What are Business Loan Interest Rates?

A business loan interest rate is the financing charge for a loan. It’s the cost of the lending product and how lenders make their money.

Interest rates can vary significantly depending on the lender, loan type, the personal credit history of the business owner(s), and the business’s credit history. Here are some key definitions to help understand business loan interest rates.

Principal: Also called the borrowing amount or loan amount, this is the money the business receives in the loan.

Interest rate: A percentage multiplied by the principal to determine your costs. Interest rates can compound on different schedules, such as annually or monthly.

Annual Percentage Rate (APR): Helps to calculate the true cost of the loan. It includes interest charges, compounding for the interest, and any fees.

Factor Rate: An alternative to interest rates, the factor rate is a decimal number multiplied by the principal to get the total repayment. It’s applied at the beginning of the loan, and there’s no compounding or amortization to consider.

What are Factor Rates for Business Loans?

Factor rates are commonly used for alternative business funding products, such as a merchant cash advance. Calculating your repayment amount using a factor rate is easy, but the costs are generally higher.

Instead of a percentage like with interest rates, factor rates are expressed as a decimal. Rates range from 1.09 – 1.90.

Let’s say you received an MCA loan for $50,000 at a factor rate of 1.25. Multiply the principal by the factor rate to determine your costs:

$50,000 x 1.25 = $62,5000.

The $12,500 charge is added to the principal to create a total repayment amount. Since it’s added in the beginning, there’s no way to save money by paying it off early like you could with an amortizing interest rate.

Are Business Loan Interest Rates Fixed or Variable?

Business loans can come with fixed or variable interest rates. It depends on several factors, including the type of loan.

A variable interest rate fluctuates throughout the loan. It’s often tied to benchmarks, such as the prime rate, Fed Funds Rate, etc. Fluctuations in the interest rate cause correlating changes in your payment amounts.

A fixed interest rate is determined at the beginning of the loan and doesn’t change. That makes your monthly payments even and predictable.

Business term loans, SBA loans, and equipment financing are more likely to have fixed interest rates. Business lines of credit, merchant cash advances, and business credit cards are more likely to be variable-rate loans. But it depends on your lender, creditworthiness, and preference.

What factors do lenders use to determine Business Loan Interest Rates?

Lenders use a variety of factors to determine interest rates. Here are some of the key components.

Industry Benchmarks

Many business loan lenders base rates on an interest rate index. One of the most common is the Federal Funds Rate. The Federal Reserve bases the rate on current economic performance. The rate increases during inflation and decreases when a recession looms.

Credit History

Lenders look at your personal and business credit history when underwriting a loan request. Your personal credit score is often directly tied to the rate you receive. The higher your credit score, the lower your interest rate.

Time In Business

Older businesses are seen as more reliable and creditworthy. Many traditional lenders, like banks and credit unions, require a minimum of two years in business. There are alternative lenders and funding options for businesses with less than a year in operation, but they usually carry a higher interest rate.

Annual Revenue

Lenders also look at your annual revenue and cash flow. Many lenders use this information when determining your borrowing amounts. It also plays a role in interest rate calculations.

Debt Service Coverage Ratio (DSCR)

The DSCR ratio determines how much your business already spends on debt obligations. It’s comparable to the debt-to-income (DTI) ratio in personal finance.

Calculating your DSCR is easy. The formula is:

Cash Flow ÷ Loan Payment = DSCR

For example, let’s say your monthly cash flow is $4,000. You have a loan payment that’s $1,600 per month. The calculation is:

$4,000 ÷ $1,600 = 2.5. The higher your DSCR, the better.

Most lenders look for a minimum of 1.25. A DSCR over 2 is ideal.

What is the Average Business Loan Interest Rate?

Average business interest rates for small business loans can vary yearly due to economic changes and rate index benchmarks. Here are the average rates as of August 2023.

Rates by Lender Type

Traditional lenders tend to have lower interest rates, but it’s much harder to qualify. Bank and credit union loans also take a long time to close and fund.

Alternative lenders are often much more accessible as they’re more lenient on credit scores, time in business, and cash flow. Most online and fintech lenders can also approve and fund loan requests within a few days.

The tradeoff is that alternative lenders charge more for accessibility and fast funding. Here are the average rates by lender type.

