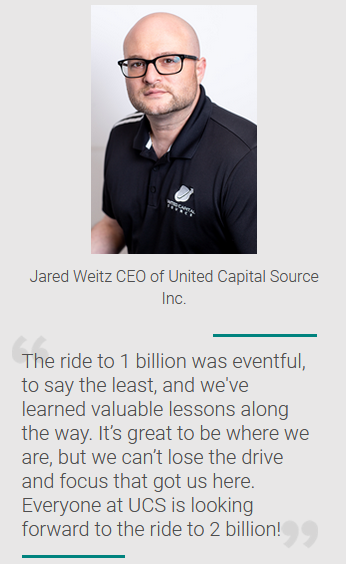

United Capital Source Inc. is proud to announce that we have surpassed $1 billion in transaction volume. We have proudly matched over 1 Billion dollars to businesses across the United States since its inception in 2011. Because of our efficient sales, marketing, and management process, we were able to achieve this milestone with far less human resources as UCS CEO Jared Weitz Explains:

“I think it’s important to note that many companies who hit this number are 50-250+ employee companies or they’ve hit the number by combining the volume of a recent company they acquired in an M&A, or by soliciting referral business. All of which is valid and commendable. However, UCS hit this number on self-generated volume with under 20 employees while maintaining the same management team since inception. I’ve said it once, and I’ll say it again, our reps here do 200-300% of what the normal rep does in volume per month.”

UCS was able to achieve this milestone through ingenuity and hard work, as Weitz explains:

“We win a few ways. We have our own marketing and demand generation engine in-house. We also implement dynamic strategies to fit specific times and circumstances. Our staff is trained and well versed in all types of business financing with a highly effective consultative skillset. And yeah…brute force hard work! Plus, we have some awesome in-house systems and technology that enable us to move fast. Our CRM is connected via API with our different relationships across multiple products, and we have a highly intuitive lender/product decision tool.”

By retaining its core management team and certain employees since inception, the synergies created between the team helped usher in this milestone sooner than most other companies could as Weitz explains:

“When I started the company 10 years ago with my now CMO, EVP, and 2 VP’s we always imagined hitting 1 Billion dollars in funding and always made projections for where we’d be 10 years in. And here we are all together along with our other staff members enjoying both of those milestones.”

Achieving such a huge milestone is no time to be complacent. In fact, our resolve to hit 2 billion in small business financing volume is greater than ever, as Weitz explains:

“The ride to 1 billion was eventful, to say the least, and we’ve learned valuable lessons along the way. It’s great to be where we are, but we can’t lose the drive and focus that got us here. Everyone at UCS is looking forward to the ride to 2 billion!”

In the coming months and years, United Capital Source will continue to execute its growth strategies in several ways. Weitz elaborates on this: “By perfecting and standardizing our in-house processes, the goal is to scale our growth at a higher rate than that of the past few years. We plan to scale in all departments and modes of procuring business, including more workforce hiring, greater emphasis on in-house demand generation, and developing B2B referral relationships. We’re also moving into larger office space in anticipation of this growth.”