for accounts receivable is already complicated. When you begin factoring your accounts receivable, it becomes even more complex. However, accurate accounting for receivables helps you understand the total cost to your business.

There are plenty of small business financing options for companies needing working capital to maintain cash flow or invest in growth and expansion. Deciding the best option requires due diligence and thorough accounting for all costs. Whether you’re currently factoring invoices or considering a factoring agreement, ensure you understand how to account for factored receivables with accurate journal entries.

Contact us to learn more about account receivables factoring through UCS, or visit our invoice factoring resources page.