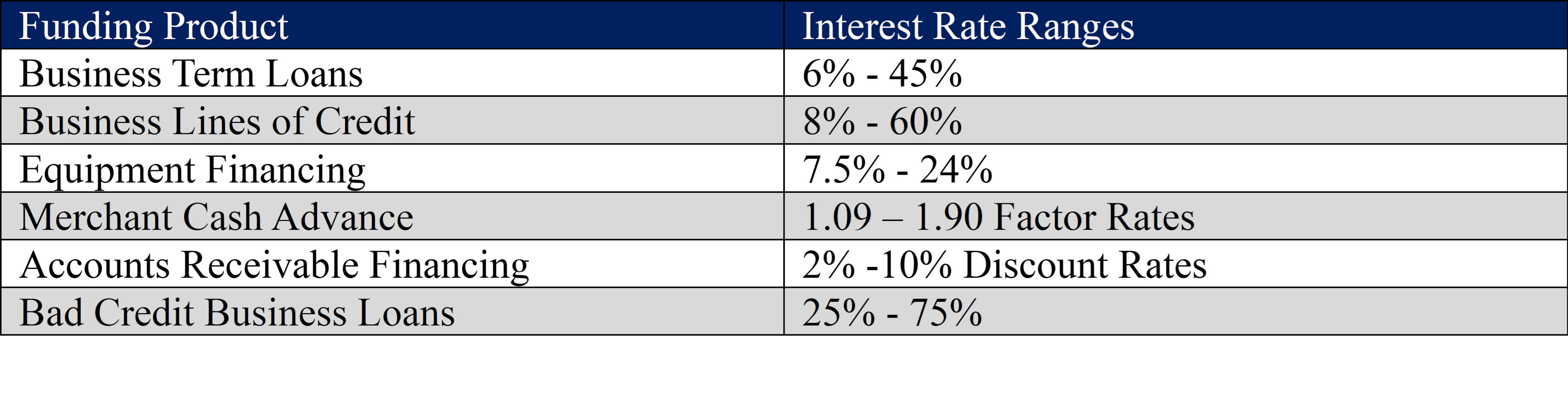

Rates by Loan Type

Interest rates also vary by type of loan. Here are the average rates by loan type in 2023.

Business Term Loans: A standard loan structure where you receive the loan disbursement in a lump sum. The business then repays the loan, interest, and fees in fixed (usually monthly) payments. Ideal for large purchases and one-time expenses.

Business Line of Credit: Instead of disbursing the funds as a one-time lump sum, they’re activated as an available credit limit. Businesses can draw from the credit line as needed. Revolving lines of credit replenish as you repay them, like a credit card. Ideal for ongoing projects and covering unexpected costs.

Equipment Financing: Loans or lease programs to acquire expensive but essential business equipment on credit. The equipment is the collateral for the loan. The lender usually pays the equipment seller directly.

Merchant Cash Advance (MCA): An alternative business funding solution where an MCA provider issues a cash advance repaid from future credit card sales. MCAs are highly accessible but can be an expensive way to borrow money. Ideal for credit-challenged business owners or companies with fluctuating cash flow, such as seasonal businesses.

Accounts Receivable Financing: Also called invoice factoring, this process allows businesses that sell on credit to convert unpaid invoices into working capital. It requires working with an invoice factoring company. The company issues the advance (usually 75%-95% of the invoice value) and then collects payment from your customers. Ideal for companies that experience cash flow interruptions due to the delay in receiving payment.

Bad Credit Business Loans: Various working capital loan products intended for business owners with a low credit score. Bad credit business loans usually have high costs and short terms. They’re a viable option for bridge financing while you improve your credit to qualify for better business loan options.

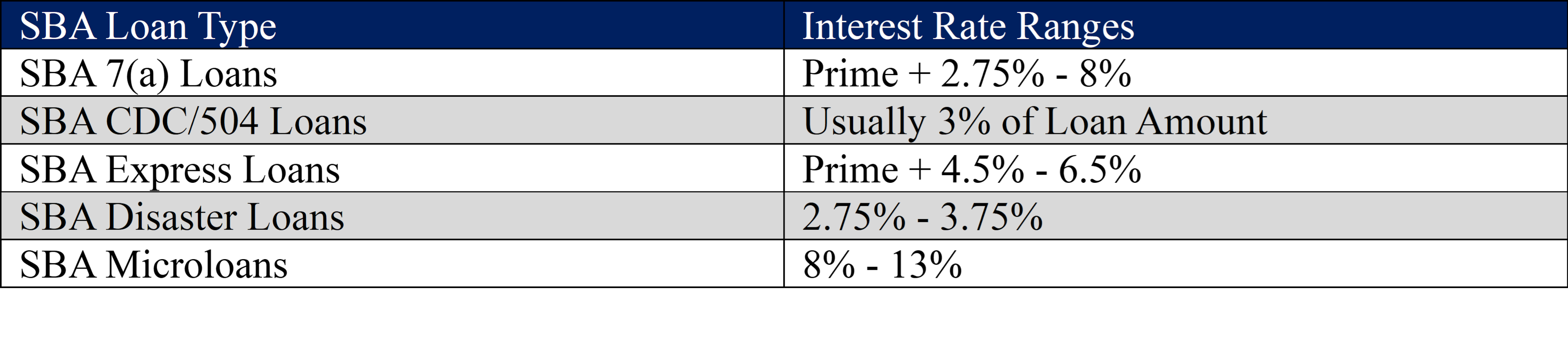

SBA Loan Interest Rates

SBA loans are often considered the gold standard of small business financing. The US Small Business Administration (SBA) established and oversees the program.

However, small business owners cannot apply directly to the SBA. Instead, you must apply to an SBA-approved lender, which could be a bank, credit union, or alternative business financing facilitator like UCS.

The SBA sets rules for lenders, caps interest rates and fees, and partially guarantees the loans up to 85%. The government agency guarantee gives lenders the security to offer higher borrowing amounts at lower rates and longer repayment terms.

Here are the current average interest rates for the different loan options in the SBA loan program.

How to get a Business Loan:

It’s best to shop around lenders when pursuing a business loan. You want to look for the most advantageous funding product for your business and cash flow.

Here’s how to apply for a small business loan through our lender network. Once you apply, our loan experts will work with you to find the best loan option for your needs.

The length of the application process depends on the product you choose. However, most products require very little paperwork and can be approved in just a few business days.

Below, we’ll explain how to apply for each product, along with the documents they require.

Step 1: Choose the Right Product

The first step is choosing the right product for your needs and goals. This requires much research, as each product is designed for different financial circumstances and cash flow cycles. Does your business experience occasional dips in revenue? Is your business highly seasonal?

You should also consider the purpose of the funds. How long will it take you to pay off the loan? This will help us determine the right borrowing amount and terms for you.

Step 2: Gather Your Documents

Here are the documents required for each type of business loan:

Business Term Loan

- Driver’s license

- Voided business check

- Bank statements from the past three months

SBA Loan

- Driver’s license

- Business license or certificate

- Voided business check

- Bank statements from the past three months (length of history varies)

- Credit report/Statement of personal credit history

- Credit card processing statements (length of history varies)

- Personal tax returns from the past three years

- Business tax returns from the past three years

- Business Plan (Not in all cases)

- Personal financial statement

- List of real estate owned

- Debt schedule

- Deeds/Title/Ownership documentation for any collateral/security

- Current Profit & Loss Statements and Balance Sheet Year-to-Date

- A/R and A/P Reports

- Lease/Rent documentation

Business Line of Credit

- Driver’s license

- Voided business check

- Bank statements from the past three months

Working Capital Loan

- Driver’s license

- Voided business check

- Bank statements from the past three months

Equipment Financing

- Driver’s license

- Voided business check

- Bank statements from the past three months

- Invoice for equipment

Merchant Cash Advance

- Driver’s license

- Voided business check

- Bank statements from the past three months

- Credit card processing statements from the past three months

Revenue-Based Business Loans

- Driver’s license

- Voided business check

- Bank statements from the past three months

Accounts Receivable Factoring

- Driver’s license

- Voided business check

- Bank statements from the past three months

- Business tax returns

- Account Receivable Aging report,

- Accounts Payable report,

- Debt schedule

Step 3: Fill Out Application

You can begin the application process by calling us or filling out our one-page online application. Either way, you’ll be asked to enter the information from the previous section along with your desired funding amount.

Step 4: Speak to Representative

Once you apply, a representative will contact you to explain the repayment structure, rates, and terms of your available options. This way, you won’t have to worry about surprises or hidden fees during repayment.

Step 5: Receive Approval

If approved, you’ll hear back from us within 24 hours. Funds for Business Term Loans, Business Lines of Credit, Working Capital Loans, Equipment Financing, Merchant Cash Advances, Revenue-Based Financing, and Accounts Receivable Factoring should appear in your bank account anywhere from 24 hours to one week. At the very least, it usually takes 8-12 weeks for SBA Loans to receive funding.

Frequently Asked Questions

Here are the most common questions about interest rates for small business loans.

What is a Good Business Loan Interest Rate?

Ideal commercial loan interest rates are usually between 6% – 16%. However, those rates are generally only available for the most well-qualified borrowers.

Credit-challenged business owners might consider rates between 25% – 30% good compared to other bad credit business loans. Ultimately, the lowest rate you can find for your credit profile is a good rate.

Bad Credit Business Loan Pros & Cons

Pros:

- Accessible financing for borrowers with a low credit score.

- Could potentially help build or repair credit with timely payments.

- Might be able to use the funds to pay off existing debt.

- Quick and easy online applications.

- Usually fast approval and funding times.

Cons:

- Higher interest rates & fees than conventional loans.

- Lower borrowing amounts than traditional business loans.

- Typically short-term financing with frequent repayments.

- Might require collateral or a personal guarantee.

- Could require automatic payment withdrawals.

- Fewer options for lenders and loan types.

How much are Business Loan Fees?

Interest rates (or factor rates) are the primary charge for business loans, but you must also consider loan fees. As mentioned, APRs give a more accurate true cost of the loan since they take loan fees and compounding interest into account.

Here are some standard small business loan fees.

Origination Fees: A loan origination fee covers processing the loan request. It includes the underwriting process, preparing and reviewing the application, and making a decision on the loan. Origination fees are usually 1% – 9% of the loan total.

SBA Loan Guarantee Fee: The SBA charges a fee for guaranteeing the loan amount. Guarantee fees provide the funds the SBA uses to cover a lender’s losses in the case of default. SBA guarantee fees range from 0.25% – 3.75% of the loan amount.

Servicing Fee: Some lenders charge a service fee to cover the costs of administering the loan. Most servicing fees are charged annually. It covers the costs of customer service, billing, payment processing, and collections. Servicing fees can also include administrative and documentation fees.

Late Fee: Most lenders charge a fee when you pay late. Consider enrolling in automatic payments or setting up payment reminders to avoid late payments.

What can I do to get a lower Business Loan Interest Rate?

You want to make your business appear as low-risk as possible to lenders. There are several ways to help lower any perceived risk of lending to your company.

Here are strategies to help you find the lowest interest rates for your business loan.

Offer Collateral

Loans that include collateral are called “secured” because the collateral provides extra security for the lender. Loans without collateral are unsecured. Secured loans have lower interest rates on average.

Some small business loans, like equipment financing, require collateral. However, offering collateral on a loan that doesn’t require it can lower your rate.

Improve Personal Credit

You’ll likely qualify for the lowest rates if you already have outstanding personal credit, say in the 760-850 range. Raising your credit score if it’s below 760 will improve your chances of getting a lower rate.

Here are a few actions to help raise your credit score:

- Timely Payments: Your payment history is the most significant factor impacting your credit score, making up 35% of FICO scores. It’s essential to build a positive payment history and never miss payments.

- Pay Down Debt: Try to keep your usage on revolving credit (credit utilization) below 30%. Ideally, your credit utilization ratio should be below 10% to significantly improve your credit scores.

- Don’t Close Old Accounts: You want your average age of accounts to be as seasoned as possible. Closing an old account lowers your average age.

- Maintain a Good Credit Mix: Having a mix of revolving credit and installment loans improves your credit score.

- Avoid Opening New Credit Accounts: Applying for a new credit account results in a hard credit inquiry. Each hard inquiry can lower your FICO score by 5 points.

- Use Credit Building Products: Consider a secured credit card or credit-builder loan to establish a credit history or improve bad credit.

- Consider Debt Management Services: A nonprofit credit counselor can help you make sense of your expenses and determine why you’re spending beyond your means. A credit repair service can help you devise a plan to pay down debt. However, be careful to avoid credit repair scams.

See our Complete Guide on Improving Credit for more detailed strategies.

Build Your Business Credit Scores

It’s important to monitor your business credit history in addition to personal credit. Several business credit reporting agencies exist, but the big three are Equifax Business, Experian Business, and Dun & Bradstreet.

Check your business credit reports to make sure they’re accurate and current. Unlike personal credit scores, there are many different business credit scoring models.

Establish a Relationship with a Lender

Lenders may be willing to offer lower rates to businesses they’ve worked with previously. For example, a bank might consider lowering its approval requirements or giving a lower rate if you already have a business checking account with them.

Many lenders lower rates and increase borrowing amounts when you renew a loan or line of credit. Of course, that’s provided you have a positive payment history on your previous account.

Understanding Business Loan Interest Rates – Final Thoughts

It’s vital that you understand the true costs of interest rates and fees when pursuing a small business loan. You must ensure your business can afford the loan.

Consider taking action to help get a lower interest rate. That means improving personal and business credit (if necessary), offering collateral, and building a relationship with your lender. You should also shop around for the lowest rates you can find.

Contact us if you have more questions on interest rates or to apply for a small business loan. Our funding experts can help you find the best business loan options for your credit profile.